Buyers hold back for new launches

Secondary transactions across 10 major estates dropped 27 percent to 13 over the weekend, according to property agency.

The

biggest decline was recorded at Kingswood Villas in Tin Shui Wai, where

the number of deals fell from six to two, as buyers held back for the

launch of new projects in the district this month.

In

the primary market, the Development Studio, backed by Keith Graham

Kerr, former chairman of Swire Properties (1972), launched five units at

42 Tung St in Sheung Wan for sale by tender.

In

the commercial market, Bridgeway Prime Shop Fund Management bought an

880-sq-ft shop in To Kwa Wan for HK$14 million, 20 percent lower than

the market price, while Hanison Construction (0896) sold the Hay Nien

Industrial Building in Kwun Tong for HK$628 million, taking in a HK$139

million profit.

(The Standard)

統一中心全層連約5.15億易手

疫情逐步回穩,為甲廈市場釋出曙光。由宏安地產持有的金鐘統一中心高層全層以5.15億易手,呎價約2.5萬,料買家享租金回報約2.7厘。

代理表示,金鐘統一中心30樓全層以5.15億易手,以面積約20488方呎計,呎價約25135元,是次成交將以買賣公司形式交易。該全層現時月租約114.7萬,租期至2023年,料買家可享租金回報約2.7厘。據了解,買家為許大絢及梁先杰。資料顯示,業主為宏安地產,於2016年以5.12億購入,持貨約5年帳面獲利約277.5萬。

約20488方呎

據大型代理行資料顯示,該甲廈對上一宗成交於今年3月錄得,為高層B室,面積10244方呎,以約2.15億售,呎價約2.1萬;另一成交為30樓F室,面積20489方呎,於2016年11月以約5.1億售,呎價約2.5萬。

代理認為,今年度核心區商廈續受用家及投資者追捧,其中,中環中心更於第二季起率先獲買家承接,累計售出5層全層,成交呎價亦見理想;而今次統一中心全層同獲承接,反映投資市場亦漸轉向價格相對低水的商廈物業,相信港島區指標商廈更有機會成為火車頭,牽動整體甲廈及乙廈表現。預料下半年商廈買賣及租務交投將會更趨暢旺,港島核心區指標商廈更會看高一綫。

(星島日報)

更多統一中心寫字樓出售樓盤資訊請參閱:統一中心寫字樓出售

更多金鐘區甲級寫字樓出售樓盤資訊請參閱:金鐘區甲級寫字樓出售

更多中環中心寫字樓出售樓盤資訊請參閱:中環中心寫字樓出售

更多中環區甲級寫字樓出售樓盤資訊請參閱:中環區甲級寫字樓出售

全幢工廈交投旺 興勝6.28億沽觀塘物業

3億售柴灣工廈5成業權 美資基金買入

投資市場明顯轉旺,大手成交屢現。興勝創建 (00896) 宣布,以6.28億沽出觀塘大業街1號禧年工業大廈全幢,持貨2年獲利約1.39億元,而集團亦宣布以約3億元售出柴灣美利倉大廈5成業權,由美資基金AEW購入。

興勝創建宣布,以6.28億元沽出禧年工業大廈全幢。

據悉,該廈地盤面積約5,780平方呎,現址為一幢14層高工廈,總樓面面積約6.28萬平方呎,按成交價計,呎價約1萬元,現時物業每月租金收入約96.7萬元。

均輝購觀塘工廈 或合併重建

興勝創建於2019年以4.89億元購入物業,去年曾申請重建成1幢36層高酒店,提供160間客房,總樓面約8.3萬平方呎。當中地積比率由現時規劃大綱圖的最高12倍,放寬至15.836倍,包括按照工廈活化政策2.0規劃容許增加地積比率2成,可建樓面約8.3萬平方呎,較現時樓面約6.3萬平方呎多出3成。如今沽出物業,2年獲利約1.39億元。

據悉,買家為均輝集團,而該集團正持有觀塘偉業街111號均輝中心,正比鄰禧年工業大廈,不排除購入後可作合併發展。據了解,均輝中心地盤面積約4,200平方呎。

興勝創建積極沽貨,該集團宣布,以3.05億元售出柴灣美利倉大廈50%權益。翻查資料,興勝創建於2019年7月,以7.35億買入柴灣利眾街第18號美利倉大廈、柴灣中心工業大廈及觀塘工業中心單位,其中美利倉大廈樓高16層,地盤面積約6,685平方呎,總面積約68,296平方呎。據悉,買家為AEW基金,購入作投資。

投資市場轉旺,工商舖買賣全綫向好。代理表示,金鐘統一中心30樓全層以5.15億元易手,按面積約20,488平方呎計算,平均呎價約25,135元,物業將會以買賣公司形式交易。該全層現時月租約114.7萬元,租期至2023年,新買家可享租金回報約2.7厘。據了解,新買家為許大絢及梁先杰。

金鐘統一中心 全層5.15億易手

資料顯示,業主為宏安地產,於2016年以5.12億元購入,持貨約5年,帳面獲利約277.5萬元,接近平手離場。

(經濟日報)

更多統一中心寫字樓出售樓盤資訊請參閱:統一中心寫字樓出售

更多金鐘區甲級寫字樓出售樓盤資訊請參閱:金鐘區甲級寫字樓出售

外資活躍 工商舖全年成交料900億

代理:工廈旺勢可持續

疫情緩和下有利投資市場,工商舖大額物業半年錄得350億元成交,按年增逾1.6倍,有外資代理行相信,市場資金仍多,特別外資基金表現活躍,下半年交投金額突破500億元,並估計上半年成焦點的工廈,旺勢可以持續。

據該代理行資料統計,2017至2018年為投資市場高峰期,成交金額分別為1,837億及1,441億元,而2019年下半年出現疫情,成交降至692億元,而去年受疫情衝擊,進一步跌至528億元。今年上半年情況向好,單計首6個多月,成交金額涉358億元,較去年上半年136億,高出逾1.6倍。

該行代理分析,上半年投資市場集多個有利因素,「香港疫情受控,對比起環球疫情反覆,香港及內地情況明顯較理想,吸引投資者留意。市場資金非常充裕,銀行體系顯示資金無流走,加上利息低,有利投資市場。」至於去年尾政府減辣,該代理則認為主要推動中細碼物業成交,「大額物業多以買賣公司股份形式進行,減印花稅對中細價物業如舖位推動較高。」

對港投資市場 憂慮漸降

提到資金充裕,上半年外資基金表現非常活躍,該代理認為,外資對本港投資市場的憂慮漸降低,即重投市場,「香港為自由市場,過往物業升值空間多,本港物業回報率平均約3.5%,或比其他城市低。但香港吸引之處,是地方細而多買家,流動性高容易沽貨。」對於社會運動、國安法等政治因素,該代理謂基金對本港憂慮已降,「去年外資基金少許擔心本港政治氣氛,希望先觀望,而今年明顯已沒有太擔心。」

外資基金今年入市策略偏向工廈,包括黑石基金以2.83億元購入葉氏化工大廈,而嘉民亞洲亦以5.7億購觀塘海裕工業大廈多層。該代理分析,「工廈收租回報普遍較高,疫情下需求不減,租金首兩季仍有3%升幅。工廈包括有物流貨倉、數據中心、凍倉等,需求很大,最近更有基金購工廈改作迷你倉。由於可塑性高,吸引基金留意。此外,供應量持續偏低,少有工廈新地皮,而政策輔助包括活化工廈、標準補地價金額等,鼓勵業主把工廈轉用途。」

工廈價全年料升約15%

對於下半年市況,預計整體交投仍上升,而工廈市場旺勢持續,「下半年反彈力度更大,年初仍有疫情,第二季成交額大幅改善,情況慢慢好轉,下半年氣氛更佳,預計400億至500億元成交,全年達800億至900億水平。工廈價上半年已升8%,預計全年升10至15%。」至於過往甚受歡迎的甲廈,該代理指多個客觀條件欠佳,反彈力度稍遜,「2022至23年為甲廈供應高峰期,疫情下很多企業重組及控制成本,由核心區搬至非核心區,令租金及空置率受壓,預計反彈力度較其他範疇弱。」

(經濟日報)

50大甲廈8買賣 創今年單月新低

7月股市表現波動,甲級商廈交投同受影響回落。綜合代理數據顯示,7月50大指標甲級商廈只得8宗買賣,創下今年以來的單月新低。

數據顯示,7月50大指標甲級商廈僅錄得8宗買賣,相對6月的20宗,按月下跌約60%;最新成交面積約5.19萬方呎,按月亦下挫38%。但總計今年首7個月,50大甲級商廈仍錄得106宗買賣成交,較去年同期的39宗大增1.7倍。

7月指標甲級商廈成交集中於九龍區,期內佔4宗;港島及新界各佔2宗。核心區中,上環信德中心及中環皇后大道中99號中環中心各錄得1宗買賣。

代理表示,股市表現波動,影響部分市場人士的信心,甲級商廈交投因而回落。近期交投仍集中於非核心區,反觀傳統核心區甲級商廈銀碼大,呎價較高,投資者態度較審慎。

(信報)

更多信德中心寫字樓出售樓盤資訊請參閱:信德中心寫字樓出售

更多上環區甲級寫字樓出售樓盤資訊請參閱:上環區甲級寫字樓出售

更多中環中心寫字樓出售樓盤資訊請參閱:中環中心寫字樓出售

更多中環區甲級寫字樓出售樓盤資訊請參閱:中環區甲級寫字樓出售

鰂魚涌匯豪峰車場7600萬售投資者羅守輝沽貨持貨九年升1.1倍

資深投資者羅守輝旗下TOYOMALL剛沽售鰂魚涌匯豪峰車場,作價7600萬,買家為投資者周永祥等人。

上址為太古城道39號匯豪峰車場,樓高3層,設56個車位,另5個電單車位,知情人士透露,該車場剛以7600萬沽售,以買賣公司形式易手,平均每個車位約136萬 (不計電單車),由投資者周永祥及另一名拍檔承接,支付一成訂金,明年一月正式成交。

車位平均作價136萬

他續說,鰂魚涌每個屋苑皆設車場,惟匯豪峰位置特別好,距港鐵站約3分鐘步程,而且被多幢大型工廈 (已被收購或收購中) 包圍,未來極具前景,加上車場樓底高,車位寬闊,極具增值空間。此車場多年來由承包商租用,月租18萬,承包商以每個4000元出租車位,另提供日租車位。

他又說,該車場最新回報僅2.8厘,買家打算成交後,為物業增值及拆售。據了解,周永祥是寵物玩具生產商,同時亦是資深鋪位投資者。

周永祥接受本報查詢,證實購入車場,惟他強調,該車場將作為長綫投資,現階段不便透露。

TOYOMALL於2013年11月以3698萬購入車場,持貨逾7年,帳面獲利3902萬,升值約1.05倍。有代理評論,2013年為鋪市高峰期,尋找投資目標不易,羅守輝極具眼光。該車場可拆售及自由買賣。

投資者周永祥:作長綫收租

有代理表示,鰂魚涌車位需求穩定,樓齡較新的車場最受捧,原因空間寬闊,設施新穎,惟部分屋苑樓齡舊,車位具需求,康景花園車位月租高達4500至4700元,皆因單位與車位比例為13比1,供不應求。

該代理又說,太古城以往劃一以3180元出租車位,輪候需時,拆售後月租驟升至4000元水平。區內部分車位規定同廈業主才能購買,包括康惠花園、太古城及逸樺園等等。值得留意的是,區內惠安苑樓齡46年,單位與車位為1.4比1,惟不乏需求,每月租金企硬3000至3500元,皆因惠安苑接近港鐵站,不少商廈車主紛在此承租車位。

(星島日報)

統一中心兩單位月租16.6萬起

代理表示,金鐘統一中心高層兩個單位招租,意向呎租約38元,月租低至約16.6萬元。

放租的大單位擁海景,為32樓A02室,面積約6953方呎,按意向呎租約38元計算,涉及月租約26.4萬元。由於單位位處大廈高層,故享有開揚海景,為物業增值,對租客吸引力上升。

另一個招租單位為32樓A03室,面積約4382方呎,每方呎叫租同約38元,總月租約16.6萬元。該單位連寫字樓裝修出租,租客可即租即用;景觀則可望開揚城市景致。

(信報)

更多統一中心寫字樓出租樓盤資訊請參閱:統一中心寫字樓出租

更多金鐘區甲級寫字樓出租樓盤資訊請參閱:金鐘區甲級寫字樓出租Wing Tai bets on affordable luxury concept in Kwu Tung after Tuen Mun projects prove popular with millennials

Wing

Tai will expand its affordable luxury concept at its new project in Kwu

Tung, New Territories, where it set a land price record.

The developer plans to build 700 units, mostly two-bedroom flats, targeted at young buyers.

Wing Tai Properties will

expand its affordable luxury concept for millennials at its upcoming

project in Kwu Tung, New Territories, where it set a price record in

terms of square footage for the land it acquired last month.

The Hong Kong developer

said that the concept leverages on its experience of designing luxury

developments, opening up a new product line that appeals to a new

generation of buyers seeking affordable prices. This has resulted in

strong sales at THE CARMEL, OMA OMA, and OMA by the Sea in Tuen Mun since they were launched in early 2019, the company said.

The company said that their designs match that of upscale luxury projects. Some of the features include a stone spa at THE CARMEL, a 40-metre long infinity pool at the OMA OMA and a 25-metre hanging garden pool at OMA by the Sea.

“This concept is well

received by new families and first-time buyers between the ages of 25

and 35,” said Kenneth Ng Kar-wai, managing director of Wing Tai’s

property division, which has developed 7.5 million sq ft of real estate

in the city since 1991, including the luxury residential projects La

Vetta and Le Cap in Kau To, Sha Tin.

The common characteristic

of these three housing projects in Tuen Mun is that they are surrounded

by greenery. Nearly 50 per cent of the flats in these projects are

two-bedroom units priced between HK$6 million and HK$8 million.

The developer plans to build 700 units, mostly two-bedroom flats, targeted at young buyers on the Kwun Tung site.

Ng said that he would

blend the development with nature, pointing out that landscape design is

their strength. “With the natural surroundings, the result will be

twice as good,” he added.

In June, the developer

paid HK$2.61 billion for the site in Kwu Tung, which can yield a total

gross floor area of 284,169 sq ft. It works out to HK$9,208 per square

foot, making it the most expensive plot in the New Territories. It was

among the three sites sold in the area by government tender since April.

“The site adjacent to

Fanling golf course already offers a great landscape,” Ng said, adding

that the plot was about 10 minutes’ walking distance to Sheung Shui MTR

station.

The relatively

underdeveloped Kwu Tung, where an MTR station is due to open in 2027 –

has caught investors’ attention after Sun Hung Kai Properties (SHKP) won

a site, Area 25, for HK$8.61 billion in April. SHKP paid nearly 40 per

cent more than the market valuation for the plot.

The per square foot price

for the site, which can yield a total gross floor area of 1.19 million

sq ft, works out to HK$7,184. Surveyors expect completed flats to fetch

as much as HK$20,000 per square foot.

Last week, Wheelock

Properties won another parcel, Area 24, which can yield a gross floor

area of 492,390 sq ft, for HK$4.19 billion, or HK$8,499 per sq ft. This

was 18.3 per cent higher than the HK$7,184 per square foot SHKP paid for

the adjacent plot, Area 25, in April.

On July 29, just before

the Lands Department awarded Area 24 to Wheelock Properties, property

agency said that it had helped a client to buy a 1,576 sq ft house at

Valais, the biggest luxury development in Kwu Tung, for HK$23 million,

or HK$14,594 per square foot.

“The deal was done with zero discount,” agent said.

The seller had paid HK$20.33 million for the house in December 2011.

“It

is one of the few profit-making transactions concluded at Valais as

many owners sold their houses at a loss in the past several years due to

the area’s inaccessibility,” another agent said.

“In

the past three months, seven transactions were done at Valais, compared

to just two to three deals a year previously,” the agent added.

(South China Morning Post)

OECD property prices break 30-year record

Property prices are surging in almost every major

economy during the pandemic along with the global fiscal and monetary

stimulus, analysis by the Financial Times found.

Only three of the 40 countries experienced

real-terms housing price decrease in the first three months of 2021,

covered by data of the Organisation for Economic Co-operation and

Development. It was the smallest portion of the price fall since the

data series began in 2000.

As countries bottomed out from the recessions

triggered by pandemic, the annual house price growth across the OECD

members is at its fastest pace in 30 years in the first quarter

recording 9.4 percent, which is also faster than growth in rent prices.

Strong growth in housing costs continued in the United Kingdom, South Korea, New Zealand, Canada and Turkey.

Properties in developed countries were overvalued

by about 10 percent compared with long-term trends, said Adam Slater,

lead economist at analysis firm Oxford Economics. He calculated that the

"housing fever" is one of the biggest since 1900, but it was not so big

as to kickoff a financial crisis.

Meanwhile, the Chinese city of Dongguan

implemented a series of property cooling measures after banning

developers from bidding sites by related companies to increase the

winning rate.

Measures included a tightening on property taxes,

which the exclusion period of individual housing transaction value-added

tax extended to five years from two years. Homeowners who sold their

property within five years of their purchase are required to pay a total

of five percent VAT.

(The Standard)

金鐘統一中心高層呎租38元

金鐘統一中心高層一籃子單位,面積由4000至7000方呎,以意向價每方呎約38元放租。代理表示,金鐘金鐘道95號統一中心32樓,其中大單位更擁海景,為32樓A02室,面積約6953方呎,按意向呎租約38元計算,涉及月租約26.4萬餘元。由於單位位處高層,故享有開揚海景。郭氏續表示,另一個獨家招租單位為32樓A03室,面積約4382方呎,每方呎叫租同約38元,總月租約16.6萬餘元,單位連寫字樓裝修出租,租客可即租即用;景觀則可望開揚城市景致。

該代理續稱,統一中心作為金鐘區地標甲廈,大廈質素及配套有保證,而今番業主租金叫價克制,相信會獲租客青睞洽租。資料顯示,統一中心最近一宗租賃為該廈中層A01室,面積約2573方呎,成交呎租約40元。

(星島日報)

更多統一中心寫字樓出租樓盤資訊請參閱:統一中心寫字樓出租

更多金鐘區甲級寫字樓出租樓盤資訊請參閱:金鐘區甲級寫字樓出租

本港經濟表現好轉,市場憧憬工商鋪後市有力回穩,部分業主趁勢放售。有代理表示,尖沙嘴東部科學館道9號新東海商業中心1樓108至109號鋪,面積約2414方呎,意向售價約4380萬,呎價約1.8萬。新東海商業中心附近商廈林立,人流有一定保證,物業現時由五家飲食業及零售業租客租用,每月租金合共約14.8萬,買家可享回報率高達4.04厘。

該代理又指,物業地理位置優越,毗鄰香港歷史博物館和香港科學館,是每年平均參觀人次最多的博物館,物業同時鄰近大型購物商場,包括The

One、K11

Musea等,日夜人流暢旺。大廈交通配套完善,徒步至紅磡站及尖東港鐵站僅需約10分鐘,附近亦有多條巴士及小巴專綫來往港九各區。預計上述放盤短期內可獲投資者承接。

(星島日報)

更多新東海商業中心寫字樓出售樓盤資訊請參閱:新東海商業中心寫字樓出售

更多尖沙咀區甲級寫字樓出售樓盤資訊請參閱:尖沙咀區甲級寫字樓出售

金鐘甲廈需求大,現海富中心單位,以每呎約38元招租。

2座單位 月租9.7萬

有代理表示,有業主現放租金鐘海富中心單位,涉及物業2座502A至03A室,面積約2,556平方呎,意向呎租約38元,涉及月租9.7萬元。

翻查資料,5月至今大廈錄得3宗租務,其中5月份,2座低層單位,面積約961平方呎,以每月3.8萬元租出,呎租約40元。另6月份2座低層01、11至15室,面積約4,388平方呎,以每月19.7萬元租出,成交呎租約45元。上月物業亦錄得一宗細單位租務成交,涉及2座一個低層,面積約327平方呎單位,以每月1.6萬元租出,呎租約49元。

(經濟日報)

更多海富中心寫字樓出租樓盤資訊請參閱:海富中心寫字樓出租

更多金鐘區甲級寫字樓出租樓盤資訊請參閱:金鐘區甲級寫字樓出租

外資代理行:商廈需求漸回穩 50%受訪企業有意擴張

有代理發表最新商廈市場調查報告顯示,約半數 (50%)

受訪企業有意在未來三年內擴張,比較2020年10月的調查結果 (23%)

大幅增加,尤其以科技公司、投資和保險公司等亞洲本地企業意願較強。就跨國企業而言,辦公室整合與升級計畫仍是公司房地產策略重點,但部分企業

(如科技公司) 仍持有適度的長綫擴張意願。

科技公司具長綫擴張意願

數據顯示,71%受訪企業認為企業經營狀況持續改善,比例遠高於2020年4月 (22%) 及10月(48%) 兩次調查結果。以大中華區和太平洋地區受訪企業的市場信心度最高,印度和東南亞地區企業對市場樂觀程度相對較低。

該行代理表示,近期而言,企業租戶繼續利用區內租金減免及優惠趨勢,重新協商租約及續租,以節省成本,受訪企業希望在疫情完全受控後,員工可花更多時間於辦公室工作,並習慣新混合辦公模式。

與此同時,企業根據實際需要制定長遠的辦公政策,管理層權利決定員工的日程以及批准遙距辦公方案。

料共享工作間需求上升

該行另一代理表示,辦公室在促進協作與溝通方面,將比以往發揮更大的作用,辦公室設計也需要作出相應的調整和改變。

該行預計,非正式協作空間以及共享工作間需求將有上升趨勢。同時,在混合辦公模式下,員工獨立工作以及組織小型專案團隊會議的情況將會更為普遍,更多企業租戶將考慮減少大型會議室數量,但同時亦期望業主能夠提供大型企業會議或活動的空間及配套。

(星島日報)

茶果嶺舊樓八成業權聯售

市區地皮供應有限,令舊樓備受財團追捧,其中,位於觀塘茶果嶺道189至193號全幢舊樓,目前業主已收集逾八成業權,並推出市場聯售,可建樓面逾1.7萬方呎。

可建樓面逾1.7萬呎

觀塘茶果嶺道189至193號全幢舊樓,業主推出市場聯售,已收集逾八成業權,並透過市區重建中介服務推出,並委託測量師作銷售,測量師表示,項目毗鄰港鐵藍田站,擁維港景致,可作重建發展,地盤面積約2350方呎,屬住宅

(甲類) 用途,地積比率達7.5倍,可建樓面逾1.7萬方呎。

下月15日截標

該測量師再指,預料可吸引不少投資者及財團,由今日起推出招標,並於下月15日截標。此外,該測量師續稱,隨着本港疫情緩和,樓價上升,樓市氣氛持續向好,資金積極追捧「磚頭」,預期是次推出招標的茶果嶺道項目,反應不俗,項目鄰近多個大型住宅物業,將陸續落成,未來具發展潛力,若有效利用最大的地積比率,可重建作商住發展,項目現時有逾8成業權聯合出售,由於預期投資額適中,故可望吸引投資者及各類型的發展商參與。

(星島日報)

全幢物業可改用途 成財團吸納對象

大額交投暢旺,近一星期先後錄得多宗全幢物業成交。由於全幢物業可更改用途及重建,價值可望提升,即成財團吸納對象。

投資市場持續暢旺,全幢物業成投資焦點,包括近月成交極少的酒店,亦罕有錄得買賣。土瓜灣譚公道103至107號酒店易手,物業樓高18層,總樓面約29,349平方呎,全幢以3.8億元成交。該物業原由一本地財團持有,早年購入地盤後自行發展,興建一幢提供99間房的酒店,並於2019年落成,其後本港社會運動及疫情影響,酒店一直未有營運,現獲財團購入,平均每房價值約383萬元。

Weave Living買酒店 作共居空間

據了解,新買家為Weave Living,該集團在港主力發展共居空間,創立品牌Weave

Co-living,過去數年先後購入旺角、紅磡、大角咀及西環4項目,把原本酒店改裝成共居,合共提供540間房。該集團去年以2.95億元收購西半山醫院道6至8號全幢,呎價約1.4萬元,據悉將會被改裝成多戶房屋

(Multi-Family)。

至於上半年投資暢旺的全幢工廈強勢持續,興勝創建以6.28億元沽出觀塘禧年工業大廈全幢。物業地盤面積約5,780平方呎,現址為一幢14層高工廈,總樓面約6.28萬平方呎,呎價約1萬元,現時物業每月租金收入約96.7萬元。興勝創建於2019年以4.89億元購入物業,去年曾申請重建成1幢36層高酒店,2年獲利約1.39億元。買家為均輝集團,而該集團正持有觀塘偉業街111號均輝中心,正比鄰禧年工業大廈。

另外,屯門東亞紗廠工業大廈第一期全幢,獲中資物流公司承接,涉約22.4億元,為2021年至今投資市場最大宗全幢工業物業成交。物業樓高15層,總面積約466,449平方呎,成交呎價約4,802元。原業主為鄧成波家族,2012年向嘉民物流基金以5.08億元購入該物業的71%業權,以及2016年以2.38億元向國泰航空旗下雅潔乾洗購入約18%業權,並於2018年統一全幢第一期業權,轉手獲利超過13億元。

全幢工廈亦具重建概念,葵涌瑞康工業大廈,獲億京以約5億元購入。物業地盤面積約14,291平方呎,項目現有建築面積為14.7萬平方呎,呎價約3,401元。億京購入後,料重建成新式工廈,或補地價重建甲廈。

分析指,工商物業於過去一年價格明顯回調,現正值疫情緩和,加上市場資金多,近月吸引財團注視。不過,由於商廈及舖位租金向下,目前回報率略為降低,而財團看好後市,故購入全幢物業,再作翻新及重建,待項目完成增值後,市況可望全面回勇,回報率即提高,料全幢物業續獲追捧。

(經濟日報)

灣仔全幢服務式住宅標售 估值3.7億

全幢物業承接力理想,業主趁勢標售,現本地財團標售灣仔道全幢服務式住宅,市場估值約3.7億元。

有測量師指出,灣仔道238至240號項目配現正標售,截標日期為8月31日。該物業現為一幢9層高服務式住宅,於1963年落成,地庫及地下現租予髮型屋,1樓至7樓屬住宅。

可重建約28485呎

測量師指,物業位於摩理臣山道及灣仔道,鄰近銅鑼灣時代廣場,地盤面積約1,890平方呎,現規劃為其他指定用途

(混合用途),可作寫字樓、酒店、住宅等用途。以最高地積比率15倍計,可重建總樓面約28,485平方呎。該物業已獲批重建為一幢22層高銀座商廈,買家可於物業外牆及天台上加設多個大型戶外廣告牌。據市場估值約3.7億元,每呎樓面地價約1.3萬元。

(經濟日報)

新蒲崗匯達商業中心 享地利交通便

匯達商業中心位處新蒲崗心臟地帶,屯馬綫通車與觀塘綫兩綫滙聚,令區內交通配套趨成熟,加上啟德發展區基建逐步落成,商貿氣氛及居住人口將慢慢增加,鄰近的新蒲崗區亦連帶受惠。

交通配套方面,大廈距離鑽石山港鐵站僅8分鐘步程,並坐擁四通八達的交通網絡,屯馬綫開通和觀塘綫兩綫滙聚,佔盡地利優勢;加上鄰近巴士站和的士站僅一箭之遙,約5分鐘路程,附近亦有多條巴士路綫可達港島地區,交通便利。

鄰近多間大型購物商場

大廈鄰近多間大型購物商場,如Mikiki、越秀廣場、荷里活廣場等,對預備擴展業務的企業家來說,確是便捷、優質的理想之選。物業提供大量時租停車位,而且共3層停車場,車位充裕。停車場亦設有自助式雙升降機直達車場,方便駕車人士出入。

飲食配套上,物業處於工廠大廈地段,四周也不乏食肆餐廳。大廈鄰近多間大型購物商場,上班族可步行至附近Mikiki及越秀廣場一帶,有多間連鎖品牌食肆、快餐店、酒樓可供選擇,若不介意步程也可選擇荷里活廣場也有食肆及美食廣場提供,食肆林立。

匯達商業中心在景觀及設計上,展現辦公室的時尚氣派。大廈配套方面,大廈大堂備有3部電梯及1部專用載貨電梯,讓繁忙時段可分流,方便客人上落。值得一提,大廈樓齡新,而外牆為玻璃幕牆,而大堂更突顯高雅亮麗的感覺。大廈每層面積約6,487平方呎,大多以一梯多伙為設計,樓層設獨立廁所。而現時租客包括教會、製造行業等。

業主多作自用 盤源矜罕

大廈大多單位由業主自用,因此大廈不論放租或出售的盤源更是矜罕。大廈樓面設計靈活,租戶可獨佔全層或每層規劃最多5個單位,加上少柱位設計,極盡空間效能。除標準單位外,亦提供行政高層單位,部分專享私人洗手間;更特設「頂層辦公廳」,坐享無與倫比的廣闊翠綠景觀;而寫字樓單位坐擁彩虹道遊樂場的翠綠園景,於較高層單位更能飽覽遠至獅子山的開揚景致,讓人能在盎然綠意的環抱中,工作效率自然能大大提升。

(經濟日報)

Flats at Kowloon Godown go down in size but up in number

Wheelock

Properties has submitted a new redevelopment plan for Kowloon Godown in

Kowloon Bay to the Town Planning Board to build 1,782 residential flats

but with smaller sizes.

Nearly

1,000 units have been added to the 784 flats that were approved 10

years ago, but the average size of each unit will shrink 56 percent to

465 square feet.

The

developer wants to build seven 28-story buildings on the 165,812 sq ft

site, providing a total gross floor area of 829,059 sq ft.

The project is located on Kai Hing Road, near the Kai Tak Cruise Terminal.

Managing

director Ricky Wong Kwong-yiu said the company has collected over HK$20

billion in the first seven months of 2021, selling 1,165 flats.

He

expected the company to break its sales record of HK$26 billion and

said overall property prices will rise 5 percent by the end of the year.

Meanwhile,

the Land Registry recorded 9,957 sale and purchase agreements for all

building units received for registration in July, up 6.1 percent from

June and 31.4 percent higher year-on-year.

The

total amount for sale and purchase agreements in July was HK$94

billion, which rose 1.5 percent from June and 35.6 percent from 2020.

In

the commercial property market, Swire Properties (1972) said the

overall Hong Kong occupancy rate for its offices remained at 96 percent

in the first half.

The

developer said its Pacific Place's office occupancy rate rose to 98

percent, while the rent dropped 11 percentage points. And for its Taikoo

Place project, the rental reversions remained positive.

However,

the company believes the increased availability and subdued demand has

exerted downward pressure on rentals, especially in Central and the

Pacific Place portfolio.

Before the completion of Two Taikoo Place,

Julius Baer, a Swiss private bank, had committed to four floors

(approximately 92,000 sq ft) and will be the first anchor tenant of the

building, the company said.

Link

Reit (0823) meanwhile said the number of visitors at its shopping malls

had returned to pre-pandemic levels and it believes the positive impact

of government coupons could last between 12 to18 months.

The

company revealed that over 60 percent of its shop tenants have

installed e-payment apparatuses which have been adopted by mall tenants,

but the acceptance in wet markets is relatively lower.

(The Standard)

Record prices of mid-sized Hong Kong flats driven by first-time buyers taking advantage of relaxed mortgage rules, say analysts

Homes

measuring between 431 and 752 sq ft soared to record-breaking prices in

June as couples and young families snapped up second-hand units

Among

the most popular developments driving the price increases were

Kingswood Villas in Tin Shui Wai, and City One Shatin in Sha Tin

More

first-time buyers have been piling in to Hong Kong’s property market,

driving up the prices of mid-sized flats in out-of-town locations,

according to analysts.

Homes

measuring between 431 sq ft and 752 sq ft soared to record-breaking

prices in June as couples and young families snapped up second-hand

units in areas like the New Territories, where their money goes a lot

further than it does in the city.

Property

agents said the prices had been driven higher by a relaxation of

mortgage rules in 2019 allowing first-time buyers to borrow a much

higher percentage of a flat’s value.

“The

relaxation measure pushed more first-time homebuyers to enter the

property market,” property agent said. At the same time, more people

were taking the opportunity to upgrade to larger units.

“This

led to more people making use of the relaxation rules,” the agent said.

“So people who previously bought units of 200 to 300 sq ft would

perhaps purchase units of 400 to 500 sq ft instead.”

Among

the most popular residential developments driving the price increases

were Kingswood Villas in Tin Shui Wai, City One Shatin in Sha Tin and

Metro City in Tseung Kwan O, according to property agency.

“For

some buyers who live in a two-bedroom unit … their family has expanded

and they have another child or their children are growing, they may need

to switch to a three-bedroom [unit],” agent said.

The

prices of second-hand homes measuring 431 sq ft to 752 sq ft set a new

record in June, according to an official price index. They edged up 0.37

per cent to 381.5 in June, breaching the previous high of 377.9 set in

May 2019, according to recent data from the Rating and Valuation

Department.

Homes

at the extreme ends of the size spectrum fell in June. Houses larger

than 1,722 sq ft saw their value drop 1.2 per cent, the biggest fall

among all types of unit, while the very smallest flats, less than 431 sq

ft, declined 0.45 per cent.

Home prices were flat overall, with the index remaining at 394.5, just a whisker below the previous peak of 396.9 in May 2019.

A

total of 3,059 transactions were recorded in 10 major second-hand

housing estates so far this year, up by a half from the 2,049 sales

recorded in the first seven months of last year.

Kingswood Villas topped the list, with 433 transactions, a 29 per cent increase, according to the agency.

Hong Kong Chief Executive Carrie Lam Cheng Yuet-ngor announced the relaxation of the lending cap in October 2019.

Under

the measure, which applies to completed flats only, the lending cap for

those who are qualified to borrow up to 90 per cent of the property’s

value rose from HK$4 million to HK$8 million. The cap on the value of

flats eligible for mortgages of up to 80 per cent also rose from HK$6

million to HK$10 million.

“The

transaction volume of people buying properties in this range is always

going to be big,” property agent said. “Now many people are first-time

buyers, and when you buy property for the first time you typically buy

around such sizes, which makes for an easier entry point.”

(South China Morning Post)

Hong Kong’s overall property deals to take a breather after coming within touching distance in July of pre-protests high

The overall number of deals were within touching distance of a high recorded in May 2019

Overall number of transactions will fall in August by nearly 13 per cent, property agent said

Hong

Kong’s overall property transactions are expected to take a breather

this month after rising to a 26-month high in July, close to levels seen

before the city’s anti-government protests broke out in June 2019,

thanks to a recovery in the economy and the coronavirus pandemic

stabilising locally.

The

overall number of transactions, including residential, commercial and

industrial properties, as well as parking spaces, rose to 9,957 deals in

July, approaching a high of 10,353 deals in May 2019, according to the

Land Registry. The value of transactions also stretched a five-month

rally to a three-year high of HK$94 billion (US$12.09 billion).

“Before

property prices could approach historical highs, buyers’ pace of entry

into the market slowed down slightly, with some taking a wait-and-see

approach,” property agent said. “The overall number of transactions in

August will fall from this high level by nearly 13 per cent to around

8,680 deals.”

The

improving economy and coronavirus outbreak, coupled with quantitative

easing, have boosted the number of transactions in Hong Kong, the

world’s most expensive real estate market. But more aggressive asking

prices, as well as rising home prices are pushing some potential buyers

to the sidelines.

The

absence of launches of large-scale new projects in late July and early

this month are also expected to weigh on the transaction volume, the

agent said. The agent, however, added that the overall transaction

number will rise again after a short break, with major new projects in

the pipeline.

Hong

Kong home prices were flat in June after reaching a two-year high,

according to data from the Rating and Valuation Department. An index

measuring the prices of second-hand homes stayed at 394.5, data from the

department shows, just a whisker below the previous peak of 396.9 in

May 2019. The rising prices have led to more aggressive asking prices

from sellers, according to property agency.

The

strong sales “reflected that under quantitative easing and low interest

rates, the boom in the second-hand market continued, stimulating brisk

turnover”, another agent said.

In

the first seven months of this year, the number of overall property

transactions totalled 60,293, an increase of 49.5 per cent year on year,

the highest in nine years, according to another property agency. The

amount was HK$568.4 billion, up 68 per cent year on year, the highest

since 1997.

The

driving force has been the housing market, occupying 49,737, or 82.5

per cent of the total number of transactions, in this period.

A

family bought a 773 sq ft flat at Hemera in Lohas Park for HK$11.6

million this week as they thought “the housing market still has rising

momentum” and did not want to keep paying rent, according to the agency.

The

number of transactions involving commercial and industrial properties

dipped 5 per cent month on month to 628 in July, but the shops market

will benefit from an improvement in the retail and catering industries,

thanks to the government’s consumption vouchers, according to property

agency.

(South China Morning Post)

上月錄628宗工商鋪買賣

根據代理統計,7月份工商鋪市場錄得約628宗買賣個案,涉及總金額約147.09億,成交宗數為連續第四個月錄超過600宗,證明買家入市心態趨穩定。代理預測,鋪市持續受惠,工廈及寫字樓市場則因應經濟環境改善而加快起動。

代理:連續四個月錄逾600宗

代理資料顯示,7月份工商鋪共錄約628宗成交,對比6月微減約5%,自今年3月起連續四個月錄超過600宗水平,反映工商鋪走勢趨穩;而對比2020年7月同期更大幅遞增約85%。金額共錄約147.09億,較6月約255.54億減少約42%,按年錄約2.9倍增長,由於今年6月份錄得九龍灣國際展貿中心全幢約105億成交,若扣除此宗大手交易後,6月總成交金額約150.54億元,與7月份相若。

代理稱,依三個範疇分析,7月份工廈及寫字樓市場成交量與上月相若,商鋪宗數按月跌約17%,反映個別低於市價盤源漸消化,不少業主趁勢提價而造成買賣雙方拉鋸局面。雖然三個類別最新成交量對比6月份未見升勢,但較去年市況大為改善。翻查資料,2020年工商鋪單月最低成交宗數分別約100宗、約16宗及約17宗。

商鋪宗數按月跌17%

代理認為,疫苗計畫已開展近半年,接種人口陸續增加,預料有助控制疫情,增強市民外出消費的信心。同時,第一期消費券已於8月1日派發,不少市民已陸續提取,零售及餐飲食肆已率先受惠,消費力有望進一步上升。隨着經濟環境陸續改善,工廈及寫字樓兩者隨之起動,整體工商鋪交投前景佔優。

(星島日報)

更多九龍灣國際展貿中心寫字樓出租樓盤資訊請參閱:九龍灣國際展貿中心寫字樓出租

更多九龍灣區甲級寫字樓出租樓盤資訊請參閱:九龍灣區甲級寫字樓出租

代理:逾億元工商鋪交投增

有代理綜合土地註冊處資料顯示,7月份工商鋪註冊共錄得644宗,當中錄13宗過億元成交,數字為近20個月以來最高。該代理行認為,隨着本港「清零」,加上資金尋找出路,後市註冊量值料繼續平穩發展。

上月錄13宗逾億元買賣

7月份工商鋪各板塊註冊宗數均錄按月下跌。工廈及商廈分別最新報363及121宗,按月減少2.7%及0.8%。商鋪註冊量亦按月跌15.3%,最新錄160宗。7月份整體註冊宗數為644宗,按月跌5.8%,已連續5個月企穩600宗以上水平。整體金額繼續攀升,7月份錄97.97億,按月升11.1%。

7月份共錄得13宗億元買賣,按月增30%,更是近20個月以來單月錄最多逾億元成交宗數,其中長沙灣青山道646號豐華工業大廈全幢及中環C

WISDOM

CENTRE全幢分別以8億元及4.32億元成交。7月份大手成交大多為鋪位買賣,共佔8宗,包括以3億元成交的屯門天生樓地下共11個商鋪。

該行代理表示,7月份的過億成交中,鋪位買賣佔多,反映大手資金看好鋪市。全幢工廈亦不乏捧場客,買家看準可塑性高,以作改裝或重建。

(星島日報)

老牌家族放售物業共22項意向價3.12億

近期市況不俗,市場有投資者趁勢放售一籃子物業合共22項,包括住宅、地鋪、地廠及工廈單位,遍布港九新界,意向價共約3.12億。

有代理表示,是次放售涉及共22個物業,3個地鋪、1個地廠及3個工廈、包括15個住宅,總面積逾30000方呎。其中,黃大仙鳳德道13至21號鳳寧樓3個相連地鋪,面積逾2700方呎,屬於民生區,現時租客為著名川菜館詠藜園。

黃大仙鋪由詠藜園承租

荔枝角通州西街1059至1061號新光工業大廈地廠,面積逾3600方呎,物業鄰近荔枝角港鐵站和長沙灣核心工商地區,單位入口面向通州西街,車輛直達,將以交吉形式出售。

土地註冊處資料顯示,上述黃大仙鳳寧樓3個相連地鋪,業主於2004年4月僅以400萬購入,荔枝角新光工業大廈地廠則於2004年7月以900萬購入。

包括鋪位工廈及住宅

除了鋪位及工廈,放售的包括大批住宅,其中,鰂魚涌英皇道846號民新大廈的6個住宅單位,每間實用面積逾千呎,陳氏表示,以意向價計算,回報近約3厘,其他住宅單位分別位於鰂魚涌 、紅磡、佐敦、旺角及新蒲崗,以現狀及連約形式放售,可即時為買家取得穩定租金收入。

(星島日報)

東亞銀行購葵涌偉倫工廈全層 作價1.07億面積25618呎

疫情逐步回穩,為工商鋪市道釋出曙光,帶動銀行機構亦加快入市步伐。東亞銀行以1.072億購入葵涌偉倫中心中層全層,每呎造價約4185元,屬市價水平,料作自用途。

據土地註冊處資料顯示,葵涌偉倫中心第二期中層全層,於上月初以1.072億售出,買家為東亞銀行有限公司 (THE BANK OF EAST ASIA,LIMITED),原業主於2011年底以4535萬買入,以公司名義利合興有限公司持有,註冊董事為吳姓及關姓人士,持貨10年,帳面獲利6185萬,物業升值約1.36倍。

據地產界人士表示,上址全層面積25618方呎,以易手價計,呎價約4185元,屬市價水平,並指出,該工廈最大優點為車場面積大,且可以入到櫃,備受實力用家追捧,惟該工廈於市場上少有放盤,全層供應更是買少見少。

十年升值1.36倍

據代理資料顯示,該工廈對上一宗買賣於2017年7月錄得,為2期中層全層,面積25618方呎,以1億元成交,呎價約3904元;另一成交為2期高層全層,面積25618方呎,於2016年11月以8400萬售出,呎價約3279元。

事實上,東亞銀行近年連環沽售5項曾作為自用的鋪位,今番購入工廈,市場人士預期,該物業將作為後勤部門用途,配合銀行經營新趁勢,減少實體店,增加網上銀行比重。

市場料作自用

由2018年12月開始,該銀行先後沽售小西灣、葵涌、土瓜灣、深水埗及屯門鋪位,合共套現逾3.36億,其中以屯門鄉事會路112至140號雅都花園商場地下16、39及41號鋪最大宗,涉資高達1.35億。其次為柴灣小西灣道23號富怡花園地下56至62號地鋪,以5980萬易手。

近年連沽五個鋪位

當中不乏持貨數十年的鋪位,其中,深水埗長沙灣道132至134號地鋪,於去年7月以約3510萬成交,交吉逾3年,東亞銀行於1978年以240萬購入上址,持貨42年帳面獲利約3270萬,物業期間貶值約13.6倍。

(星島日報)

華人行千呎舖 50萬租跌逾5成

部署通關旅客重臨 租客搶一綫靚舖

核心區舖租大幅調整後,漸見商戶重返。中環華人行地下千呎舖,獲鐘錶店以50萬元租用。該舖曾由Swatch租用,其後由口罩店短租,現成交月租較對上長租約跌逾5成,較高峰期更下挫近8成。

市場消息指,中環核心地段錄得舖位租務成交,涉及華人行地下舖位,面積約1,098平方呎,以每月約50萬元租出。該舖位處皇后大道頭段,正對娛樂行,為中環心臟,可說是區內最優質地舖之一。據了解,新租客為鐘錶店。

高峰期舖租230萬 跌約78%

翻查資料,該舖多年來曾獲不同租客承租,2012年零售高峰期,舖位曾由鐘錶店以每月230萬元租用,及後2015年獲Folli

Follie以180萬租用,租金下跌。其後2018年,零售明顯從高峰回落,Swatch以110萬元租用舖位,惟本港受社會運動及疫情衝擊,零售甚差,而品牌亦於去年6月提早遷出,及後更被業主入稟追討租金。由於舖位交吉日久,業主決定把舖放短租,去年疫情時獲口罩店以每月約20萬租用。如今鐘錶店以每月約50萬元租用,租金上一份長租合約下跌約55%,若與高峰期的230萬元相比,租金更跌約78%。

事實上,自從疫情爆發以來,奢侈品不時收縮業務,棄租核心零售區舖位,而是次罕有出現鐘錶店租用,料因租金出現大幅調整,至相對合理水平,加上零售品牌憧憬年尾或有望通關,旅客有望重臨,故趁租金便宜搶佔核心區一綫靚舖。近日中環舖位租務成交略為增加,華人行對面的陸海通大廈地下一舖位,面積約700平方呎,獲首飾店以每月約20萬租用,租金跌約4成。

(經濟日報)

更多華人行寫字樓出租樓盤資訊請參閱:華人行寫字樓出租

更多娛樂行寫字樓出租樓盤資訊請參閱:娛樂行寫字樓出租

更多陸海通大廈寫字樓出租樓盤資訊請參閱:陸海通大廈寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

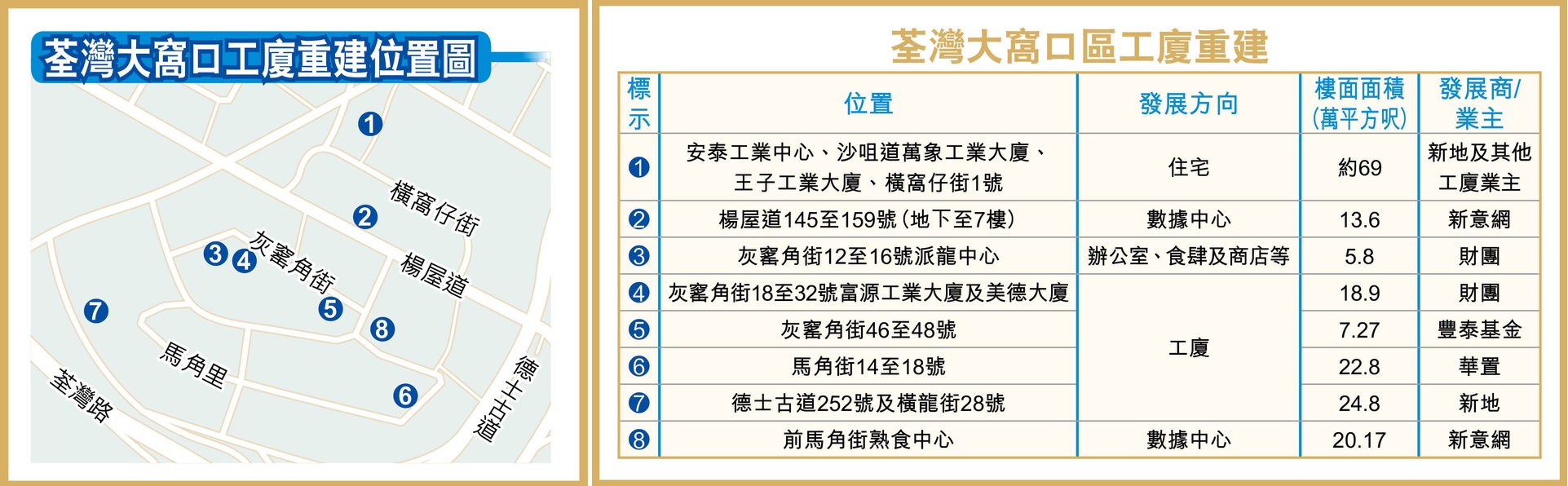

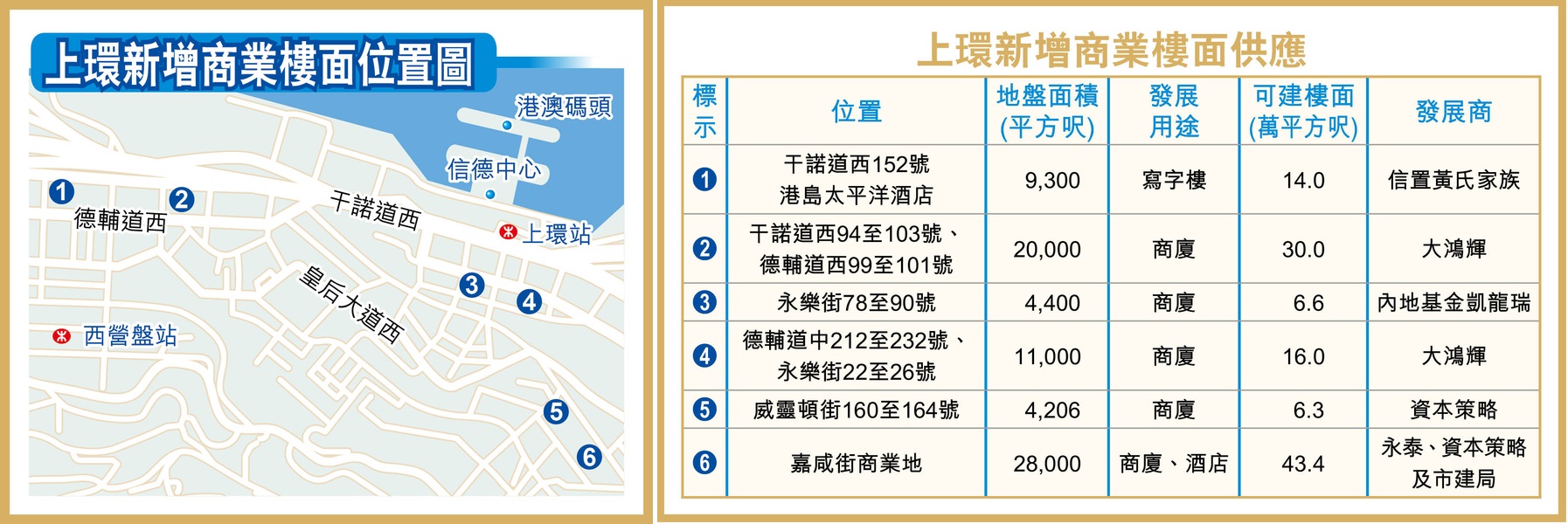

大窩口工業區 半數項目建新式工廈

鄰近港鐵站的大窩口工業區,近年有不少工廈重建及改裝個案,其中8個項目涉及182.34萬平方呎樓面,當中一半或4個項目屬於重建成新式工廈,涉及約74萬平方呎樓面。

分拆5小型綜合發展區

荃灣區內共有兩個規模較大的工業區,東面屬於大窩口工業區,西面則為柴灣角工業區,當中大窩口工業區近年有不少工廈重建計劃。大窩口工業區北面的德士古道、沙咀道及楊屋道交界,早年已經獲規劃署改劃成「綜合發展區」,希望推動重建轉型,及後加快發展,更在2010年分拆成5個較小型的「綜合發展區」,並已經陸續有工廈展開重建成住宅發展,成功轉型成為住宅區。

新地4工廈增地積比建住宅

當中新地 (00016)

近期再就安泰工業中心、王子工業大廈及亞洲脈絡中心等4幢工廈的重建方案提交修訂,申請將地積比率將增加22%至6.1倍,當中6倍作為住宅用途,將會興建5幢31層高分層住宅,較舊方案減少1幢但高度增加7層,總單位數目約1,330伙,較舊方案增加327伙,約27%。

項目將繼續分為4期發展,當中新地旗下安泰工業中心位於第1期,將會興建1幢31層高住宅,總樓面約20.1萬平方呎,較舊方案增加2成,預計提供約465伙,較舊方案增加42%。至於鄰近轉型速度較慢,只有數年前房委會已經將前大窩口工廠大廈重建成居屋尚翠苑,而新意網 (01686) 則申請將工廈Jumbo iAdvantage地下至7樓,改裝成為數據中心之用。

而楊屋道以南的部分,目前仍然規劃「工業」用途,但亦有不少發展商、投資者看準機會,購入區內的工廈展開重建,其中4個重建項目,預計可帶來約73.77萬平方呎樓面。當中有財團今年初申請將灰窰角街18至32號的富源工業大廈、美德大廈,放寬地積比率至11.4倍,以作准許的工業用途,並計劃重建1幢22層高的工廈,另設2層地庫,涉及總樓面面積約18.9萬平方呎。

另外,華人置業 (00127)

去年以約3.6億元增持的馬角街14至18號栢獅電子大廈,則計劃重建成1幢23層高的工廈,總樓面約22.8萬平方呎,預計於2024年底前完成。而新意網在2018年以約7.26億元購入的前馬角街熟食中心工業地,則將會用來興建高端數據中心,涉及樓面約20.17萬平方呎。

(經濟日報)

NikeLab銅鑼灣舖縮近半樓面 年慳432萬

雖然疫情回穩,政府亦大派消費券,增強市民消費意欲,但仍有個別零售商削減店舖樓面。其中運動服裝店旗下香港唯一一間NikeLab位於銅鑼灣白沙道之相連舖位,早前棄租其中一個,以該舖每月租金36萬元計,即每年慳租432萬元。

上述舖位位於白沙道5、7號地下,面積分別約1400及約1600方呎,合共即約3000方呎,由NikeLab於2015年起租用,至2018年續租3年,月租分別約36萬及約56.4萬元,呎租即約257及352元水平。

月租56萬承租白沙道1600呎舖

不過,有關租約今年6月到期,NikeLab已放棄租用5號地舖,土地註冊處顯示,該舖已由飛騰體育用品租用,月租大減至21.8萬元,較NikeLab棄租前租金減幅達四成。

而雖然7號地舖租約亦已到期,暫未見新租約登記,不過,就記者日前現場所見,獲NikeLab棄租的5號舖已上圍板,而7號舖的NikeLab仍繼續營業,原本打通的兩舖亦已分間開,估計已跟業主達成續約共識。換言之,NikeLab今次棄租一半樓面,以原來租金計,每年可慳租432萬元。

NikeLab為NIKE旗下副線品牌,全球只有約8間實體專門店,專門出售與設計師合作推出的特別版產品,故香港店外不時有人排隊爭購限量版波鞋。除白沙道分店外,NikeLab其餘分店位於東京南青山區、北京三里屯、上海徐匯區,其餘城市分別有紐約、米蘭、倫敦、巴黎,位置全為潮人集中地。

香港NikeLab所在的白沙道,亦有多間潮流品牌進駐,包括Stussy、Carhartt、Patagonia等,而白沙道6號的太平館餐廳,更擁不少明星食客。

敏華控股老闆娘9800萬購京瑞廣場舖

另外,有名人趁機入市舖位。土地註冊處顯示,沙田安群街3號京瑞廣場1期地下8號舖,上月以9800萬元由敏華控股 (1999) 創辦人兼董事局主席黃敏利之妻許慧卿購入。原業主2017年底以約7055萬元購入,持貨不足4年,帳面獲利2745萬元或39%。

另外,市場消息指出,資深投資者楊萬勤等持有的旺角快富街33至35號利大廈地下A舖,面積約900方呎,連入則閣樓約500方呎,連租約以6500萬元易手,呎價4.64萬元。商舖現租予醫務中心及兌換店,每月租金共約14.8萬元,租金回報約2.7厘。楊氏等於2007年2月以1450萬元購入該舖,持貨逾14年,帳面獲利5050萬元或3.5倍。

(明報)

更多京瑞廣場寫字樓出售樓盤資訊請參閱:京瑞廣場寫字樓出售

更多石門區甲級寫字樓出售樓盤資訊請參閱:石門區甲級寫字樓出售

Tsing Yi flats set to go on sale

Wang On Properties (1243) released the sales brochure for The Met. Azure in Tsing Yi and said sales will launch soon.

The project offers 320 homes ranging from 181 square feet to 257 square feet, according to its sales brochure.

Located at 8 Liu To Road, the 16-floor building offers 20 units in each floor, nearly 80 percent of which are studio flats.

Executive

director Teresa Ching Tak-won said the core concept of the design was

to create an ideal home life that is environmentally friendly,

convenient and healthy with modern technology.

Ching added that the sales of the flats will open soon.

Sun

Hung Kai Properties' (0016) Wetland Seasons Bay in Tin Shui Wai also

uploaded its sales brochure yesterday. It offers 1,224 units ranging

from 268 to 1,158 sq ft.

The

project comprises 6 multistory residential buildings, providing a total

of 1,104 units, and 10 multistory villas offering 120 units ranging

between 757 sq ft to 1,158 sq ft in size.

The project offers units ranging from studio flats to four-bedroom units, and also has a rare one-bedroom plus storeroom layout.

The project is expected to open sales in early August.

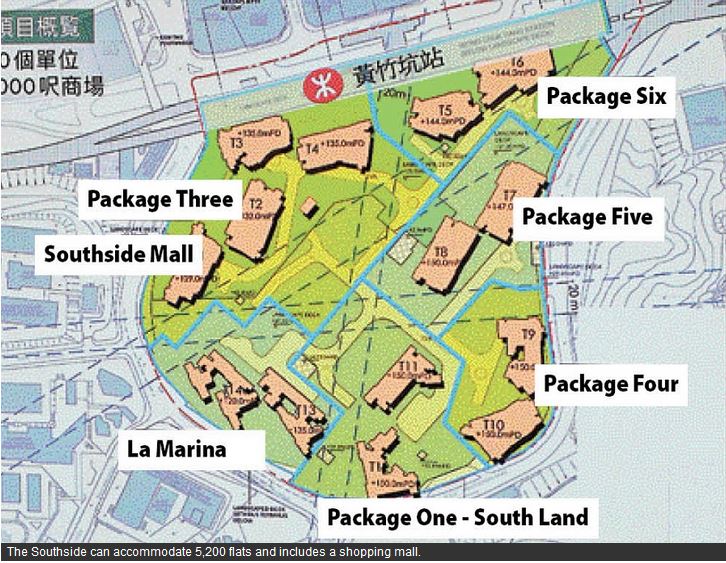

Meanwhile,

La Marina, phase II of The Southside, which is located above Wong Chuk

Hang station, has received pre-sale consent, and will open sales this

month at the earliest.

Codeveloped

by Kerry Properties (0683), Sino Land (0083) and MTR Corporation

(0066), the project offers 600 residential flats, providing one- to

four-bedroom units.

The developer added that the connected 500,000 square feet shopping mall, The Southside, will be completed in 2023.

(The Standard)

Hong Kong’s mass-housing rental market picks up as mainland Chinese students snap up even haunted flats

Some

mainland Chinese students returning for the new academic year next

month are closing deals after viewing flats online, agents say

Rents are likely to rise 10 per cent in this half due to demand from students, economic recovery and vaccinations, agents say

Activity

in Hong Kong’s mass-housing rental market is picking up thanks to

mainland Chinese students who are returning to the city after a gap of a

year, as universities resume classroom lectures next month.

Market

observers said that many of the mainland students will be arriving in

the city earlier than usual as they have to undergo 14 days of

quarantine and prepare for the new academic year, with many booking

flats after simply viewing only photos or videos.

Home

rents are likely to rise 10 per cent in this half because of the rise

in demand from mainland students, economic recovery and vaccinations,

property agent said.

“The

summer high season for leasing has begun,” the agent said. “The demand

in the leasing market will gradually increase, which is likely to drive

rents upwards and support property prices at the same time.”

The

city’s rental index has risen for four straight months in June,

according to the latest data from the Rating and Valuation Department.

The

view was echoed by analyst. The analyst said that rents have risen

along with the booming sales and prices in the property market in the

year’s first half.

Hong

Kong’s universities had 13,580 mainland students in the last academic

year, according to data from the University Grants Committee. Since not

all students can be accommodated in dormitories, many of them end up

renting private flats individually or in groups.

A

property agency in Tseung Kwan O struck 23 leases with mainland

students in 20 days last month. They made decisions remotely by viewing

photos and videos online, agent said. Tseung Kwan O is close to the Hong

Kong University of Science and Technology.

“Even

some haunted flats were leased,” the agent said, adding that all of

them paid a full year’s rent and deposit in advance, making them very

popular with landlords.

For

a 659 sq ft flat at Metro City in Tseung Kwan O, the annual rent and

two months’ deposits is around HK$294,000 (US$37,815), according to the

property agency.

Festival

City in Tai Wai, which is close to Baptist University and City

University of Hong Kong in Kowloon Tong, is also popular, as 41 leases

were signed in July alone, according to another property agency.

In

one instance, six mainland students rented a four-bedroom flat

measuring 959 sq ft for HK$37,000 a month in the estate. Festival City’s

average rent saw the biggest increase among 18 estates tracked by

property agency, with rents rising 10.2 per cent to HK$31.8 per square

foot in June from February levels.

Another estate, Solaria in Tai Po, which is near the Chinese University of Hong Kong, saw over 15 leases in July, another agent said.

One

mainland student paid an entire year’s rent, some 15 per cent above the

market level, after only viewing photos, the agent said .

(South China Morning Post)

向來放盤甚罕有的尖沙嘴新東海商業中心,最新錄一宗成交,該廈中高層14室,建築面積約1102方呎,以每呎11700元易手,涉資1289.3萬,地產界人士指,該單位擁維港景,屬於優質單位,成交價屬市價水平,該廈中層12室,建築面積約2732方呎,早於今年4月以每呎11640元易手。

涉資1289萬 屬市價水平

該廈於過去5年約錄20宗,當中17宗為中低層 (位處2樓至7樓) 單位,該廈5樓3室,建築面積1178方呎,以2018年6月以1508萬易手,平均呎價12801元。

市場消息指,深水埗栢樹街17號地鋪,建築面積約480方呎,以1020萬易手,該鋪位由食材店承租,月租2.38萬,新買家料回報2.8厘。盛滙商舖基金李根興評論,該地段人流一般,但千餘萬的鋪位盤源少,該鋪位目前由食材店承租,疫下食材店特別受捧,相信日後並不一樣。

春園街地鋪傳9100萬沽

灣仔春園街1至11號地下2B及2C鋪,市場消息指以約9100萬易手,建築面積約1500方呎,租客南記粉麵,月租20萬,新買家料回報3厘。

有代理表示,觀塘敬業街59號敬業工業大廈單位,面積約3686呎,以1550萬成交,平均呎價4205元,市值呎租約15元,料回報約4.4厘,原業主於2009年以100萬購入,持貨12年,帳面獲利1450萬。

(星島日報)

更多新東海商業中心寫字樓出售樓盤資訊請參閱:新東海商業中心寫字樓出售

更多尖沙咀區甲級寫字樓出售樓盤資訊請參閱:尖沙咀區甲級寫字樓出售

小西灣新藝工廈意向1.55億

工廈物業有價有市,部分業主亦趁勢放售。小西灣新藝工業大廈一籃子物業以意向價1.55億放售,呎價約4019元,較早前放售價調低約15%。

代理表示,小西灣安業街3號新藝工業大廈共11個單位,分布於5、7、9及10樓,總樓面面積約38566方呎,佔新藝工業大廈近一成業權,現以意向價約1.55億出售,平均呎價約4019元。

平均呎價約4019元

該代理稱,物業現已全數租出,租客以經營倉存行業為主,總月租收入約52萬元,按此計算,租金回報高達4厘,極其適合投資者購入作中長綫收租投資之用。代理補充,項目曾於去年底推出市場放售,當時意向呎價約4685元,今次業主調低叫價約14%,以提升項目的租金回報,增加物業競爭力及吸引力。

代理補充,位處新藝工業大廈斜對面,新業街5號王子工業大廈於今年中錄得一宗逾億元成交,涉及樓層為5層全層、天台連車位,總成交額約1.597億元,據悉買家為迷你倉公司,證明小西灣一帶工業物業的投資及自用價值均受肯定。

代理續稱,小西灣新藝工業大廈周邊重建項目林立,包括太古地產及中華汽車共同持有柴灣道391號住宅項目,前身中巴車廠,該項目毗鄰新藝工業大廈,落成後該地段人流將大幅增加。此外,毗鄰新藝工業大廈旁,由新地早年發展的數據中心iAdvantage租務暢旺,岑氏相信,今次業主因應市況調整叫價,令項目租金回報見可觀。

(星島日報)

永泰粉嶺地15%股權 3.9億售董建成唐英年

永泰地產 (00369) 在6月底以26.168億元高價投得粉嶺高爾夫球會旁住宅地,據永泰最新公告,以3.9億元售出項目公司15%,予全國政協副主席董建華的胞弟董建成、前政務司司長唐英年。

可建樓面28.4萬呎

該幅地皮可建樓面約28.4萬平方呎,由永泰以每呎樓面地價9,208元擊敗另外16組財團投得,較估值上限高15%。

據發展商最新宣布已訂立協議,Sunbeam Star及Su Sih兩間海外註冊公司,向集團收購持有粉嶺住宅地項目公司的分別10%及5%的股權以及股東貸款。

當中Sunbeam的實際持有人為董建成,而Su

Sih則為唐英年,而永泰在項目所佔權益則會降低至85%,並會向兩人就股東貸款收取3.9252億元,亦即是地價26.168億元的15%。當中董建成為船王董浩雲兒子、董建華胞弟、前東方海外主席,今年初曾夥永泰、銀娛副主席呂耀東以及羅嘉瑞旗下冠君產業信託合資以2.55億英鎊收購倫敦金融城商廈;唐英年則為「紡織大王」唐翔千兒子、曾任政務司司長,其胞妹唐英敏亦曾參與永泰的屯門項目OMA By The Sea。

永泰地產發言人指,集團常夥拍不同策略合作夥伴共同參與項目發展,今次與兩位合作夥伴均對新界東北、落馬洲河套等發展十分有信心。永泰將會是最大的股東,負責是次項目發展、銷售及市場推廣。

(經濟日報)

洗衣街核心區地舖 連租約開價3500萬

本地疫情持續清零下,加上消費劵推動,市場上零售氣氛大為好轉,素來市場敏感度高的舖市,亦陸續步入復甦階段,價格回落更陸續吸引投資者趁勢吸納,當中核心區舖位成交更為顯著;有業主乘市況轉活,將手持的旺角洗衣街地舖推出應市,意向價約3,500萬元。

古早蛋糕店承租至2022年底

代理指,位於旺角洗衣街111至115號地下C號舖,面積約680平方呎,現連租約,以意向價約3,500萬元放售,平均呎價約51,471元。上址現由古早蛋糕店承租,月租約4.8萬元,租期至2022年年底,新買家可享穩定租金回報。

前水務署大樓重建計劃 升值潛力增

舖位位處洗衣街飲食旺段,計有利苑酒家外,亦有居酒屋、韓燒店及冰室等,餐飲類別多元化,不時吸引外區客捧場。而現正放售的舖位,其正面向旺角前水務署大樓原址,該用地一直積極研究作重建發展,而待日後重建計劃落實開展後,勢將帶動該地段人流增加,大為提升該舖位的長綫投資潛力,而上址業主出售舖位作重整物業投資組合,屬市場難求,此洗衣街一段的舖位業主大都看好後市,一直作長綫持有,鮮有放售。

而據資料顯示,洗衣街同一地段上,近年成交以租務為主,最新買賣為今年年中易手的165號地下,面積約2,015平方呎,成交價約5,600萬元。但隨着疫苖接種普及,市民消費意慾回升,旺角區內商舖空置率為大為改善,6月份區內商舖空置率約11.9%,按月升0.03個百分點,按年錄得0.34個百分點的跌幅,表現向好。

代理續指,旺角作為本港核心旅遊消費區,雖然受封關影響,旅客幾近絕跡,但旺角區同時亦為港人愛到之處,本土消費力不容忽視,而且近月本地疫情緩和,市民外出消費意慾回升,可望日後市況回復時,更顯旺角舖位投資價值更見穩健。至於今以放售的舖位,其地理位置極具優勢,周邊有大型重建項目有待發展,重建計劃一旦落實,預料周邊的工商舖物業造價亦會受惠。

(經濟日報)

第一集團續推工商新盤 荃灣工廈呎價6000起

第一集團營業及市場部助理總經理郭照華表示,疫情穩定,經濟逐步恢復,工商舖最壞情況已經過去,料下半年價量齊升,集團會繼續推售工商新盤。

集團旗下共有7個工商重建項目,包括3個位於荃灣、3個位於長沙灣及1個位於九龍灣。荃灣工廈國際企業中心二期在售呎價6000至8000元;商廈國際企業中心三期呎價1.04萬元起。

郭照華指,集團未來會作多元化發展,目標研究更多住宅項目。現時旗下住宅包括南區淺水灣道72號屋地,估值22億元。

宏安地產

(01243)

投資部高級物業經理胡日發指出,早前以逾4.1億元購入香港仔黃竹坑珍寶閣509個車位,將作長線收租,因為黃竹坑上蓋物業發展項目陸續落成,區內停車場升值潛力大,目前平均車位月租2000元,回報約3厘,集團將為停車場增值。他認為,市況轉好,預計通關之後反彈幅度更大。

(信報)

HK ultra-luxury market sizzles

Hong Kong was among one of the seven cities which

saw the number of ultra-luxury home transactions double in the first

half of 2021, racking up 785 deals over the period, according to

property agency.

In value terms, the transactions were worth US$2.4

billion (HK$18.72 billion) year-to-date compared to US$1.4 billion a

year ago, the real estate consultant said.

And though Hong Kong's luxury property prices fell

7 percent in 2020, prices now are only about 3 percent lower than

historical highs, the agency added.

The news came as a 2,849-square-foot duplex unit at Dukes Place sold for HK$185 million, or HK$64,935 per sq ft.

A total of 2,843 residential units received pre-sale consent from the Lands Department in July, a 32-month high.

Meanwhile, the Urban Renewal Authority has offered

owner-occupiers of the Shing Tak Street/Ma Tau Chung road development

project an acquisition price of HK$19,848 per saleable area sq ft, the

highest amount among its Kowloon projects.

The offer price was calculated based on the unit rate of a seven-year-old notional replacement flat of the same locality.

In the primary market, the second phase of Grand

Victoria, which is offering 108 units via tender, saw 12 sales today.

All the units have three or more bedrooms with saleable areas ranging

from 752 sq ft to 3,029 sq ft.

Property brokers expect the per square foot price

and selling price of the duplex units, which have rooftops and

platforms, to surge to a new high.

The developers have cashed in a total of HK$5.7

billion by selling 413 units in the first and third phases of the

residential project at an average price of HK$28,109 per sq ft. The

highest price was HK$53,850 per sq ft.

Also in the primary market, Wang On Properties

(1243) revealed the first price list of the Met. Azure in Tsing Yi

yesterday, which offers 64 units at an average price of HK$18,700 per sq

ft.

(The Standard)

Asia-Pacific companies willing to pay higher rent for green buildings to reach net zero carbon goals

While

70 per cent of occupiers in the region are willing to pay a rental

premium for green space, compared with 62 per cent in Hong Kong

Existing supply of green buildings in many regional markets was not enough to meet demand

Most companies in the

Asia-Pacific are willing to pay a premium to rent space in sustainable

buildings as they look to make good on their sustainability pledges,

real estate consultancy said.

While 70 per cent of

occupiers in the region were willing to pay a rental premium for green

space, that ratio was lower at 62 per cent among those in Hong Kong,

according to a survey of 550 industry leaders across the region by the

consultancy.

“With 40 per cent of real

estate occupiers across Asia-Pacific having already adopted net zero

carbon goals and another 40 per cent planning to do so by 2025, green

buildings are no longer just ‘nice to have’ if corporates are to follow

through on their sustainability pledges,” property consultant said.

The consultant said that

companies in the Asia-Pacific were looking to achieve a goal of making

50 per cent of their property portfolios accredited by 2025, but the

existing supply of green buildings in many markets was not enough to

meet this demand.

Under the 2015 Paris

Agreement, countries from China to the United States have vowed to

cooperate to cap peak emissions of greenhouse gases in a bid to limit

global warming to below 2 degrees Celsius compared with pre-industrial

levels to slow down the impact of climate change. Chinese President Xi

Jinping pledged last September that China, the world’s top carbon

emitter, would cap its emissions by 2030 and reach carbon neutrality by

2060.

Such growing concern over

climate emergency and governments policies around the world were

driving companies to take action and transition to net zero carbon,

property consultant said.

Hong Kong companies were not far behind.

“The enquiries around net

zero carbon we received in Hong Kong in the first half of this year

were more than double the total enquiries received in 2020,” the

consultant said.

“Businesses acting now

are the ones that will benefit the most as they prepare themselves for

inevitable legislation, while meeting growing investor, customer and

employee demands while realising savings through operational

efficiencies,” the consultant said.

The

regional real estate decarbonisation drive was prompting companies to

prioritise locations that help them reduce carbon emissions and focus

more on green building investments, property consultancy said.

the

property consultancy said that banks and financial companies were

likely to be interested in relocating to so-called green buildings,

given their interest in green financing and bonds.

“Banking

and finance is the sector that pays highest attention to green space

because their own businesses have already got quite a high exposure to

environmental, social and governance and green concepts,” said Martin

Wong, director and head of research and consultancy for Greater China at

Knight Frank.

(South China Morning Post)

資金充裕 逾億元大手成交增

市場資金非常充裕,大手買賣增加。近1星期逾億元買賣明顯轉旺,工業、分層甲廈及停車場等均錄買賣,反映投資者對後市有信心。

近日大手買賣市場暢旺,逾億元成交相繼出現,如興勝創建 (00896)

連環出貨,以6.28億沽出觀塘大業街1號禧年工業大廈全幢,物業總樓面約6.3萬平方呎,集團於於2019年以4.89億元購入,去年曾申請重建成1幢36層高酒店,提供160間客房,總樓面約8.3萬平方呎。如今沽出物業,2年獲利約1.39億元。據悉,買家為均輝集團,該集團正持有觀塘偉業街111號均輝中心,正比鄰禧年工業大廈,料作合併發展。

興勝創建沽兩工廈 套現逾9億

此外,興勝創建亦以3.05億元售出柴灣美利倉大廈50%權益。集團於2019年7月,以7.35億買入柴灣利眾街18號美利倉大廈、柴灣中心工業大廈及觀塘工業中心單位,其中美利倉大廈樓高16層,地盤面積約6,685平方呎,總面積約68,296平方呎。新買家為外資基金AEW,購入作長綫投資。興勝創建沽出兩項工廈物業,合共套現逾9億元。

宏安換貨 沽甲廈購停車場

去年交投淡靜的甲廈市場,近2個月市況略轉好,其中金鐘統一中心30樓全層以5.15億元易手,面積約20,488平方呎計算,平均呎價約25,137元,物業將會以買賣公司形式交易。該全層現時月租約114.7萬元,租期至2023年,新買家可享租金回報約2.7厘。據了解,新買家為許大絢及梁先杰。資料顯示,業主為宏安地產

(01243)

,於2016年以5.12億元購入,持貨約5年,帳面獲利約277.5萬元,接近平手離場。宏安地產沽貨後,即斥逾4.1億元,購入黄竹坑惠福道珍寶閣509個車位,平均每個車位約80萬元,集團發言人指,是次購入停車場作長綫投資,目前車位每個月租約2,000餘元,屬偏低水平,將透過翻新,提高價值。

此外,酒店亦錄買賣,土瓜灣譚公道103至107號酒店易手,物業樓高18層,總樓面約29,349平方呎,以3.8億元成交。該物業原由一本地財團持有,發展興建一幢提供99間房的酒店,一直未有營運,現獲財團購入,平均每房價值約384萬元。新買家為Weave

Living,該集團在港主力發展共居空間,相信購入該酒店轉作共居。

分析指,市場資金仍非常充裕,加上疫情緩和,財團入市意慾較高,令近期大手買賣轉多。從最近成交中,不乏本地財團換貨,亦有外資基金入市,反映多路資金看好後市,相信未來數月大手買賣保持理想。

(經濟日報)

更多統一中心寫字樓出售樓盤資訊請參閱:統一中心寫字樓出售

更多金鐘區甲級寫字樓出售樓盤資訊請參閱:金鐘區甲級寫字樓出售

嘉民2億 購葵涌工廈多層

工廈續成基金追捧對象,消息指,外資基金嘉民亞洲,以約2億元購入葵涌厚豐工業大廈多層樓面,連同早前成交,今年累購逾13億元工廈樓面。

涉厚豐工業大廈10萬呎

市場消息指,葵涌厚豐工業大廈多層樓面成交,該物業位於葵涌永健路,於1983年落成,樓高22層。據悉,是次成交涉數層樓面,由零售品牌持有自用多年,涉及面積約10萬平方呎,如今以約2億元沽出,並將售後租回物業。

據悉,新買家為嘉民亞洲,購入作長綫收租,因該廈呎價便宜回報率高,故決定入市。事實上,嘉民亞洲基金今年甚積極入市,集團於本年初,以5.7億元大手購入觀塘海濱道177號海裕工業中心半幢業權,物業總面積約117,381平方呎,呎價約4,855元。

另外,基金亦連環購九龍灣三湘九龍灣貨運中心單位,先以1.82億購入該廈低層B室,連4個上落貨車位成交,其後再斥3.68億元,購入該廈高層全層,面積約69,700平方呎,呎價約5,279元。連同是次購葵涌物業,今年已斥逾13億元購入。

(經濟日報)

Prices for 32 Tsing Yi studios released

Wang On Properties (1243) has released 32 studio flats in the second price list at the Met. Azure in Tsing Yi.

The

flats in the list have an average price of HK$21,361 per sq ft after

discounts, 14 percent higher than the first price list of HK$18,700 per

sq ft. The cheapest flat, measuring 203 sq ft, is priced at nearly

HK$4.1 million or HK$20,177 per sq ft.

Of

a total of 320 flats in the project, the first batch was more than 11

times oversubscribed, with over 800 checks for the 64 units offered on

its launch last Saturday.

Separately, Sun Hung Kai Properties (0016) sold a 437-sq-ft special unit with a terrace of the second phase of Regency Bay

in Tuen Mun via tender at HK$10.81 million, or HK$24,737 per sq ft. The

developer has cashed in over HK$2.1 billion in the second phase for 279

units, accounting for 98 percent of the flats at the project, with an

average price of HK$19,748 per sq ft.

In

the secondary market, a buyer walked away from a deal to buy a HK$7.43

million flat at Sunshine City in Ma On Shan, due to a lower valuation by

banks.

The 363-sq-ft

flat was valued at HK$6.65 million and HK$6.85 million by HSBC and Bank

of China respectively, which was 8 to 10.5 percent lower than proposed

sale price. The buyer forfeited a deposit about HK$370,000, which was 5

percent of sale price.

(The Standard)

中環金利豐變身「醫生大廈」 朱俊浩:醫療集團簽十年長約

疫市下中環有全新商廈落成,金利豐主席朱李月華7年前購入商廈,重建為 金利豐中心 (35 QRC),並變身「醫生大廈」,金利豐執行董事朱俊浩表示,該全幢由醫療集團承租,租客簽署10年租長約。

該全幢商廈由朱太兒子朱俊浩 (Kingston) 負責策劃及打理招租事宜,他表示,早於疫情前,中環已有不少寫字樓供應,港島東、黃竹坑及九龍東亦供應充裕,疫市後不少企業員工在家工作,令企業對寫字樓需求減少,他不希望在此平台與人競爭,將該廈定位為醫療行業,況且,該廈毗鄰的萬邦行,本身是很成功的醫生大廈,35 QRC規模不算大,但位置十分理想,極具優勢吸引醫療行業,因此,雙方洽商僅1個多月時間,租客一簽10年長約。

洽商僅一個多月拍板

他表示,雙方迅速達成協議,皆因大家有相同理念,一起將該廈打造成為醫療大廈。他續說,樓高26層,每層約1000方呎,新租客嘉仁專科醫療集團,日後每層將容納2至3名專科醫生,包括心臟科、腫瘤科、泌尿科等,目標吸納中產病人。

朱太2014年逾16億購入

皇后大道中35號前身為舊式商廈,於1957年落成,「殼后」朱李月華於2014年7月斥16.0086億向福利集團購入,但朱氏婉拒透露租金,惟他表示,該全幢總投資額逾20億。

代理表示,港島區「醫生大廈」需求殷切,由於吸納本地客,受疫市影響相對輕微,他估計該廈市值呎租逾50元。

該廈地鋪除了作醫療中心外,尚有一個建築面積約2300方呎地鋪,據地產界人士指,曾以每月92萬放租,後來封盤,最後由朱太擔任集團主席的先施錶行旗下FRANCK MULLER進駐。

代理料呎租逾50元

FRANCK

MULLER自從2014年起,承租銅鑼灣霎東街15號OLIV地下至3樓,作旗鑑店,建築面積約9499方呎,一簽9年租約,土地註冊處資料顯示,首3年月租238萬,呎租約251元。隨後3年續租權,加租20%至每月285.6萬,最後3年續租月租高達365.6萬至2023年。

(星島日報)

更多萬邦行寫字樓出租樓盤資訊請參閱:萬邦行寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

銅鑼灣舖空置 按年減1.47百分點

零售市道好轉,帶動舖位空置情況逐步改善。代理資料顯示,本港5個核心消費區商舖空置率,以銅鑼灣改善情況最為理想,7月份空置率10.06%,按年更大減1.47個百分點。

代理表示,根據統計,7月份本港各核心區商舖空置情況平穩向好,銅鑼灣空置率連續第3個月遞減,7月份錄得約10.06%,比對6月份下降0.22個百分點,較去年同期下跌1.47個百分點,反映租客對進駐銅鑼灣區舖信心回升。

登龍街舖洽租烈 搶至27萬租

近月銅鑼灣區舖位租務氣氛暢旺,登龍街28號永光中心一個地舖,原本意向租金約26萬元,由於洽租情況熱烈,據了解,業主終以約27萬元由冰室承租。

九龍區方面,以尖沙咀及旺角兩區7月份商舖空置率按月走勢相對穩定,但對比2020年同期則見改善。尖沙咀區最新舖位空置率為15.47%,對比6月輕微增加0.04個百分點,不過就較去年同期大幅回落1個百分點,反映區內吉舖數量持續遞減,逐漸獲承租。

大角咀舖叫價1950萬 加價7成

該代理分析,舖位租賃市場已調整一段長時間,核心區舖租回落至吸引水平,加上市民抑壓已久,乘近月本地疫情有所緩和,再加上消費券於8月份開始派發,舖租市場相應受惠。

另外,據市場消息指,大角咀中滙街32至38號中堅樓地下12A舖,地舖面積700平方呎,另設500平方呎天井,現時由美式餐廳月租5萬元租用,原業主叫價1,800萬元,最終以1,150萬元獲承接,減價36%或650萬元。據悉投資者即時將舖位重新放售,叫價1,950萬元,加價高達7成。

(經濟日報)

CK Asset to convert some hotels into residential units to make most of decline in hospitality sector, rise in home prices

There is value in converting some of the company’s hotels into residential units, chairman Victor Li Tzar-kuoi says

Because of Covid-19, operating hotels has become riskier than ever before: analyst

CK

Asset Holdings will convert some of its hotels for residential use amid

a decline in the hospitality sector thanks to the Covid-19 pandemic and

a record rise in the city’s home prices.

Victor

Li Tzar-kuoi, the company’s chairman and managing director, stated

publicly for the first time on Thursday that a specific percentage of CK

Asset’s hotels portfolio will be converted for housing in the world’s

most unaffordable housing market.

“We

have a huge hotels portfolio. [For] 10, 15 per cent of that portfolio,

the neighbourhood has changed, pricing has changed. And there is value

generation by converting some of [these hotels] to residential,” he

said.

Harbour

Plaza Resort City in Tin Shui Wai could generate a residential area of

139,500 square metres, or 5,000 units, according to a document released

by the Town Planning Board in December last year. Horizon Suites in Ma

On Shan could generate up to 758 flats, with a residential area of

44,863 square metres, according to another document released in February

this year. The two hotels have a total of 1,933 rooms currently, or

about 13 per cent of the about 15,000 hotel rooms and serviced suites CK

Asset owns.

Li’s

comments come at a time when hotels in Hong Kong have struggled to fill

rooms and break even, especially on weekdays, after the protests of

2019 and the coronavirus pandemic, which broke out last year, dragged

the city’s visitor arrivals to almost zero. But home prices have proved

far more resilient, with local demand and quantitative easing

contributing to a recent rally.

Hotels

that focused on tourists had “gone through possibly the most difficult

period” already, according to Li. And while the company was converting

some of its tourist-focused hotels into long-stay properties, Li

remained optimistic about tourism. “I still remember the tough time

during Sars. The lesson I learned from Sars was that [outbreaks] go away

and tourists come back, and business will recover,” he said. “I’m quite

sure one day tourists will come back and we’ll be giving good numbers.”

The company was building a new hotel in Ap Lei Chau for long-term lease, Li added.

“The

hotels business involves long-term investments. Developers always

prefer building residential flats for sale, rather than building

hotels,” surveyor said. “Whilst we cannot foresee the impact of Covid-19

… operating hotels has become riskier than ever before.”

Stephen

Ng, chairman and managing director of The Wharf Group, also spoke about

the limitations of the hotels business on Thursday, during his

company’s results briefing. Even though staycations, or bookings by

locals, had become mainstream business for hotels, their impact was

limited, he said. He said that even if business were to resume, there

may be problems with staff recruitment, as many staffers had changed

track or decided against joining the industry amid a pessimistic outlook

for the sector because of the pandemic.

The

redevelopment of CK Asset’s hotels into flats “will be good as this can

provide immediate supply”, another surveyor said. “This will help boost

supply even if they only lease out the flats, instead of selling

[them].”

Even

though developers will need to spend big to convert hotels into

residential units, it will be worthwhile given the strong performance of

the residential market even during Covid-19 and the economic downturn,

the surveyor added.

Hong

Kong home prices were flat in June after reaching a two-year high,

according to data from the Rating and Valuation Department. An index

measuring the prices of second-hand homes stayed at 394.5, data from the

department shows, just a whisker below the previous peak of 396.9 in

May 2019.

(South China Morning Post)

英皇1.1億購香港仔全幢舊樓增購毗鄰項目擴發展規模

市區地皮供應有限,令市區舊樓成財團併購對象,而據土地註冊處資料,香港仔舊大街72號舊樓全幢,於上月獲英皇以1.1億購入,毗鄰的74至80號地盤,英皇早已統一業權,目前增購毗鄰舊樓擴發展規模。

市區舊樓再獲財團出手收購,據土地註冊處資料顯示,香港仔舊大街72號全幢,於上月以1.1億易手,買家以公司名義登記,為ALL

HARVEST CORPORATION

LTD,公司註冊董事包括英皇國際執行董事張炳強、英皇集團董事總經理黃志輝,以及該集團另一名董事總經理范敏嫦。

至於毗鄰的香港仔舊大街74至80號地盤,早前已統一業權,並已完成清拆,至於74至80號地盤,其佔地為4289方呎,將興建為1幢樓高23層的商住物業,總樓面約3.8萬方呎,提供約110至120伙。

毗鄰74至80號已統一業權

英皇近月就頻頻出手,透過收購舊樓增加土地儲備,其中,筲箕灣南安街67、69、69A及71號仲齊大廈舊樓,英皇亦於上月透過強拍統一業權,以底價1.95億購入,其地盤面積約3000方呎,以地積比9.5倍計,可建樓面約2.85萬方呎,每呎樓面地價約6842元。

項目現址為1幢樓高8層商住舊樓,於1964年落成,樓齡約57年,地下有3個商鋪,1至7樓為住宅,共有兩條公用樓梯,規劃用途為「住宅 (甲類) 2」。鄰近筲箕灣港鐵站,甚具重建價值。發展商早前曾指出,項目將會連同南安街73至77號合併發展,地盤總面積約5980方呎,計畫興建1幢約25至26層高商住物業,提供約168伙。

除仲齊大廈外,英皇亦於上月統一西營盤高陞大樓業權,同樣透過強拍統一業權,以底價2.59億購入,地盤面積約2144方呎,以地積比率約9倍計,可建樓面約19296方呎,每呎地價約13422元。

近月頻收購港島舊樓

高陞大樓樓齡約55年,與筲箕灣仲齊大廈相若,位於西營盤皇后大道西78至80號及荷李活道265至267號,毗鄰荷李活道公園,以及西營盤港鐵站。

項目現址為1幢十層高樓宇,地下及1樓為商鋪,設有兩條公共樓梯。政府租約年期由1861年6月25日起計999年。

(星島日報)

Hysan Development, IWG form flexible office joint venture as Hong Kong landlord eyes Greater Bay Area market

The

joint venture will acquire and operate IWG’s 32 existing locations and

the Regus, Spaces and Signature brands across the Greater Bay Area.

Hong

Kong’s office rents have declined by a quarter from two years ago as

demand for office space has fallen because of remote working

arrangements.

Hysan Development is

expanding into the shared-office market in the Greater Bay Area through a

joint venture with IWG, the world’s largest flexible workspace

operator, as it seeks to cash in on the growing trend of remote working

arrangements by companies who are looking to contain costs.

The joint venture will

acquire and operate IWG’s 32 existing locations and brands across the

Greater Bay Area, Hysan said on Monday, without disclosing its

investment in the venture.

Sixteen of these shared offices are in Hong Kong, which are operated under three brands – Regus, Spaces and Signature.

“The workspace ecosystem

is fast evolving to better meet end users’ needs and expectations, and

flexible workspace will play an important part,” said Ricky Lui, chief

operating officer of Hysan Development. “The joint venture reflects our

confidence in the economic growth of the Greater Bay Area.”

Hysan has market value of

HK$30.8 billion (US$3.95 billion) and ranks among the biggest office

landlords in Causeway Bay, the city’s prime commercial district.

The formation of the

joint venture comes as Hong Kong’s office rents have fallen by a quarter

from two years ago. Demand for office space has reduced as remote

working arrangements have taken hold across the globe as companies

implemented social distancing to prevent the spread of Covid-19 and cut

costs.

“In the wake of the

pandemic, we are seeing record levels of demand as companies embrace

hybrid work and rethink their real estate strategy,” said Mark Dixon,

founder and chief executive of IWG.

Some of big office users like HSBC and Standard Chartered have accelerated the shift towards remote working.

HSBC has downsized its

global office footprint by 10 per cent since January 2020 as it has

adopted a hybrid model of splitting work between the office and home,

the bank said during its half-year results announcement on August 1.

In February, Standard

Chartered signed an agreement with IWG giving its 85,000 employees

globally access to IWG’s 3,500 offices around the world for a trial

period of 12 months.

The newly emerging

flexible office trend is pushing landlords to seek greater exposure into

the sector to diversify from their core business, analysts said.

“Operators with a strong

track record of successfully running flexible workspace locations, at

scale, are more interesting for investors, particularly operators with a

robust client base and potential to tap into the corporate real estate

market, which IWG certainly have,” property consultant said.

Almost all of the clients

were looking at ways to incorporate flexible offices into their real

estate strategy, the property consultant added.

Hysan said it would continue to expand IWG’s brands in the growing flexible workspace market in the region.

Currently, more than 10

per cent of Hysan’s 2.5 million square feet of prime office space in

Hong Kong’s Causeway Bay has been leased to different flexible workspace

operators, including IWG.

Last year, IWG’s Signature brand took over 32,000 sq ft of space vacated by rival WeWork at Hysan Place. IWG’s Spaces brands operates a flexible location at Lee Garden Three.

Hysan’s other co-working operator tenants include The Desk at One Hysan Avenue, and WeWork and Compass at Lee Garden One.

(South China Morning Post)

For more information of Office for Lease in Hysan Place please visit: Office for Lease in Hysan Place

For more information of Office for Lease in One Hysan Avenue please visit: Office for Lease in One Hysan Avenue

For more information of Office for Lease in Lee Garden One please visit: Office for Lease in Lee Garden One

For more information of Grade A Office for Lease in Causeway Bay please visit: Grade A Office for Lease in Causeway Bay

50大甲廈上月8買賣 今年低

近期股市表現波動,連帶與股市關係密切的甲級商廈,交投也受到影響而回落。綜合代理數據顯示,7月份50大指標甲廈合共錄得8宗買賣,創下今年來的新低。不過,總計今年首7個月,指標甲廈仍然錄得106宗買賣,按年大升逾1.7倍。

7月份50大甲廈僅錄得8宗買賣,相對6月份的20宗,下跌約60%,最新成交面積約5.19萬平方呎,按月亦下挫38%。

首7月106宗成交 增1.7倍

雖然指標甲廈成交量按月略為回落,但總計今年首7個月,50大甲廈仍然錄得106宗買賣成交,較去年同期的39宗大增1.7倍。

若按地區劃分,7月份成交集中於九龍,期內佔4宗,而港島及新界各錄得2宗。上月表現較活躍的為葵涌新都會廣場,錄得2宗買賣;而核心區方面,上環信德中心及中環中環中心也各錄得1宗買賣。當中,中環中心上月錄得1宗全層成交,是繼6月底連錄2宗全層買賣後,又一宗全層成交。

代理表示,近期受到中概股風波影響,股市表現波動,影響部分市場人士的信心,而與股市關連較大的甲廈交投表現亦會受到影響,交投因而回落。不過,中長綫的角度而言,日後中概股料會加快來港上市的步伐,對於香港寫字樓的需求有正面作用,相信甲廈仍然會受到一定追捧。

該代理續指,近期甲廈的交投仍然集中於非核心區,因為相關地區甲廈涉及的銀碼較低,平均呎價也較低水,對於部分投資者有一定吸引力,反觀傳統核心區甲廈銀碼大,呎價較高,投資者會表現較為審慎,相信要待重新恢復通關後,交投表現才會有所改善。

(經濟日報)

更多信德中心寫字樓出售樓盤資訊請參閱:信德中心寫字樓出售

更多上環區甲級寫字樓出售樓盤資訊請參閱:上環區甲級寫字樓出售

更多中環中心寫字樓出售樓盤資訊請參閱:中環中心寫字樓出售

更多中環區甲級寫字樓出售樓盤資訊請參閱:中環區甲級寫字樓出售

灣仔資本中心 位置優越合中小企

灣仔資本中心位處商廈林立的告士打道,地點甚為優越。單位享維港海景,而間隔方正實用,適合中小型企業使用,吸引不同種類的租客進駐,如證券及金融等行業。

資本中心坐落於灣仔商業區地段,地理位置優越,鄰近港鐵灣仔及銅鑼灣站,享雙鐵路優勢。大廈比鄰一帶為香港會議展覽中心、主要政府大樓、新鴻基中心、中環廣場及華潤大廈,屬區內黃金地段,對上班一族絕對便捷。

大廈正位處告士打道繁華路段,步行約7分鐘即達灣仔港鐵站、銅鑼灣站約8分鐘步程,附近亦有多條巴士綫及電車可到達,交通便利。加上比鄰行人天橋可直達香港會議展覽中心、華潤大廈及新鴻基中心,位置優越,亦設有多條巴士及小巴轉綫,前往港九新界各區,十分便利。此外,大廈設備完善設有停車場,提供大量月租時租停車位,而停車場入口設於謝斐道,方便駕車人士出入。

大廈地理環境優越,四周不乏食肆餐廳,附近軒尼詩道、謝斐道及駱克道一帶,有多間茶餐廳、酒樓、特色小店及咖啡室可供選擇,食肆林立。若不介意步程可步行至登龍街等銅鑼灣地段,或也有大型購物商場食肆及美食廣場選擇。

物業於1982年落成,至今樓齡約39年,樓高25層,大堂裝修氣派非凡,備有8部電梯及1部專用載貨電梯,設高低樓層升降機,讓繁忙時段可分流,方便客人上落。大廈每層面積約15,727平方呎,大多以一梯多伙為設計,樓層設獨立廁所。

樓面設計靈活 可變多個單位

大廈樓面設計靈活,租戶可獨佔全層或每層規劃多個單位,大多單位享海景景觀,坐享維港美景及灣仔運動場,單位落地玻璃大窗,盡擁維港海景,工作效率自然能大大提升。

而部分單位坐擁城市開揚景觀,單位正對電梯,出入極為方便;而間隔方正實用,適合中小型企業使用,吸引不同種類的租客進駐,如證券及金融等行業。

買賣方面,今年2月物業錄成交,涉及中層2室,面積約2,171平方呎,以約4,233萬元易手,呎價約1.95萬元。

(經濟日報)

更多資本中心寫字樓出租樓盤資訊請參閱:資本中心寫字樓出租

更多資本中心寫字樓出售樓盤資訊請參閱:資本中心寫字樓出售

更多新鴻基中心寫字樓出租樓盤資訊請參閱:新鴻基中心寫字樓出租

更多華潤大廈寫字樓出租樓盤資訊請參閱:華潤大廈寫字樓出租

更多灣仔區甲級寫字樓出租樓盤資訊請參閱:灣仔區甲級寫字樓出租

更多灣仔區甲級寫字樓出售樓盤資訊請參閱:灣仔區甲級寫字樓出售

黎姿醫美公司51.6萬租南豐大廈 英國《金融時報》提早15個月撤出

新冠肺炎疫情雖然緩和,但經濟受壓,對部分企業營運帶來挑戰,故商廈仍有退租情況。英國《金融時報》的香港辦事處原租用上環南豐大廈兩層樓面,現提早超過一年退租18樓全層,每月節省64.71萬元租金;有關樓層火速獲黎姿 (現名黎珈而) 旗下醫學美容公司以51.58萬元承租,租金回落約20%。

據了解,《金融時報》香港辦事處於2019年10月開始承租上環干諾道中88號南豐大廈18樓全層作為辦公室,建築面積9165方呎,月租約64.71萬元,呎租約71元,成為該廈近年呎租新高成交,並簽約3年。

18樓全層新約平20% 呎造56元

雖然《金融時報》簽訂的租約要到明年9月底始到期,但土地註冊處資料顯示,租客THE FINANCIAL

TIMES (HK)

LIMITED已在7月起退租,即提早15個月離場。以單位月租約64.71萬元計算,未計賠償,《金融時報》可節省約970.65萬元租金支出。

《金融時報》退租18樓全層後,目前仍租用同廈6樓全層,該單位已承租多年,建築面積9165方呎,目前月租約54.37萬元,每呎約59元,租期至明年9月。

在《金融時報》離場後,業主南豐隨即找到新租客頂上租用18樓單位。土地註冊處文件顯示,G MAX

GROUP

LIMITED由7月起租用上址3年,最新月租約51.58萬元,呎租約56元。以最新租金計,較《金融時報》接近兩年前簽訂的租約月租減少13.13萬元,跌幅約20.3%。

中東基金租國際金融中心二期設港據點

據公司註冊處資料顯示,G MAX GROUP LIMITED的董事為黎珈而,該公司的登記地址亦與黎珈而擔任主席兼行政總裁的卓珈控股 (01827) 總部相同,料租用南豐大廈單位作為旗下醫學美容公司分店。

另外,全港指標商廈中環國際金融中心二期錄大手租賃成交,70樓12、15至16室,租用面積約5306方呎,以100.8萬元租出,呎租約190元。據了解,新租客為中東基金公司,首度在港設立據點。

資料顯示,由於單位屬高層,3年前高峰期呎租可高達220元,最新成交呎租已較高位下跌13.6%。

(信報)

更多南豐大廈寫字樓出租樓盤資訊請參閱:南豐大廈寫字樓出租

更多上環區甲級寫字樓出租樓盤資訊請參閱:上環區甲級寫字樓出租

更多國際金融中心寫字樓出租樓盤資訊請參閱:國際金融中心寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

鄧成波家族6.95億售粉嶺工廈

「鋪王」鄧成波家族連環沽貨,由該家族持有的粉嶺勉勵龍中心全幢,以6.95億由中資公司承接,每呎造價4550元,市場消息透露,買家為華潤物流。

平均呎價4550元

據代理指出,由鄧成波家族持有的粉嶺安樂門街35至37號勉勵龍中心全幢,項目地盤面積60547方呎,總樓面152762方呎,作價6.95億易手,買家為中資公司,平均呎價4550元,創今年以來粉嶺區內最大宗金額工廈成交。原業主鄧成波家族於2015年以5.15億購入,持貨6年帳面獲利1.8億,物業期間升值約34%。

代理表示,今年上半年粉嶺工廈投資活動活躍,工廈價格升勢凌厲,政府政策有利工廈,包括活化計畫和標準金額措施,令工業資產被定位為具吸引力的投資資產類別。

華潤物流承接

市場人士透露,上述買家為華潤物流,華潤物流活躍於市場,除了勉勵龍中心,並購入屯門東亞紗廠工業大廈全幢,作價22.4億,屬今年以來市場上最大宗全幢工廈成交,平均呎價4802元,該全幢樓高15層,總面積約466449方呎,平均每呎4802元。鄧成波家族近期頻頻沽貨,早前以3650萬售出九龍城候王道26號地鋪。

(星島日報)

新地1.15億沽九龍城巨鋪屯馬綫通車帶動平均每呎1.5萬

受港鐵屯馬綫通車帶動,沿綫地段鋪位備受追捧,由新地持有九龍城獅子石道巨鋪,放盤逾一年,最新在屯馬綫通車帶動下,以1.15億成交。自從該鐵路開通後,沿綫地段鋪位暫錄6宗買賣,涉資逾2.7億,當中以食肆鋪位最受最捧。

由新地持有的九龍城獅子石道1號基座商場,包括地下1至3號鋪及1樓全層,知士人士指,物業早於一年放盤,直至最近,在屯馬綫開車後帶動,以1.15億易手,買家投資者為曾廣達、曾善兒及朱家偉,該巨鋪總樓面約7607方呎,呎價約15118元,現址租客包括家品店及補習社。

放盤逾一年終售出

代理表示,上述獅子石道的優勢是路面夠闊,而且門口可停車,該地鋪亦適宜分拆兩個,出租予食肆,以提高回報率,1樓則仍然租予補習社,預期增值後,月租可達30萬或以上,回報提高至3至4厘。

上述獅子石道1號由新地發展,於2002年3月落成,樓高19層,一梯3伙,擁有57伙,新地當年出售住宅,持有鋪位收租,直至近期才沽貨。

地鋪適宜拆細出租

同區近期鋪位頻錄成交,包括龍崗道12號地下及入則閣,面積約1000方呎,以3100萬成交,呎價約3.1萬,該鋪位由食肆以7萬租用,料買家享回報約2.7厘,原業主於1977年4月以40萬買入,持貨44年帳面獲利3060萬,物業升值約76.5倍。

地產界人士表示,九龍城區為民生地段,受惠港鐵屯馬綫通車,帶動區內人流量,區內食肆受惠,近期午市及晚市皆見人流如鯽,加上區內鋪價遠較核心區便宜,故吸引投資者紛「吼準」洽購,成交鋪位以食肆鋪為主導。

事實上,自港鐵屯馬綫於今年6月底通車以來,九龍城、土瓜灣及新蒲崗區共錄至少約6宗鋪位買賣,合共涉資逾2.7億,資料顯示,新蒲崗崇齡街90號地鋪,面積約900呎,以3276萬易手,呎價約3.64萬,該鋪由食肆以6.5萬承租,料回報約2.38厘。原業主於2004年以140萬購入,持貨17年帳面獲利3136萬,物業期間升值約22.4倍。

盛滙基金早前亦以1400萬購入土瓜灣麟祥街27號,面積880方呎,呎價約1.59萬,該鋪由冰室以2.45萬租用,租金回報約2.1厘。原業主於1990年以107萬買入,持貨31年帳面獲利1293萬,升值約12倍。

(星島日報)

Wetland Seasons Bay puts up 245 homes

Wetland Seasons Bay phase 1 in Tin Shui Wai opened its first price list, offering 245 units at an average price of HK$13,689 per square foot.

The cheapest flat, a 300-sq-ft one-bedroom unit, costs HK$4.55 million after discounts.

The first batch of 245 flats range from 300 to 795 sq ft and cover one- to four-bedroom units.

The

average price of this batch is 20 percent higher than Wetland Seasons

Park in Tin Shui Wai, which was also developed by Sun Hung Kai

Properties (0016), but is slightly lower than the last batch of Wetland

Seasons Park.

The project will open show flats and start receiving checks tomorrow with the first round of sales starting next week.

In

Sheung Wan, Hollywood Hill, developed by Hanison Construction (0896),

also unveiled its first price list of 10 flats with an average selling

price of HK$31,000 per sq ft.

The price per sq ft is 8 percent lower than the first batch of 28 Aberdeen Street in the same district.

The

prices of the 400-sq-ft one-bedroom units range from HK$11.56 million

to HK$13.6 million. Sales start this week on a first come, first served

basis.

The developer said that there will be a five to 10 percent price hike for the coming batches.

In

Ho Man Tin, Madera Garden announced its second price list and offered

three more units. The properties range from 286 to 414 sq ft. The price

per sq ft is between HK$24,630 and HK$26,762 and prices range between

HK$7.65 million and HK$10.7 million after discounts.

It

will open the second round of sales for a total of 11 units, including

the remaining eight flats from the first round of sales and the three

newly added units, on Saturday.

(The Standard)

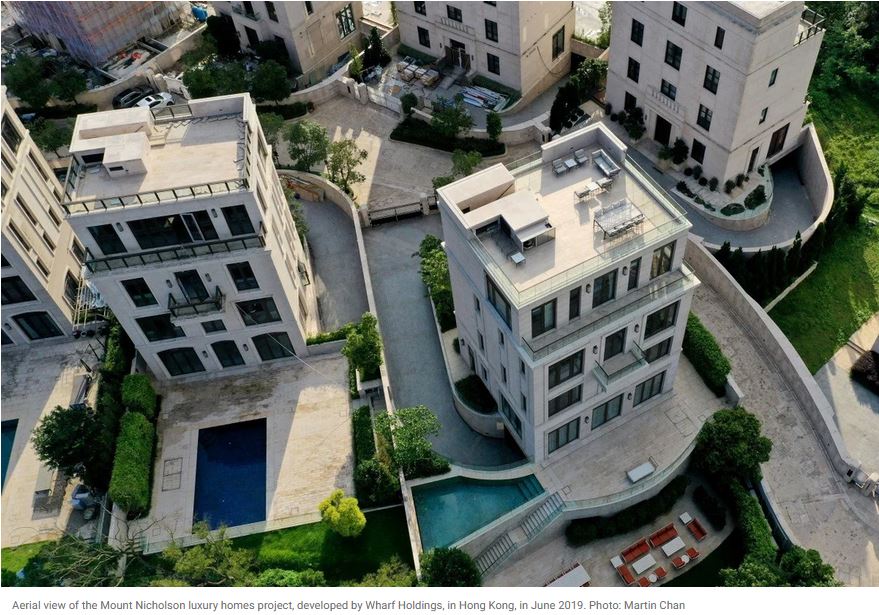

Wharf’s first-half results improve, helped by resurgent sales of luxury homes in Hong Kong and strong consumption in China

Wharf’s

underlying interim net loss narrowed by 53.5 per cent to HK$526 million

(US$67.58 million), after an impairment provision of HK$3.65 billion

Including

valuation gains, Wharf posted an interim net profit of HK$1.04 billion,

swinging from a loss of HK$1.74 billion last year

Wharf

Holdings, one of Hong Kong’s biggest builders of luxury homes and

shopping centres, improved its first-half financial results, as strong

sales of ultra-expensive residences and investment gains bolstered its

bottom line.

The

company’s underlying interim net loss narrowed by 53.5 per cent to

HK$526 million (US$67.58 million) from HK$1.13 billion loss in the first

half of 2020, after an impairment charge of HK$3.65 billion, Wharf said

in a filing to the Hong Kong stock exchange. Including valuation gains

and one-time gains, Wharf reported an interim net profit of HK$1.04

billion, swinging from a loss of HK$1.74 billion a year earlier.

Wharf’s

fortunes were helped by strong sales of ultra luxury homes in the

world’s most expensive urban centre. Five units of Wharf’s luxury

project at 77/79 Peak Road were sold for a combined HK$3 billion, or up

to HK$92,100 per square foot. It also sold a luxury apartment at the

exclusive Mount Nicholson project for HK$490 million. Two town houses at

11 Plantation Road were leased by tender for a combined HK$2.2 million

per month.

“Since

a series of transactions of ultra-luxury housing in January and

February, the following few months have become quiet,” said Stephen Ng,

chairman and managing director, said at a briefing on Tuesday. “This

fully matches the nature of the ultra-luxury housing market, where not

every day has home sales. But when there are sales, they can sometimes

be high.”

The

resurgent sales of luxury homes underscores how the coronavirus

pandemic has not impeded the fortunes or spending habits of the wealthy

class. Wharf spent HK$15.6 billion to buy two prime residential land

plots at The Peak in Hong Kong to further its grip on the city’s luxury

residential market. In particular, the acquisition of two sites in

Mansfield Road doubled the total attributable gross floor area to nearly

600,000 square feet.

Still,

the luxury housing segment is characterised by long holding periods,

Wharf said in its filing. Mount Nicholson, one of the most expensive

addresses in Asia on a per square foot basis, may be a useful

illustration in this regard, Wharf said. The site was bought in 2010. It

was not until 2016 that the first property was sold. Two houses and 10

flats remain unsold, out of the entire project’s 19 houses and 48

apartments, which underscores how the internal rate of return will be

weighed down by the long payback period, Wharf said.

“Land

on The Peak is not easy to handle,” said Ng. Mount Nicholson “looks

like Asia’s king of housing on the outside, but the return may not be as

high as some mid- and low-tier housing,” he added.

Wharf’s

shopping centres are doing well in mainland China, helped by a recovery

in luxury retail sales. Revenue from investment properties jumped by 45

per cent to HK$2.68 billion, while operating profit increased by half

to HK$1.78 billion, driven mainly by the malls at the International

Finance Square in Chengdu and Changsha. The developer sold 1,815 homes

in China in the first six months totalling 214,400 square metres (2.31

million square feet), with the contracted sales value falling 29.6 per

cent to 5.7 billion yuan (US$879 million).

Wharf

announced an unchanged interim dividend of 20 Hong Kong cents. Its

shares fell 0.4 per cent to HK$26.30 after the earnings were announced.

(South China Morning Post)

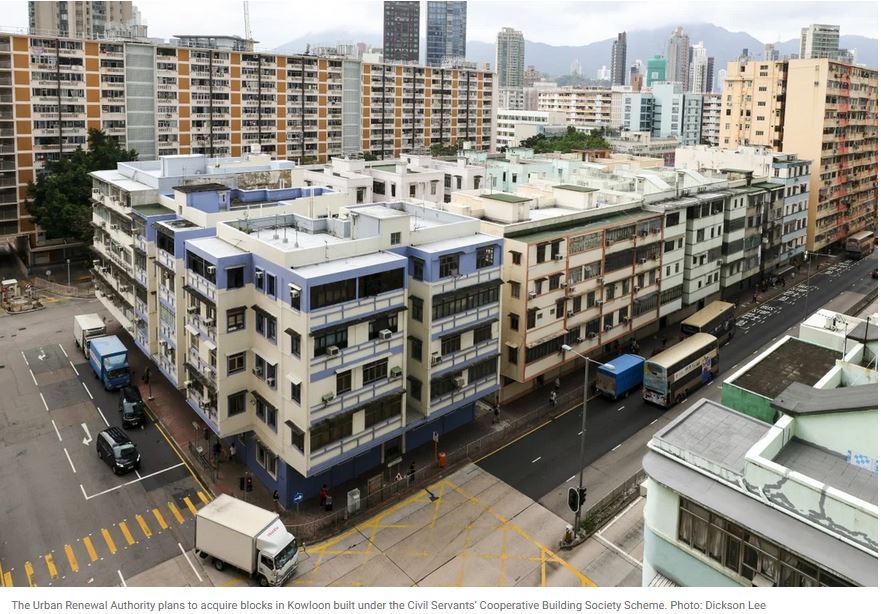

Home prices in Kowloon rise after Urban Renewal Authority’s record compensation offer for old residential buildings

Lived-in

home prices in Ma Tau Wai, Kowloon, have risen by about 3 per cent in

the past month; some agents expect a further 5 per cent boost by

year-end.

The

URA last week offered 154 flat owners of a Civil Servants’ Co-operative

Building Society HK$19,848 (US$2,550) per square foot

The

Urban Renewal Authority’s (URA) record-high acquisition price for units

in ageing residential buildings in Ma Tau Wai, Kowloon, has led to a

slight increase in home prices in the area. Market observers, however,

said that any rise would be limited as the boost will be tempered after

the gains in June following the opening of a new MTR line.

The

URA last week offered 154 flat owners of a Civil Servants’ Cooperative

Building Society Scheme (CBS) development project in Shing Tak Street,

Ma Tau Wai, HK$19,848 (US$2,550) per square foot of saleable area, the

highest such offer in Kowloon, according to analyst.

Lived-in

home prices have risen by about 3 per cent in the past month as news of

URA’s impending offer started doing the rounds, putting it on a par

with newer developments, market observers said. They have risen about 5

per cent since the Tuen Ma line opened in June.

“It’s

almost HK$20,000, of course [homeowners] will be aggressive,” property

agent said. “Coupled with the opening of the Sha Tin to Central link,

raising asking prices and withholding listings is inevitable.”

Another

agent said that prices in the area could rise a further 5 per cent

until the end of the year aided by the opening of the Tuen Ma line,

acquisitions and economic recovery.

CBS

buildings were built between 1952 and the mid-1980s on land granted by

the government – usually at a third of market value – to civil servants

who formed cooperative societies. Such buildings can also be found in

Hung Hom, To Kwa Wan, Kowloon City and Kowloon Tong among other areas.

The flats in these societies tend to be large, ranging from around 800

sq ft to 1,600 sq ft.

The

URA said that the offer of HK$19,848 per square foot was based on the

price of a seven-year-old replacement flat nearby. The authority had

appointed seven independent consultancy firms, which compared

transactions of similar properties, to arrive at the rate. The residents

received the offer letters last Friday and have 60 days to consider the

offer.

For

instance, a 950 sq ft CBS flat will fetch HK$16.33 million after

deducting the land premium, which is enough for buying a three-bedroom

flat at One Kai Tak or Billionnaire Avant in Kowloon City or Bayview in

To Kwa Wan, analyst said.

the

analyst estimated that the site could fetch between HK$12,500 to

HK$13,000 per square foot from developers when it is available for

tender.

Overall,

197 out of the 238 cooperative societies have been dissolved, according

to the Development Bureau. Twelve have been redeveloped already,

whereby 600 flats were cleared to make way for 3,800 units. Another

4,400 units in 185 CBS projects are ready for redevelopment.

However, some residents of CBS projects that are likely to be redeveloped fear that it could affect their quality of life.

The

substantial fall in living standards, quality of neighbourhood, higher

management fees in new flats and difficulty for elderly residents who

have lived there for decades to adapt to a new environment were among

their chief concerns, said Irene Wong, whose CBS home in To Kwa Wan may

be acquired by the URA.

She

also said owners were unhappy with the URA for not engaging in enough

discussions and not giving them the option of acquiring the development

as a whole without dissolving the societies, so that the value of common

space could be included in the offer price.

The URA said it plans to conduct an opinion survey with these residents by the fourth quarter to look into their concerns.

(South China Morning Post)

美基金趁低吸納 9.8億購尖沙咀酒店

平均每間房值620萬 近1年最大宗酒店成交。

全幢酒店價格回調,獲基金留意趁低吸納。消息指,帝邦旗下尖沙咀寶勒巷晉逸精品酒店全幢,以9.8億沽出,較高峰期意向價回落約兩成,為近一年最大宗酒店成交。買家為外資基金,屬首度在港投資物業。

市場消息指,尖沙咀錄全幢酒店成交,涉及物業為「晉逸精品酒店尖沙咀」,位於寶勒巷。物業原為商廈,帝邦集團早年購入後,改裝成酒店。地盤面積約6,000平方呎,地下為商舖,現由餐廳租用,地下屬酒店大堂,1至18樓為客房。物業總樓面約71,600平方呎,提供158間房。受疫情影響,目前仍是零旅客,故尖沙咀酒店房租仍在低水平,現該酒店每晚房租約400餘元。

總樓面7.16萬呎 供158間房

消息指,早前業主曾把物業放售,意向價約12億元,獲多路財團洽購,最終以約9.8億元沽出,較高峰期回落約18%。按成交價計,平均每間房價約620萬元。據了解,買家為一家美資基金,過往投資內地及亞洲地區房地產,如今首度在港入市,相信有見酒店價格回落,趁低吸納。

原業主帝邦集團由邱騰達創立,旗下晉逸Butterfly精品酒店,原本共有5幢,近年沽出部分項目,包括2013年以6.8億元,沽出灣仔晉逸時代精品酒店。

持續1年多的疫情,令旅客數字跌至近乎零,酒店成為最直接受衝擊的範疇,因房價急劇回落,導致投資價值降低,過去一年市場極少出現全幢酒店買賣。較大手為去年銅鑼灣摩頓台7號珀麗尚品酒店,以4.6億元易手,較叫價減3成,故是次晉逸精品酒店成交,已成為近一年多最大碼酒店買賣。事實上,上月土瓜灣譚公道103至107號酒店,以約3.8億元成交,由共居空間品牌Weave購入。

疫情緩和,大手買賣明顯增加,今年大額物業投資市場上,以外資基金作主導,上半年先後購入多項全幢物業。踏入下半年,基金持續掃貨,如粉嶺葉氏化工大廈,早前以約2.83億元成交,由黑石基金購入;該基金今年先後購兩幢工廈並部署改裝,發展迷你倉業務。

(經濟日報)

上環南豐大廈呎租56元黎姿旗下公司承租全層

南豐旗下的上環南豐大廈,其中一層樓面錄租客提早退租,該全層旋即由黎姿旗下公司承租,月租51.58萬,平均呎租56元。

上環南豐大廈其中兩層樓面,由英國《金融時報》承租作為香港辦事處,其中的18樓全層,月租64.71萬,租客提早逾一年退租,而該全層獲黎姿 (現名黎珈而) 旗下醫學美容公司承租,月租51.58萬,平均呎租56元。

每月逾51萬租出

土地註冊處資料顯示,G

MAX GROUP

LIMITED由7月開始租用上址三年,到期日為2024年6月,每月租金51.58萬,相比舊租金回落約20%。土地註冊處資料顯示,G MAX

GROUP董事黎珈而,登記地址亦與由黎姿擔任主席兼行政總裁的卓珈控股總部相同,為銅鑼灣禮頓中心單位。

《金融時報》香港辦事處於2019年10月開始承租該廈18樓全層作為辦公室,建築面積9165方呎,月租約64.71萬,簽約3年,平均呎租約71元,為該廈近年呎租新高,現時,該全層最新月租較舊租金減20%,最新平均呎租56元。

(星島日報)

更多南豐大廈寫字樓出租樓盤資訊請參閱:南豐大廈寫字樓出租

更多上環區甲級寫字樓出租樓盤資訊請參閱:上環區甲級寫字樓出租

更多禮頓中心寫字樓出租樓盤資訊請參閱:禮頓中心寫字樓出租

更多銅鑼灣區甲級寫字樓出租樓盤資訊請參閱:銅鑼灣區甲級寫字樓出租

尖東康宏廣場意向價9368萬

有代理表示,尖東科學館道1號康宏廣場中高層15至16室放售,建築面積約5064方呎,叫價每方呎約1.85萬,涉及總意向價約9368萬,可以買賣公司交易,物業連約出售,現租客上市公司,呎租約30餘元,租期至2023年,適合投資者購入作中長綫收租投資之用。該代理稱,今次放售物為康宏廣場罕有相連單位放盤,單位位處大廈中高層,享有開揚木球會景致。

平均每呎約1.85萬

市場消息指,康宏廣場中層08室,面積約約1891方呎,目前交吉,意向價約3365萬,呎價約1.78萬元,單位連裝修及傢俬,用家可即買即用。康宏廣場於6月份錄1宗租賃,該廈中層11室,面積約825方呎,以每月約2.5萬租出,呎租約30元。另同廈中層04室,面積約2526方呎,以每呎約20元租出。

由長實、信和、南豐及大昌四家發展商合組財團,於1992年初以12.5億投得尖東科學館道商業靚地,發展為樓高28層的康宏廣場,總樓面約60.3萬方呎,自94年開售以來,見證26年間商廈樓市起落,當時吸引一眾城中巨賈大手購入,其中最經典當推項目高層全層,由當時城中娛樂大亨斥4.173億購入,建築面積約27928方呎,呎價達14942元,創當年整個尖東區的呎價新高。

(星島日報)

更多康宏廣場寫字樓出售樓盤資訊請參閱:康宏廣場寫字樓出售

更多尖沙咀區甲級寫字樓出售樓盤資訊請參閱:尖沙咀區甲級寫字樓出售

觀塘海濱道133號萬兆豐中心相連單位,建築面樍6161方呎,物業曾九度向財團公司借貸,以6150萬易手,平均呎價9982元,業內人士指低市價逾20%。

低市價逾20%

上址為萬兆豐中心8樓F及G室,建築面樍6161方呎,以6150萬易手,原業主於2011年5月以2491.9萬購入上址,帳面獲利3658.1萬,物業升值1.46倍,不過,由於原業主曾9次向財務公司借貸,因此,實際所賺將大為減少。該物業買家為牛頭角潮語浸信會,料物業作為自用。

現時,萬兆豐中心一個中高層C室,面積約2475方呎,意向呎價約1.4萬,涉及總金額約3465萬;物業現由業主自用,將以交吉形式出售,單位享有全海景景觀,將會連寫字樓裝修出售。該單位現時市值呎租約25至28元,準買家亦可同時洽購萬兆豐中心1個車位,售價約210萬,不但可作自用,亦可考慮出租及作中長綫投資。萬兆豐中心向來受用家追捧,該廈早前獲社福機構購入作自用,為大廈低層F室,面積約4065方呎,成交價約4065萬。

單位屬「九按財仔」

紅磡民裕街37至45號凱旋工商中心11樓D室,實用面積3230方呎,以1710萬易手,平均呎價5294元。

(星島日報)

更多萬兆豐中心寫字樓出售樓盤資訊請參閱:萬兆豐中心寫字樓出售