Local

developer Tai Hung Fai Enterprise has applied to turn its Travelodge

Kowloon Hotel and several old buildings around it at Saigon Street in

Yau Ma Tei into a development which will offer 230 flats upon

completion.

A 28-story

building with a gross floor area of 7,110 square meters is proposed to

be built upon the 778-sq-m site, information from the Town Planning

Board showed.

Meanwhile, properties are trading actively in the city.

In

Kennedy Town, the third price list of 35 units for Kennedy 38 was

unveiled, making it a total of 130 flats set to be sold in the first

round of sales on Saturday. At an average price of HK$28,633 per sq ft

after discounts, the third batch is 3.4 percent costlier than the

previous one.

In Fo Tan, Centralcon Properties has sold 815 or 71 percent of the total flats at The Arles at an average price of HK$20,225 per square foot, raking in HK$8.1 billion.

It

plans to keep 15 to 20 percent of the units for rental with prices

ranging from HK$40 to HK$60 per sq ft, or an annual return rate of

around 2 percent.

In Tuen Mun, a duplex unit with a garden at Oma Oma sold for HK$22.92 million, the developer Wing Tai Properties (0369) said.

Separately, a new project from Kerry Properties (0683) at 3 Lung Cheung Road has been named Montverra. It will offer 64 units.

(The Standard)

Hong Kong property developers ready luxury projects amid expectations of high demand following China border reopening

A

partially reopened border will make it easier for interested buyers

from the mainland to possibly visit properties, Wheelock executive says

Reopening

of the border will definitely help with sales, especially those of

residential units, says executive of developer Empire Group

Hong

Kong property developers are looking to release more expensive homes in

the city’s The Peak and New Territories districts in anticipation of

the reopening of the border with mainland China.

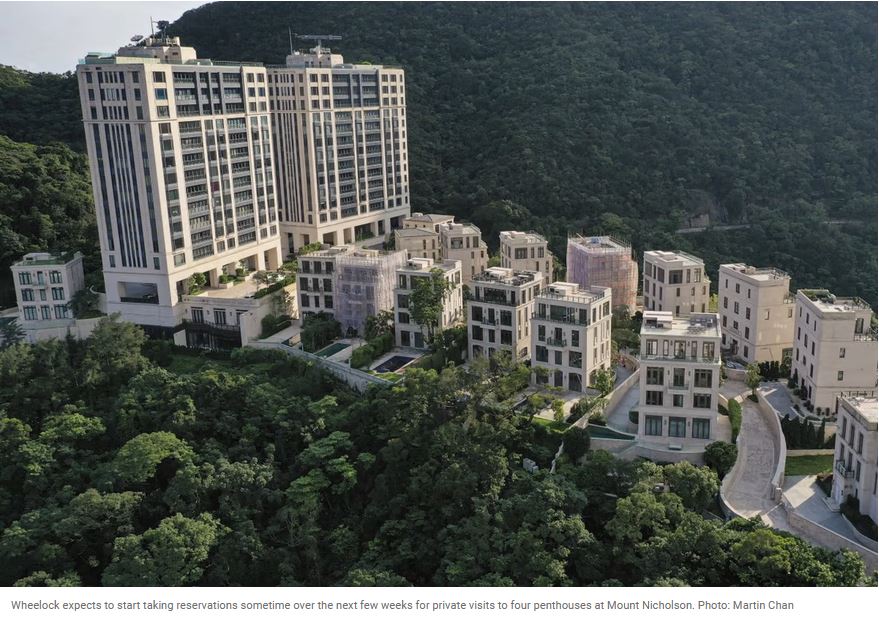

Wheelock Properties, for instance, expects to start taking reservations for private visits to four penthouses at Mount Nicholson, Asia’s priciest address, sometime over the next few weeks.

“It

is expected that, in short term, the border may be reopened partially.

This may make it more convenient for interested buyers from the mainland

to possibly pay visits [to properties],” said Ricky Wong, Wheelock’s

managing director. “We thought it would be the right time.”

The

city’s border with mainland China is expected to reopen partially next

month as part of a pilot involving daily quotas for Guangdong province

only, followed by an expansion in February that will allow mass events. A

full reopening allowing quarantine-free travel is expected by June at

the latest.

The importance of buyers from the mainland is highlighted by the sale last week of Flat 16D and three car parking spaces

at Mount Nicholson, which were marketed by Wheelock and fetched about

HK$640 million (US$82.2 million) or HK$140,800 per square foot, the

highest price per square foot for flats in Asia.

Flat 16D as well as 16C were sold to “new Hongkongers”,

or mainland Chinese who had acquired permanent residency in Hong Kong,

for a combined HK$1.2 billion. The buyers were likely to keep the flats

for their own use, Wong said.

The

four penthouses, measuring between 4,194 sq ft and 4,551 sq ft, come

with rooftops and were rare, Wong said. If the price of flat 16D Flat

and three car parking spaces at Mount Nicholson was taken into account,

the largest penthouse measuring 4,551 sq ft may fetch about HK$641

million.

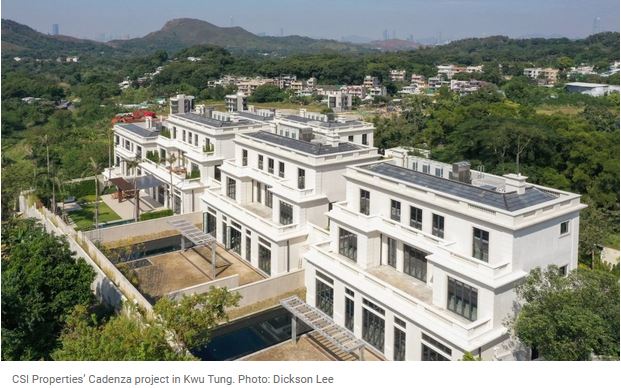

Elsewhere,

CSI Properties said it would soon release its Cadenza project, which

has five villas of up to almost 7,000 sq ft in Kwu Tung in the New

Territories.

Lai

Sun Development, another local developer, last month won a land parcel

in Kowloon Tong earmarked for luxury housing for a higher-than-expected

price of HK$1.6 billion. It was “keen to look for opportunities to

increase our land bank to meet mainland buyers’ upcoming demands when

the border reopens”, Dr Hoyi Lam, the developer’s senior vice-president

and daughter of tycoon Peter Lam, said.

“To

meet this demand, we will speed up construction and promotion

activities,” Lam said. “We believe the subsequent sales will be active

and generate substantial revenue for our group. By using the intake of

sales revenue, we can acquire more land to increase our portfolio.”

Lam

said she anticipated a 5 per cent increase in sales price of small to

medium units, and a 10 per cent increase in the prices of luxury

housing.

The company will also explore using social media and newspapers to communicate with buyers in mainland China, Lam said.

The

reopening of the border will “definitely help with sales, especially

for the residential market – we are hopeful for an increase of 10 to 20

per cent, if not more”, said Lesley Kwok, the director of Empire Group.

She also said low interest rates would help.

The

Northern Metropolis plan, together with a low-interest environment, for

instance, will undoubtedly help to attract more potential mainland

Chinese and overseas buyers to the market, Kwok said. “We will be

launching sales for our two Kai Tak runway residential projects in 2022,

so it is fortuitous that the timing works out for us.”

But

the extent of any boost to the market could be limited by Hong Kong’s

30 per cent stamp duty for non-local buyers and mainland China’s capital

controls, property agent said. The luxury market could benefit most, as

those willing to pay the extra 30 per cent were mostly luxury

homebuyers, the agent added.

(South China Morning Post)

黎永滔斥15億重建旺角地盤 昔日「鋪王」地段打造地標商住項目

資深投資者黎永滔重建旗下旺角地盤,該地盤位處亞皆老街及西洋菜南街單邊位置,包括三幢舊樓,其中一個地鋪曾由老鳳祥承租多年,是區內著名的「鋪王」,黎氏表示,趁疫市下鋪租大跌時起樓,減低機會成本,將打造旺角地標商住項目,總投資額逾15億。

上址為旺角亞皆老街67至71號全幢舊樓,其中67及69號地鋪曾由老鳳祥承租多年,屬於旺角「鋪王」,黎氏表示,該舊樓地盤逾3000方呎,將合併重建商住項目,總投資額逾15億。

落成後將拆售住宅

他續說落成後總樓面約2.8萬方呎,地下至2樓為鋪位,每層約3000方呎,合共9000方呎,樓上提供35個住宅,主打面積200多至300方呎單位,落成後將拆售住宅,鋪位則持有長綫收租。

他表示,項目剛於近日入則,預期批則需時,明年下半年才開始拆樓,在拆樓之前,打算將鋪位一直短租;近年隨着政治活動引起動亂,加上疫市持續,鋪位租金大跌,把握此時起樓,將機會成本大為減低,事實上,早於去年已計劃將重建該舊樓,假如早入則早起樓更加好,不過,規劃及起樓需時,入則申請亦要等批准,一切急不來。

他續說,對比去年低潮時,近期市況明顯轉活躍,商戶不但樂於趁聖誕新年擋期做生意,不少更洽商長租約,相信現時是租鋪買鋪「Last call」(最後時機),一旦通關,鋪位租售價將立即明顯上升。

上述的旺角「鋪王」,老鳳祥於2015年以每月逾200萬承租,轟動市場,現時在疫市下,鋪位由樓上有限公司短租,月租約30萬,售賣大眾化食品,攻本地客生意,樓上有限公司創辦人侯君剛早前表示,該店鋪生意額一直有增長,樂於繼續短租。

租鋪買鋪「最後時機」

黎永滔並非第一次當發展商,早於2003年後,他發展灣仔告士打道酒店項目,近年,亦重建銅鑼灣景隆街舊樓為全幢巨鋪。不過,今番發展項目較為龐大,他亦剛沽售中環鋪位,套現逾1.83億,用作新項目的發展。

(星島日報)

中環德己立街鋪1.83億沽 持貨11年升值約32%

黎永滔早於二十年前涉足鋪市,購入的鋪位皆位處極旺位置,近期沽售中環單邊鋪位,亦屬蘭桂坊地標之一,作價1.83億,持貨11年升值約32%,買家為鷹君集團羅嘉瑞等人。

上址為德己立街德和大廈地下1及1A號,建築面積1045方呎,上月以1.83億易手,平均呎價約17.5萬,黎永滔於2010年中以約1.39億購入,持貨11年,帳面獲利約4400萬,物業升值幅約32%。該鋪位由泰國菜及日本菜餐廳承租,月收48.8萬,新買家鷹君集團主席兼董事總經理羅嘉瑞,以及執行董事羅俊謙等人,料回報3.2厘。

平均呎價17.5萬

該物業位處和安里單邊,租客泰國菜鋪面裝潢搶眼,鋪面的熊熊火炙,成為蘭桂坊地標之一。黎永滔回應指,持有該鋪位一段時間,沽貨獲利不俗,可用於發展新項目。

鷹君集團羅嘉瑞等承接

黎永滔極少沽貨,對上一次為2018年6月,沽出中環皇后大道中41

號聯成大廈鋪位,包括地下750方呎、閣樓500

方呎及一個3200方呎地庫,作價4.448億,呎價約10萬,買家為幸福醫藥家族成員黎元淑等人,黎於2007年以1.18億購入物業,持貨11

年帳面獲利3.268億,升幅約2.8倍。

(星島日報)

大鴻輝彩鴻酒店申建住宅

大鴻輝集團持有的油麻地彩鴻酒店及毗連的數幢唐樓,向城規會申建一幢樓高28層的商住大樓,提供230個住宅,平均單位面積約320方呎,涉及可建總樓面約7.7萬方呎。

據城規會文件顯示,上述項目位於油麻地西貢街15至15A、17、19及23號,目前屬「商業」地帶,申請改劃為擬議綜合發展以作分層住宅及商店及服務行業/食肆用途。

地盤面積共8374方呎,住宅部分以地積比不多於8.79倍發展,重建一幢樓高28層 (包括各有1層地庫及平台層) 的分層住宅、商鋪及食肆,包括73609方呎住宅樓面,提供230個單位,平均單位面積約320方呎。

提供230個住宅單位

另有2927方呎非住宅樓面,提供零售/餐飲等設施,設於地下面向西貢街;換言之,整個項目可建總樓面約76536方呎。

申請地點現時為提供126間酒店房間的彩鴻酒店以及數幢唐樓。申請人指,該區域是一個擁有混合用途的地區,彌敦道兩旁商業大廈林立,但在同一街區內商業大廈及住宅發展並存的現象並不罕見,適合作擬議的混合式發展。

而是次發展提供230個中小型單位以切合公眾對住屋的需求,並與政府的增加房屋供應政策相符。擬議發展與該區現時的混合性用途特質相符,其面向西貢街的零售/餐飲設施能保持其活力。

(星島日報)

波斯富街一籃子舊樓 逾2成業權易手

核心商業區銅鑼灣的舊樓有價有市,向來吸引各路財團積極收購,其中位處波斯富街的舊樓早年由不同財團進行併購,掀起一場長達多年的收購戰,而據悉,項目餘下關鍵逾2成業權,最終由新世界 (00017) 或有關人士購入,加速收購步伐。

膠着多年的波斯富街的舊樓收購戰終見突破,因早前招標放售的項目逾2成業權,終獲發展商成功購入。該批招標單位為銅鑼灣利園山道23、25號 (部分)、波斯富街72號及波斯富街74號 (前段) 的4間地舖,及16個分布於同廈1至5樓的住宅單位。據土地註冊處資料,這批單位最近以約12.8億元沽出。據了解,以涉及的樓面共約1.2萬平方呎計算,整批物業的收購呎價約10.7萬元。

新世界或相關人士奪得 加快收購

據市場消息指,成功購入該批物業的為新世界或相關人士。事實上,集團本身已持有項目逾6成業權,現時奪得關鍵的逾2成業權後,料已成功收購逾8成業權,即已達8成強拍門檻,意味可加快收購進度。

上述舊樓位於希慎廣場後面,鄰近時代廣場,亦比鄰曾多次成為全球最貴舖租地段的羅素街,擁有極高發展潛力。值得一提的是,利園山道5至27號、波斯富街54至76號,及羅素街60號的舊樓群,佔地約2萬平方呎。鑑於項目具收購價值,早於2013年獲財團「插旗」收購,並有多批投資者、發展商「落釘」,掀起一場膠着多年的收購戰。

新世界在銅鑼灣擁有的項目不算多,集團現持有銅鑼灣百德新街名珠城部分單位,而原由新世界持有的景隆街新安大廈,亦已經轉手予永倫集團,並已在本年初以約14.5億元投得項目,正式完成強拍程序。

加路連山道商業地 投資額逾260億

另外,有財團亦於本年4月以約6.06億元,統一霎東街5號舊樓的業權。市場消息透露,該財團不排除為希慎 (00014) 或相關人士。同一財團於去年6月亦就勿地臣街10及12號、勿地臣街16號,及霎東街9A及9B號的舊樓地盤分別申請強拍,料會連同霎東街5號的舊樓合併重建,組成一個近9,700平方呎的地盤,總樓面涉約14.5萬平方呎。

有銅鑼灣大地主之稱的希慎,進一步鞏固區內的商業王國地位。集團於今年5月夥拍華懋以約197.78億元奪得銅鑼灣加路連山道商業地,每平方呎樓面地價逾1.8萬元,預計會發展為1幢樓高28至30層的商廈,總投資額達260億元。

(經濟日報)

更多希慎廣場寫字樓出租樓盤資訊請參閱:希慎廣場寫字樓出租

更多時代廣場寫字樓出租樓盤資訊請參閱:時代廣場寫字樓出租

更多銅鑼灣區甲級寫字樓出租樓盤資訊請參閱:銅鑼灣區甲級寫字樓出租