The British fashion brand has maintained a presence on Russell Street since 2012, occupying 5,200 sq ft of space in Soundwill Plaza

Burberry will be moving to a new location in World Trade Centre shopping centre, according to local media

British luxury fashion house Burberry will shut its flagship store on Hong Kong’s Russell Street, once the world’s most expensive shopping strip, after a 10-year lease expires early next year, according to sources.

The

iconic brand, known for its trademark check pattern, has maintained a

presence in the Causeway Bay shopping district since 2012, occupying

5,200 square feet of space across two levels at Soundwill Plaza.

It initially paid HK$7.7 million (US$988,000) per month, which was

later increased to HK$8.6 million in 2015 amid the retail boom, sources

said.

“With

no mainland tourists, international brands are finding it hard to

repeat sales achieved three years ago,” property agent said. “Now,

retailers have ample choice as there are so many empty spaces on Russell

Street and nearby areas that are being offered at cheaper rents.”

The

agent said that the landlord, Soundwill Holdings, had cut the rent for

the existing lease due to expire early next year, but was unsure of the

current rate.

Soundwill declined to comment, while Burberry did not immediately reply to a request for comment.

It has been reported in the local media that Burberry will move to the nearby World Trade Centre shopping centre on Gloucester Road, a nine-minute walk from Russell Street.

Burberry

will be the third major international brand to close its flagship store

on Russell Street. The Italian fashion label Prada started the trend,

shutting its 15,000 sq ft outlet in June 2020, followed by lingerie

maker La Perla three months later in September.

Hong

Kong’s retail sector is struggling to recover from its worst downturn

on record. Many international brands such as Topshop, Gap and Victoria’s

Secret have closed their operations in the city after they were hit by

the anti-government protests in 2019 and later by the Covid-19 pandemic.

Burberry, however, said early this month that it would continue to build its new concept stores across the world.

“We

have no intention to significantly reduce the footprint of our stores,”

Julie Brown, chief operating and financial officer, said during a media

call on November 11 to discuss the half-year earnings.

Burberry’s

revenue in the six months to September 25 rose 45 per cent year on year

to £1.2 billion (US$1.6 billion), returning to pre-pandemic levels on

the back of strong growth in mainland China, South Korea and the US.

Adjusted operating profit increased nearly four times in the same period

to £196 million.

Brown conceded that online shopping had accelerated because of the Covid-19 pandemic.

“Burberry

has always been one of the biggest innovators in digital, and we

continue to put a lot of emphasis on digital channels,” she said. “That

being said, since stores have reopened, we have found that consumers

still value the luxury experience in a physical store.”

This

means that the key to success is an omnichannel approach, which

provides a seamless experience for consumers, whether they shop in-store

or online, she said.

“We

think omnichannel is really the way to create a truly luxury experience

with personalised service, while at the same time allowing us to focus

on local consumers in our key markets,” she said.

(South China Morning Post)

For more information of Office for Lease in Soundwill Plaza please visit: Office for Lease in Soundwill Plaza

For more information of Office for Lease in World Trade Centre please visit: Office for Lease in World Trade Centre

For more information of Grade A Office for Lease in Causeway Bay please visit: Grade A Office for Lease in Causeway Bay

Kwok

Family’s Empire Group bets on Hong Kong’s border reopening to spur

tourism demand for its HK$6 billion five-star hotel Kimpton

Construction of The Kimpton, a HK$6 billion five-star hotel project, has reached 10th storey of the 42-storey structure

Family-owned

Empire Group has also joined partners in building the Greenwich Village

mall in Tseung Kwan O South and the Fullerton Ocean Park hotel

Empire

Group Holdings, founded by the late Hong Kong tycoon Walter Kwok

Ping-sheung, is pushing on with its HK$6 billion (US$770 million) luxury hotel project in Tsim Sha Tsui, betting that tourism in the city will rebound from one of its worst patches on record.

The

Kimpton, a 42-storey five-star hotel built on the former Mariners’s

Club, will offer 492 rooms with harbour views at its opening in the

second half of 2023. Construction has reached the 10th floor, fully

making up for delays over the past two years by the city’s social unrest

and material supply bottlenecks during the Covid-19 pandemic.

The

plan will allow the family-owned developer to benefit from an expected

recovery in the industry amid tentative signs of border reopening and

room demand.

The

local pandemic situation “is gradually settling,” said director

Jonathan Kwok, a son of Walter Kwok. “Hopefully by the end of 2022, I

think the border should be [fully] reopened.”

While

the city has maintained its strict quarantine requirements for inbound

visitors, local residents would be allowed to enter mainland China

without quarantine starting from early December, the South China Morning Post reported last week.

Average hotel occupancy

jumped to 60 per cent in the first nine months this year, versus 43 per

cent in the same period in 2020, according to the Hong Kong Tourism

Board, due to quarantine demand, long-stay incentives and staycation

business. Visitor arrivals slumped 98.2 per cent to 63,000.

The Mariners’ Club is a blue-and-white building that was opened in 1967

by the city’s former colonial-era Governor David Trench. It sits on a

parcel of land next to the K11 Musea mall, a New World Development project in the Tsim Sha Tsui shopping district.

Empire

Group’s other projects include a HK$1 billion shopping centre called

Greenwich Village in Tseung Kwan O South. The mall, covering 100,000

square feet (929 square metres) and 90 per cent tenanted, is a venture

with Lai Sun Group which opened for business earlier this month.

The 425-room Fullerton Ocean Park, Empire Group’s venture with Sino Land, is expected to open in the first half of next year. The luxury hotel is located next to the Water World of the Ocean Park.

While

the group’s focus is on operating hotels, it would like to retain the

flexibility of offering serviced apartments or co-living space in its

property, director Lesley Kwok said.

“Now

the demand for staycation in Hong Kong is really great,” she added. “We

will try to cater to the business with more packages.”

Property

agency is optimistic about Hong Kong hotels’ average room rate and

occupancy growth in the year ahead. Over the next couple of years, room

supply could increase by 2.5 per cent, it said. It grew by 3.6 per cent

annually over the past decade.

The

industry dynamics have improved as new supply dwindled over the past

two years when the building cycle that started in 2016 came to an end,

hastened by the street protests of 2019 and the Covid-19 outbreak.

“In

2020, there were almost no new hotel openings because some developers

opted to slow their construction or delay the opening of their

properties to wait for market conditions to improve,” agent said. New

additions were also offset by hotel conversion or closures, the agency

firm said.

Those

that have closed or are planning to close include the Excelsior,

Novotel Nathan Road and the Harbour Plaza Resort City in Tin Shui Wai.

Other properties are getting delayed or may be redesigned for different

uses, which could also keep a lid on new supply in the years ahead, the

agency added.

Walter Kwok, who founded Empire Group in 2010, passed away in October 2018 at 68. He was the former chairman and chief executive of Sun Hung Kai Properties before his ouster from the city’s biggest developer following a family squabble.

(South China Morning Post)

疫情走勢緩和,帶動核心區指標甲廈交投轉活,消息指,中環美國銀行中心低層單位以4935萬售出,每呎造價約3.5萬,屬市價水平。

市場消息指出,中環美國銀行中心低層8至9室,面積約1410方呎,以4935萬售出,平均呎價約3.5萬。據悉,原業主於2009年以1269萬購入,持貨12年帳面獲利約3666萬,物業期間升值約2.8倍。

據業內人士指出,上址大門正對電梯大堂,並坐享開揚海景,成交價屬市價水平。

12年升值2.8倍

據代理行資料顯示,該甲廈對上一宗成交為中層15室,於今年1月以約5060萬售出,以面積1375方呎計,呎價約3.68萬;至於該甲廈近期矚目成交為由美國商會持有的19樓4至7室及13室,合共面積約5968方呎,於去年10月以1.43億易手,呎價約2.4萬,當時低市價約兩成。

另外,由新世界發展的長沙灣荔枝角道888號於昨日亦錄成交,為低層B1室,面積約1162方呎,以約1553.36萬售出,呎價約13368元。

此外,標指甲廈亦頻錄承租個案,消息指,中環皇后大道中九號中層13室,面積405方呎,以每呎約68元租出,月租約27540元;上環信德中心西座高層07室,面積約2559方呎,以每呎約60元租出,月租約153540元。

(星島日報)

更多美國銀行中心寫字樓出售樓盤資訊請參閱:美國銀行中心寫字樓出售

更多金鐘區甲級寫字樓出售樓盤資訊請參閱:金鐘區甲級寫字樓出售

更多中環區甲級寫字樓出售樓盤資訊請參閱:中環區甲級寫字樓出售

更多荔枝角道888號寫字樓出售樓盤資訊請參閱:荔枝角道888號寫字樓出售

更多長沙灣區甲級寫字樓出售樓盤資訊請參閱:長沙灣區甲級寫字樓出售

更多皇后大道中九號寫字樓出租樓盤資訊請參閱:皇后大道中九號寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

更多信德中心寫字樓出租樓盤資訊請參閱:信德中心寫字樓出租

更多上環區甲級寫字樓出租樓盤資訊請參閱:上環區甲級寫字樓出租

甲廈租金逾兩年首錄升幅

疫情持續放緩,為甲廈市場釋出正面訊息,據一外資代理行指出,上月整體甲廈租金按月微升0.2%,為自2019年5月、即29個月以首錄升幅。

該行最新發表的報告指出,上月整體甲廈租金按月微升0.2%,為自2019年5月高位以來首次錄得升幅,主要分區市場中,中環區和尖沙嘴皆錄得租金升幅。

代理行:按月微升0.2%

上月甲廈市場錄10.72萬方呎淨吸納量,市場錄得更多擴充成交個案,而租戶在選擇辦公空間時會重視靈活性和健體配套設施,例如,商務中心營運商IWG租用銅鑼灣 Tower 535 兩層樓面開設新的中心,涉及建築面積23400方呎,以滿足市場對靈活辦公空間持續增長的需求。

月內中環區租賃交投活躍,較矚目的租賃成交為一家投資管理公司原區搬遷,租用交易廣場一座全層樓面,涉及淨樓面面積13900方呎。

該行代理表示,隨着租戶在選擇辦公空間時會重視靈活性和健體配套設施,業主應密切留意這趨勢及持續增長的需求,並提升辦公空間內的設施。

工廈物業方面,他指出,9月商品出口貨值繼續顯著增長。貿易總額按年穩定增長20%,當中進口貿易和出口貿易分別上升23.5%和16.5%。儘管全球多個地方受供應樽頸的問題困擾,但月內本地需求繼續支持工廈租賃市場。例如,第三方物流公司北歐國際物流公司據報於葵涌現代貨箱碼頭貨倉大樓二期樓內擴張,承租約57500方呎倉庫樓面。

(星島日報)

更多Tower 535寫字樓出租樓盤資訊請參閱:Tower 535 寫字樓出租

更多銅鑼灣區甲級寫字樓出租樓盤資訊請參閱:銅鑼灣區甲級寫字樓出租

遠洋九龍城舊樓強拍底價七億

近年不少財團透過強拍途徑增加土儲,遠洋集團今年中向已故「鋪王」鄧成波及相關人士購入的九龍城衙前塱道舊樓業權,最新獲土地審裁處頒下強制售賣令,底價為7.05億,對比2018年7月申請強拍時市場估值約6億,高出1.05億。

據土地審裁處文件顯示,是次獲批強拍令的項目位於衙前塱道3至13號大華樓,該財團持有不少於80%業權。據判詞指出,申請人曾委託結構工程師對該舊樓進行結構評估,認為該舊樓的狀況很差。

該建築已有逾50年歷史,需要大量維護,而且在不久的將來需要進行維修工作,以保持建築物處於安全狀態。而且申請人已採取合理步驟收購餘下業權,故批出強拍令。

可建樓面6.3萬方呎

上址現為一幢6層高商住物業,地下1至3樓為九龍城博康護老院,另有商鋪物業,樓上為住宅,早於1967年落成,至今樓齡約54年;該項目地盤面積約7030方呎,現時劃為「住宅 (甲類) 2」用途,若以9倍地積比率,作商住重建發展,可建總樓面約63270方呎。

向鄧成波家族購入

資料顯示,已故「鋪王」鄧成波家族及相關人士曾於今年中推出其持有的業權放售,消息指,並由遠洋集團購入。

(星島日報)

燕貽大廈批建5.3萬呎

屋宇署9月共批出17份建築圖則。當中,西半山羅便臣道燕貽大廈,剛獲批建一幢樓高30層的住宅,可建樓面約53169方呎。項目原先由中國奧園持有,自18年起積極收購,唯集團於本月中以蝕讓價9億售予投資者伍登輝,料虧損約1.77億。

大昌鴨脷洲建單幢樓

由大昌集團持有的鴨脷洲海旁道住宅項目,獲批一幢樓高30層、設有4層地庫的分層住宅,涉及樓面約88280方呎。

恒基持有的大埔舊墟直街美新里3號地盤,獲批建一幢樓高17層的商住大廈,涉及住宅樓面約35860方呎,以及商業樓面約7359方呎。

由中國移動持有的沙田松頭下路與桂地街交界,獲建一幢樓高17層並設兩層地庫的數據中心,涉及樓面逾93.9方呎。

(星島日報)

光輝凍倉申改建數據中心 葵涌區工廈紛轉型 創科熱潮帶動

新世代進入「大數據」時代,各行各行業均搶佔科技革新先機,對數據中心服務需求急增,近年葵涌工業區隨即掀起重建數據中心熱潮,最新由外資基金ESR持有的光輝凍倉 (二倉),向城規會申請改裝全幢工廈作數據中心發展,涉及總樓面約35.2萬方呎。

本報早前率先報道,疫情下各行各業加速數碼轉型,市場對數據中心設施及服務需求殷切,葵涌工業區掀起重建數據中心熱潮,並具潛力發展成一個新晉數據中心的重要地區;據本報統計,連同上述改劃申請,該區至少有7個項目改劃作同類發展,涉及至少約179.2萬方呎樓面。

外資基金持有

有不少財團已覷準該區舊式工廈發展潛力,最新再有工廈申請全幢改裝作數據中心發展,據城規會文件顯示,上述項目位於葵涌永業街11至19號,目前屬「工業」用途地帶,申請擬議略為放寬地積比率限制、以進行整幢現有工業大廈改建,作准許的資訊科技及電訊業 (數據中心) 用途。

上述地盤面積約3.46萬方呎,申請放寬地積比率限制約7.3%,至不多於10.19倍發展,以滿足數據中心的運作要求,並改裝為一幢樓高15層 (包括1層地庫) 的數據中心,涉及可建總樓面約35.23萬方呎,現時主水平基準上84.36米的建築物高度維持不變。

可建樓面逾35萬呎

申請人指,是次申請符合本港鼓勵數據中心發展的政策方向,能夠支持重整葵涌工業區土地用途及本港再工業化的相關規劃政策。擬議發展可加速葵涌工業區的活化進展,而且放寬的地積比率實屬輕微,與近期城規會批准的類似申請一致。

資料顯示,上述光輝凍倉 (二倉) 原本由已故「鋪王」鄧成波家族持有,於今年5月以18億售予外資基金ESR。

事實上,該區最矚目為萬國數據於區內持有3個項目、先後改劃作數據中心發展,涉及約75.9萬方呎佔最多。最快落成的為藍田街2至16號項目,獲批建一幢樓高23層的數據中心,可建總樓面約24.68萬方呎,料最快於2022年落成,預計同年中正式啟用及開始營運。

(星島日報)

建華7600萬購美孚新邨鋪

建華集團以約7600萬購入荔枝角美孚新邨鋪位,每呎造價約7.6萬,該集團今年以來連購4項鋪位,涉資約逾兩億。

市場消息指出,荔枝角美孚新邨1期百老匯街地鋪,面積約1000方呎,以約7600萬易手,呎價7.6萬,買家為建華集團相關人士,該鋪現時由菜檔以20萬承租,料買家享租金回報約3.15厘。原業主於1999年以430萬買入,持貨22年帳面獲利約7170萬,期間升值約16.6倍。

城市金庫劏鋪跌價76%

劏場鋪位再錄蝕讓,北角城市金庫地庫單號鋪以41萬售出,以面積34方呎計,呎價約12059元,原業主於2013年以175萬購入,持貨8年帳面蝕讓134萬,物業貶值約76.5%。

尖沙嘴柯士甸道105號百安大廈地鋪,面積約800方呎,以約3850萬售出,呎價約4.81萬,原業主於2019年9月以3280萬購入,持貨兩年多帳面獲利約570萬,物業期間升值約17%。該鋪現時由食肆以約9.8萬承租,料買家享回報約3厘。

Burberry將撤出羅素街

佐敦廟街286至298號華志大廈地鋪,建築面積1500方呎,以約4000萬成交,呎價約2.6萬,該鋪由食肆及僱傭中心以約9.1萬承租,料買家享回報約2.7厘。原業主於1997年以700萬買入,持貨24年帳面獲利約3300萬,升值約4.7倍。

由英國時尚品牌Burberry承租的銅鑼灣羅素街金朝陽中心地下至2樓巨鋪,總樓面約5200方呎,租約於明年初屆滿將撤出,據悉,該鋪現時租金約200萬,惟於2015年高峰期時租金高達880萬。

(星島日報)

更多金朝陽中心寫字樓出租樓盤資訊請參閱:金朝陽中心寫字樓出租

更多銅鑼灣區甲級寫字樓出租樓盤資訊請參閱:銅鑼灣區甲級寫字樓出租

旺角百老滙多層舖 2.8億洽至尾聲

近期核心區舖位獲留意,消息指,旺角西洋菜南街多層百老滙電器舖位,獲2.8億元洽購至尾聲,料快易手。

消息指,旺角豉油街28號旺角廣場地下3號舖、1樓及2樓全層舖位快將易手。物業位於西洋菜南街與豉油街交界,共佔3層,地下部分約350平方呎、1樓面積約4,312平方呎,而2樓面積約4,376平方呎,總建築面積合共約9,038平方呎。

美孚新邨地舖 7600萬易手

據了解,舖位由連鎖電器百老滙租用,該影音店自2014年起租用,月租約125萬元,連同品牌自用地下舖位,組合成3層複式舖位。據了解,租約至本年中到期,而租客與業主早前達成續租,預計月租降至約70萬元。業主早於半年前,委託代理行放售,叫價約3.2億元,據悉現舖位獲2.8億元洽購至尾聲。據悉,業主於94年以8,780萬元購入舖位,一直持有作收租,若最終以2.8億元成交,持貨27年,可望獲利近2億元。

另消息指,荔枝角美孚新邨1期百老滙街12A號地舖,以7,600萬元易手,舖位面積約1,000平方呎,成交呎價約7.6萬元。

(經濟日報)

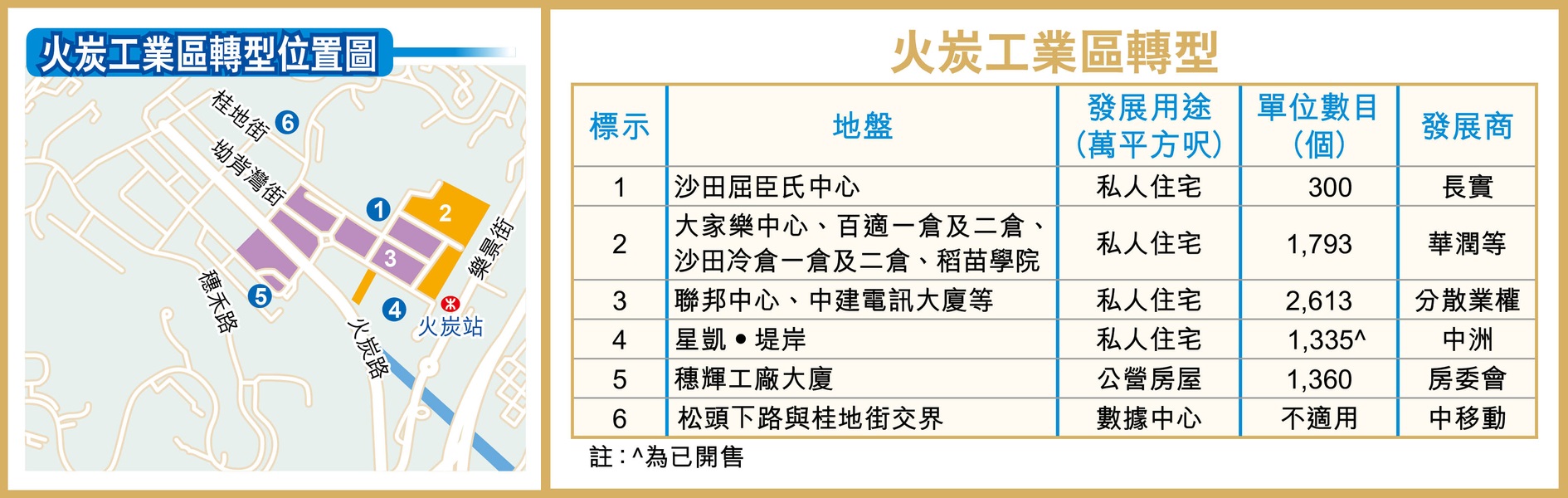

火炭工業轉住宅 料增7400伙

火炭屬於傳統工業區,近年在政府加快改劃區內工業地作公營房屋下,亦吸引私人發展商參與重建,長實 (01113) 日前則申請重建區內逾20幢工廈成大型住宅區,涉及約4,700伙,連同區內其他項目將提供逾7,400伙供應。

火炭工業區位於港鐵火炭站西北面,面積約30公頃,屬於傳統工業區,區內共有約45幢工廈,一般樓齡逾30年以上,其餘一半樓齡介乎約15至30餘年,但由於近8成的工廈屬於分散業權,要重建轉型的困難較大,因此政府一直傾向維持作為工業區的定位。

政府帶頭轉型

不過,近年政府陸續將自己持有的工業區重建成住宅發展,由公屋駿洋邨、居屋彩禾苑、旭禾苑等前身都屬於工業區,近年再有房委會決定重建穗輝工廠大廈兩座住宅物業,料可提供約1,360個單位,預計重建工程於2023年展開,並於2031年落成。

隨着政府先行,私人發展商參與推動轉型,繼近年中洲將前惠康倉貨重建成新盤星凱‧堤岸後,近日長實亦申請將火炭工業區東部20幢工廈,由「工業」用途改劃為「住宅 (戊類)」等用途,重建成為24幢大型住宅屋苑,提供4,706伙。

長實申建區內20幢工廈

根據重建方案將3期進行,當中第一期是由長實持有的沙田屈臣氏中心,提供約300伙,平均單位面積約608平方呎,預計2026年落成。

至於第二期則涉及鄰近火炭站的多幢工廈,包括大家樂中心、沙田冷倉一倉、二倉和百適一倉、二倉,及稻苗學院,均屬於單一業權,提供1,793伙,預計2028年落成,屬於可行性較高的部分。由於第二期所涉及的工廈多由大業主所持有,例如華潤持有冷倉一倉、二倉和百適一倉、二倉等,過往亦曾經申請重建成酒店等用途,預計若果今次順利獲批重建後,發展商亦會有興趣展開重建,令到落實第二期發展亦有若干可行性。

至於屬於第三期的中建電訊大廈、峯達工業大廈等13幢工廈,現時業權相當分散,無單一大業主主導重建,預計由展開收購至完成重建,難於在10年內落實,而所涉及工廈卻佔據了火炭工業區的中心位置,將對周邊轉型有一定阻礙。

(經濟日報)