Industrial

buildings made up 53 per cent of property transactions in the first

quarter, versus 16 per cent for all of 2020 deals.

They

offered 2.8 per cent yield in March versus 2.5 per cent for grade A

offices and 2.4 per cent for retail assets, according to government

data.

Hong

Kong is experiencing a boom in transactions involving industrial

buildings as rising demand for storage space from businesses and

homeowners lures local and foreign funds.

US

private equity giant Blackstone Group teamed up with StoreFriendly Self

Storage Group to pick up an industrial building known as New Media

Tower in Kwun Tong for HK$508 million (US$65.43 million) in April. The

seller was Emperor International Holdings.

This

added to a noticeable surge in demand in the first quarter, when the

city saw a jump in investment volume. Industrial properties made up 53

per cent of the HK$10.1 billion total, according to property agent, compared with 16 per cent of HK$61.4 billion of deals in all of 2020.

Demand

for such property is likely to increase by 10 to 15 per cent in the

near future amid shrinking living space, higher residential costs and

growth in online retailing and general population in recent years, said

Kevin Chan, chairman of Hong Kong-based Storefriendly.

“Demand

from business users is growing with e-commerce standing out ...

particularly as a growing number of consumers shift their focus online

in response to Covid-19,” said Chan, whose group operates more than 130

branches and 40,000 self-storage units across Asia. Smaller living

spaces also encourage households to substitute storage space in their

homes, he added.

Industrial

properties also offered the best returns to investors in the sector in

Hong Kong, according to government statistics. They yielded 2.8 per cent

compared with 2.5 per cent for grade A offices, 2.4 per cent for retail

properties and 2.3 per cent for small flats, according to March data.

Chan

said the group will convert the entire New Media Tower for self-storage

purposes. Its partner Blackstone declined to comment about the property

or transaction.

Apple

Storage, a local operator, echoes the view that shrinking living spaces

will benefit the sector. The firm expects to see 10 per cent growth

annually over the next three years in its branches and the broader

market, despite some pressures on operating costs and revenue in the

short term.

Andrew

Work, executive director at the Self Storage Association Asia, said all

major operators in its membership base are expanding into new

locations. Demand for storage space is typically fuelled by death,

divorce, downsizing and dislocation. In Hong Kong, it is mostly

downsizing by small and medium-sized businesses, such as restaurant

operators.

Demand

has tracked rising affluence, said Gigi Wong, country manager at The

Store House. Collectors of artworks, for example, prefer to use

self-contained storage units to warehouses, she added.

The

social unrest of 2019 and the onset of Covid-19 over the last 15 months

led to demand catalysts with relocations, said Tim Alpe, chief

executive at Redbox Storage. Retail operators are also going from

bricks-and-mortar to online, needing more space in their physical

premises for inventories.

Despite

the intensifying local competition, the self-storage market in Hong

Kong is still in its infancy, Alpe said. He estimates the per-capita

amount of storage space in Hong Kong at “just over half a square foot”

versus more than 2 square feet in more mature markets in developed

cities, indicating the vast potential ahead.

“Flexible

workspaces also tend to have limited storage space for users,” said

Alpe. “We see this as a growing trend that will continue as people

embrace smaller spaces or adjust their businesses and lifestyles.”

Industrial

revitalisation policies over the past few years, he added, have reduced

the stock of appropriate industrial buildings for use as storage. New

fire-safety requirements for all mini-storage facilities have also led

to less supply, according to Wong of The Store House.

“Investors

know that self-storage is recession-proof” with steady income and

requiring relatively low business inputs, Work of the Self Storage

Association said. “Self-storage has stood up better than every class of

real estate. It’s a real estate play and investors love real estate in

Hong Kong.”

(South China Morning Post)

Primavera’s founder splashes US$55 million on Hong Kong mansion after year of blockbuster deal making

Primavera Capital’s founder Fred Hu paid HK$428 million for a 4,755-square foot mansion in Tai Tam

Hu,

who turns 58 next month, paid HK$89,634 per square foot for the

mansion, and HK$18.19 million in tax as a first-time homebuyer in the

city

Fred

Hu, the former Goldman Sachs banker who founded one of China’s most

active private equity firms, has splashed out on a mansion in Hong Kong

following a blockbuster year of deal making, continuing the trend of

wealthy mainland Chinese buyers snapping up prized real estate in the

city.

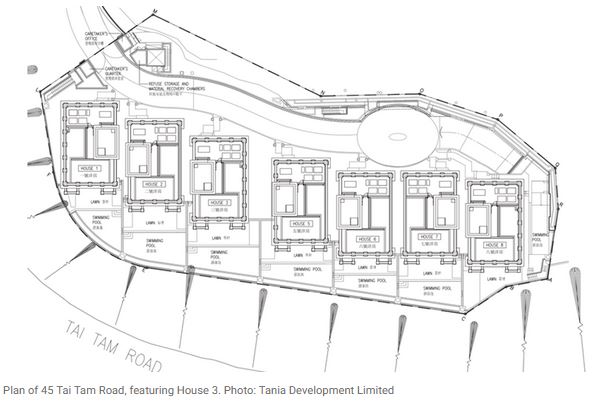

The

founder of Primavera Capital Group paid HK$428 million (US$55 million)

for House 3 at 45 Tai Tam Road, located between the American Club and

the Turtle Cove Beach near Stanley in the south-eastern corner of Hong

Kong Island, according to Land Registry records.

The

4,775-square foot (444 square meters) mansion, one of seven developed

by Tania Development Limited, features a basement car park, three

stories above ground with a roof terrace, a lawn and an infinity pool

looking out into the South China Sea, according to the developer’s

brochure. Hu, who turns 58 next month, paid HK$89,634 per square foot

for the property, and another HK$18.19 million in tax as a first-time

homebuyer in the city, where he is a permanent resident.

“Many

of those who come to Hong Kong are bankers, or [executives of large

technology companies] like Alibaba,” agent said. “Those who do

fundraising really made a lot of money, especially in the past few

months.”

The

vast majority of the most noticeable, big ticket real estate

transactions in Hong Kong over the past 10 years featured buyers with

names spelt in pinyin, the romanisation system used in mainland China,

the agent said. There has been a high number of migrants from mainland

China since the 1997 handover, so “even if only 1 per cent of them”

bought these mansions, that’s still a lot of transactions, the agent

said.

More

than HK$15 billion worth of luxury home sales, involving abodes of at

least HK$100 million each, changed hands this year in Hong Kong,

according to Lee, underscoring how the ultra-wealthy continue to defy

the city’s worst recession on record.

The

upscale apex of Hong Kong’s property has seen record-breaking

transactions, as the city’s economy and the overall market recovered

from the coronavirus pandemic. A house on The Peak, Hong Kong’s most

exclusive address, was reportedly rented out this month for a record

monthly rent of about HK$1.6 million.

In

February, CK Asset Holdings sold a five-bedroom flat at 21 Borrett Road

for an Asian record of HK$459 million on a per-square-foot basis, to a

Hong Kong permanent resident with Chinese pinyin name. That same month,

a Wharf Holdings-led consortium won a residential plot on The Peak for a

record price by square feet in Hong Kong.

Chen

Ying, whose name is spelt in pinyin, paid HK$467 million earlier this

month for a 5,630-sq ft villa at 90 Repulse Bay Road, according to Land

Registry records.

Hu,

an independent non-executive director at SCMP Group Limited - the

publisher of this newspaper - from 2010 to 2016, did not respond to

requests for comment.

Before

establishing Primavera in 2010, the Tsinghua University-trained

engineer and Harvard doctorate holder in economics was chief China

economist and executive director of Goldman Sachs Asia, where he rose to

Greater China chairman over a 13-year tenure.

He

worked at the International Monetary Fund, lectured at Tsinghua as well

as the Communist Party School, and advised the Chinese government on

debt restructuring.

He

previously sat on the Hong Kong government’s Strategic Development

Committee and the Advisory Committee for the Hong Kong Securities and

Futures Commission. He still sits on the board of the Industrial and

Commercial Bank of China (ICBC), one of the country’s largest

state-owned banks.

Primavera

is one of the most active private equity firms in China, with US$2.9

billion of assets under management in 31 active investments across five

funds, according to Bloomberg’s data.

The

company took over the KFC and Pizza Hut chains from Yum! Brands in

2016, packaged them into Yum China Holdings and listed them in New York

and Hong Kong. Yum China raised HK$17.3 billion in a stock sale last

year in Hong Kong.

Lufax

Holding Limited, in which Primavera was an early investor, raised

US$212.7 million last October in a New York initial public offering

(IPO).

Primavera

is also an early investor in several of China’s most valuable

companies, including the world’s first US$100 billion start-up

ByteDance, and Ant Group, the fintech affiliate of this newspaper’s

owner Alibaba Group Holding.

Another factor drawing Chinese buyers to Hong Kong is the difference in currency value and tax rates with the mainland.

“If

you have a Hong Kong identity card, the difference in tax rate and the

lack of inheritance tax or value-added tax” make investing in the city’s

real estate “really attractive,” agent said. “We often remind them that

buying a HK$500 million house is not like spending, but like making a

time deposit. They very much buy this idea.”

(South China Morning Post)

Four failed bids for Kwu Tung site exceeded $6b

Among

the bid prices of developers who failed to secured a residential site

in Kwu Tung, four exceeded HK$6 billion - the upper limit of market

estimates, according to the Lands Department.

Sun

Hung Kai Properties (0016) won the tender last month for the first

residential site in Kwu Tung North which had been sold by government

tender for HK$8.61 billion, or HK$7,183 per buildable square foot - 44

percent higher than the market estimate. Surveyors valued the plot at

HK$4.8 billion to HK$6 billion.

Following

SHKP, the nine tender amounts submitted by the unsuccessful bidders

ranged from HK$4.07 billion to HK$8.21 billion, and the top four bidding

amounts all exceeded the HK$6 billion mark.

The

bidders included Great Eagle (0041), Kowloon Development (0034),

Chinachem, Henderson Land Development (0012), Chinese Estates (0127) and

CK Asset (1113), as well as three joint ventures. The site area is

around 200,000 sq ft.

In

the primary market, Henderson Land Development will offer 45 flats at

The Upper South in Ap Lei Chau for sale on Sunday. The 45 flats,

measuring between 183 sq ft and 264 sq ft, are priced between HK$4.27

million and HK$6.78 million, or HK$22,990 per sq ft to HK$27,058 per sq

ft after discounts.

(The Standard)

在疫情進一步放緩下,用家、投資者重拾入市信心,當中,寫字樓市場由於調整呎價,成為市場追捧對象,交投有所回升,有業主亦乘市況升溫,將持有多時的貴重核心區商廈推出市場,其中,罕有全層放售的灣仔海外信託銀行大廈高層單位,連車位,以意向價約2.35億元放售,並以月租約32萬元放租。

擁煙花海景備裝修 連兩車位

代理指,獲獨家代理放售為位處灣仔告士打道160號海外信託銀行大廈高層全層單位,面積約7,344平方呎,單位已交吉,連兩個車位,現以意向價約2.35億元放售。單位因樓層高,可享開揚煙花海景,而物業採中間無柱設計,內籠四正實用,並連寫字樓裝修出售,買家可即買即用,再者,由於物業屬全層樓面,私隱度高,為市場上罕有交吉大樓面全層放盤,極其適合企業進駐作旗艦店或集團總部之用。

同步放租 意向叫租32萬

至於,上述放售單位,同時附連兩個車位出售,買家可作自用之餘,亦可考慮日後將其轉手放售,對於核心商業區素來車位供應緊絀,上址連車位出售,自然大為提升叫座力,同時車位具投資價值,亦可作為長綫投資或分拆出售。而上址同時亦招租中,意向月租約32萬元,以單位面積計,平均呎租約44元。

代理指,海外信託銀行大廈坐落於灣仔告士打道,屬區內商廈群地段,而且大廈位處單邊,因此單位景觀更見開揚明亮;而且灣仔擁有多幢政府大樓,灣仔地標會議展覽中心同時正在擴建中,港鐵沙中綫會展站等工程亦積極進行,灣仔北將面臨大變天,區內物業投資價值更為優厚。而是次獨家放售單位,屬核心商業區矜罕全層交吉戶,自用或投資兩相宜,而且項目又連兩個車位放售,令物業吸引力大為提升,料市場洽購反應會大為理想。

據資料顯示,過去一年以來,海外信託銀行大廈鮮有租、賣成交,反映業主甚為惜售,而市場新近租務成交為中層全層單位,面積約7,344平方呎,以約21萬元租出,平均呎租約29元,至於區內新近商廈成交,可參考剛易手的港灣道25號海港中心中層04至05室,面積約3,567平方呎,以約1.034億元沽出,平均呎價約2.9萬元,獲用家承接。上址屬單邊位,擁全海景,並以交吉形式出售,屬市場上優質單位,據悉原業主於2007年以每平方呎約8,800元購入,多年來一直作長綫收租之用,早前租客遷出後,決定沽售。

(經濟日報)

更多海外信託銀行大廈寫字樓出租樓盤資訊請參閱:海外信託銀行大廈寫字樓出租

更多灣仔區甲級寫字樓出租樓盤資訊請參閱:灣仔區甲級寫字樓出租

更多海外信託銀行大廈寫字樓出售樓盤資訊請參閱:海外信託銀行大廈寫字樓出售

更多海港中心寫字樓出售樓盤資訊請參閱:海港中心寫字樓出售

更多灣仔區甲級寫字樓出售樓盤資訊請參閱:灣仔區甲級寫字樓出售

富臨6380萬 購駿業街46號全層

土地註冊處資料顯示,豐展資產旗下觀塘駿業街46號低層全層,建築面積6,371平方呎,上月以6,380萬元成交,呎價約10,014元。新買家為TYS46 (1F) Limited,公司董事為楊維,即富臨集團主席兼執行董事。

不過,翻查公司註冊處資料,項目發展商EAGLE CROWN HOLDINGS LIMITED的其中一位公司董事,是楊維的哥哥楊潤全。他目前為富臨集團執行董事兼聯席營運總裁,即同屬於富臨的相關人士,因此未知是否為內部轉讓個案。

(經濟日報)

油塘越秀倉重建 申增337伙明闖關

城規會將於明日 (28日) 將審批一批申請,其中越秀地產旗下油塘東源街越秀冷藏倉庫住宅重建項目,去年就已批准方案提出修訂,增建337個住宅單位,即提供合共1,393伙,而平均單位面積減至398平方呎。規劃署不反對,料可獲城規會通過。

皇后大道東舊樓重建 不獲支持

根據文件顯示,新修訂的方案配合地政總署的要求,把地盤內約5,522平方呎的政府土地,納入計算地積比率,故地盤面積增至131,991平方呎。申請人擬以地積比率5倍,興建5幢23至29層高的住宅,涉及總樓面約659,953平方呎,共提供1,393伙,較原方案增加337伙。

另外,明興水務旗下公司明興土木工程有限公司,早前就灣仔皇后大道東72至76號舊樓申請重建成26層高商廈,惟規劃署不支持方案。

項目樓齡逾50年,地盤面積約2,113平方呎,現劃為「住宅 (甲類)」用途,為1幢10層高住宅。申請人擬以地積比率15倍,重建成1幢26層高的辦公室、商舖及食肆,涉及總樓面約3.2萬平方呎。規劃署認為,申請人不應在規劃作住宅用途的區域中作商業發展,加上申請人沒有提供強烈理據,故不支持申請。

(經濟日報)

亞皆老街鋪王呎租234元租金重返十年前水平

隨着疫情改善,市場憧憬經濟情況有所改善,鋪位租賃趨活躍,旺角亞皆老街一個單邊鋪王,連鎖時裝店半年前以短約形式進駐,最新改為長租,月租約60萬,平均呎租234元,租金重返十年前水平。

上址為旺角亞皆老街24至26號地下連閣樓,地下及閣樓建築面積各約1278方呎,合共約2556方呎,剛由時裝連鎖店BALENO承租,月租約60萬,簽下三年約,平均呎租234元。事實上,該家時裝店早於去年11月以短約形式進駐,當時簽下三個月租約,月租約20萬,及後續約三個月,在測試水溫成功後,最終改為長租。

BALENO由短約轉長租

代理表示,近期鋪市租賃有所改善,上述時裝店由短租轉長租,證明生意有得做,為市場打下強心針,事實上,上述鋪位位處亞皆老街當眼位置,而且是大單邊,佔據地利,於反修例運動前市值月租逾100萬,亦由此可見,雖然現時零售市況漸有改善,惟鋪租下跌,以該鋪王為例,比較兩年前下跌約40%,最新租金亦重返十年前水平。

每月租金60萬

事實上,上述鋪位由老牌譚氏家族持有,旗下Apple

Shop早於80年代已自用鋪位,售賣自家生產的蘋果牌牛仔服裝,惟於2020年3月不敵反修例運動及疫症來襲,選擇遷出並將鋪位推出招租,意向每月180萬,同年5月將月租改為80萬,鋪位於丟空七個月後,2020年11月短租予Baleno,最新轉為長租,現場所見,鋪位正在裝修中,有工程人員在鋪設地磚。

譚氏家族於1992年以8350萬購入鋪位,WELFORD PROPERTIES LIMITED以公司名義持有物業。

亞皆老街旺段對上一宗大租賃於去年10月錄得,亞皆老街32至34號全幢,樓高3層,總面積6000方呎,由中信嘉華銀行承租,月租約60萬,平均呎租約100元,該鋪位由G2000承租逾十年,於反修例運動前月租180萬,新租金較舊租金大減66%。

海外信託銀行大廈全層叫2.35億

代理表示,灣仔告士打道160號海外信託銀行大廈高層全層,面積約7344方呎,項目連兩個車位放售,叫價約2.35億,現已交吉,單位擁煙花海景,連寫字樓裝修,買家可即買即用。

另一代理表示,深水埗楓樹街11至13號華楓樓地下及一樓連租約放售,地下面積約1800方呎,一樓面積約為2800方呎,合共約4600方呎,意向售價為約5500萬元,呎價為約1.19萬,物業現時由寵物醫院承租,月租約12.9萬,料回報約2.81厘。現租客由2013年經營至今。

(星島日報)

更多海外信託銀行大廈寫字樓出售樓盤資訊請參閱:海外信託銀行大廈寫字樓出售

更多灣仔區甲級寫字樓出售樓盤資訊請參閱:灣仔區甲級寫字樓出售

古洞地中標價高次標僅5%半數財團出價高市場估值

上月開標的古洞北首幅住宅地,由新地以86.14億投得,每呎樓面地價達7183元,餘下發展商出價於昨日公布,出價介乎82.1億至40.728億,每呎樓面地價6846至3396元,中標價僅高次標近5%,競爭激烈,當中,更有半數財團出價高於市場估值上限,但同時亦有個別財團抱「執雞」心態出價,較中標價低逾五成。

新地上月以86.14億,每呎樓面地價7183元奪古洞首幅住宅地,高市場估值上限30%,地政總署昨以不具名方式,公開古洞北首幅地皮各標價,出價介乎82.1億至40.728億,以可建樓面約119.9萬方呎計,每呎樓面地價由6846至3396元。

新地86.14億中標

其中,次標出價為82.1億,每呎樓面地價為6846元,首標較次標高出約4.9%,競爭激烈。另外,首五標出價均高於市場估值上限,可見各財團均看好古洞區長遠發展。至於最低出價為40.728億,每呎樓面地價為3396元,較中標價低約53%。

地皮於上月截標,並接獲10份標書,入標財團包括成功奪地的新地,其餘財團包括長實、恒基、華懋,而佳兆業夥拍萬科出擊,至於嘉里夥拍信和、新世界及嘉華合組財團。

最低出價差逾五成

有測量師稱,古洞北地皮首三標的出價相差約11%至12%,而次標與中標價相差近5%,由於各財團出價接近,可顯示不少發展商對古洞未來發展具信心,在政府大力推動新界東北發展下,該幅地皮貼近未來港鐵古洞站,不單止其住宅部分可吸引買家,商業部分亦具相當潛力,足證市場看好後市。

越秀油塘項目增建337伙

另外,越秀旗下油塘東源街越秀冷藏倉庫,於18年獲批重建為住宅項目,可建1056伙,目前提出修訂方案,將可建單位數目增加337伙,令項目可建伙數達1393伙。另外,新修定方案將地盤內的政府土地,納入計算地積比,令地盤面積增至13.1萬方呎,地積比為5倍,總樓面達65.9萬方呎,可興建5幢23及29層高的分層住宅。 而有關修訂規劃署不予反對,料獲城規會通過。

(星島日報)