Total

sales, including homes, shops, industrial units and parking spaces, hit

their highest monthly level in almost two years as buyers bet on the

local economy bouncing back from recession.

Used homes fared much better than new units, with an estimated 5,800 flats changing hands for HK$50 billion.

Hong

Kong's total property sales, including homes, shops, industrial units

and parking spaces, may have soared to their highest monthly level in

almost two years as buyers bet on the local economy bouncing back from

recession amid a decline in coronavirus cases.

The

number of property transactions in April climbed to 9,100 deals with a

total value of HK$82.5 billion (US$10.6 billion), according to an

estimate by property agency on Sunday.

Official data from the Land Registry will be released in the next few days.

The

property agency’s forecast represents a 0.4 per cent rise in the number

of deals from March’s 9,067 deals, and a 5.7 per cent increase in value

from HK$78 billion.

“Both

sales volume and value will be the highest since May 2019,” agent said.

That month saw 10,353 deals with a total transaction value of HK$90.3

billion.

In the residential market, the agent said sales of second-hand homes had outperformed those of new units.

The

agent said there was a sharp rebound in demand for used homes last

month, with an estimated 5,800 flats changing hands for HK$50 billion.

That would be the largest number of transactions in the secondary market

since October 2012, when 5,994 deals were closed.

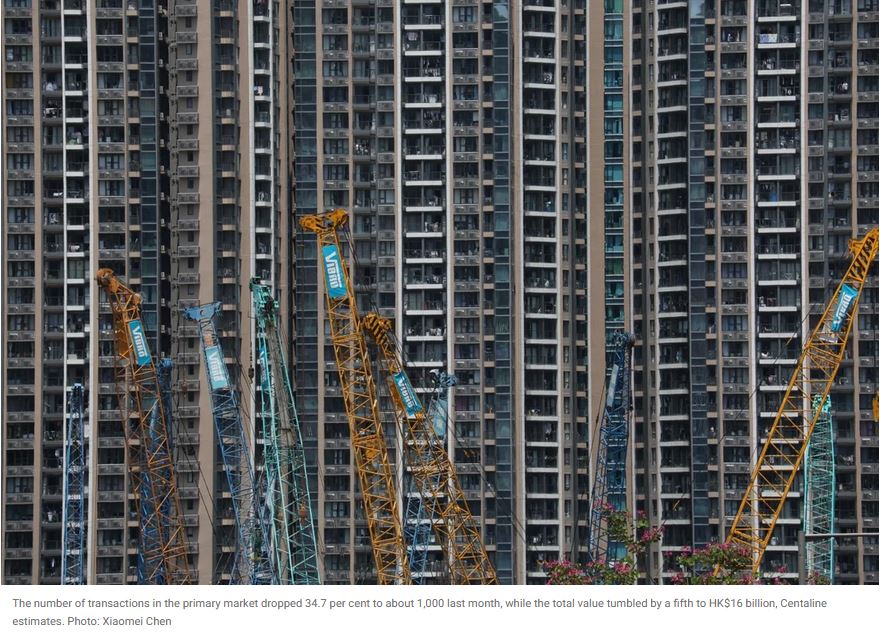

Sales

of new homes did not fare as well. The number of transactions dropped

34.7 per cent to about 1,000 last month, while the total value tumbled

by a fifth to HK$16 billion, the property agency’s estimated.

Hong

Kong will experience “considerable growth” in its economy in the first

quarter of the year, but the Covid-19 pandemic will still be a hurdle on

the path to recovery, Financial Secretary Paul Chan Mo-po wrote in his

official blog on Sunday.

The government is expected to reveal its projection for first-quarter gross domestic product on Monday.

Kingswood

Villa in Tin Shui Wai, where flats cost as little as HK$10,000 per

square foot, was the most actively traded housing estate with 63 homes

changing hands last month, according to the property agency’s estimate.

City One in Sha Tin saw 47 transactions completed, making it the

second-most popular housing estate, followed by Taikoo Shing with 45.

On

the Labour Day holiday weekend, buyers splashed out more than HK$5.4

billion snapping up close to 380 units of the 500 on offer across the

city. It was the biggest weekend for property sales in seven months.

To capture the positive sales momentum, developers have raised prices for the next batch of units to hit the market.

Road King Infrastructure said it raised the prices of the next batch at its South Land

project adjoining the Wong Chuk Hang MTR station by 11 per cent on

Sunday, after all 240 units sold a day earlier for a total of HK$4.6

billion.

It

has released 180 units at an average HK$33,103 per square foot, up 11

per cent from the launch price of HK$29,680 per square foot.

South Land was jointly developed by Road King, Ping An Insurance and the local subway operator MTR Corporation.

Meanwhile,

Sino Land said it had raised HK$830 million from the sale of 121 units

at its joint venture project, One Soho in Mong Kok, on Saturday. It

plans to release another 78 units for sale on Thursday.

(South China Morning Post)

Buyers pile into Hong Kong’s biggest weekend property sales in seven months as they park their investments in fixed assets

Increased investor interest was seen in Saturday’s sales of three newly released projects in Hong Kong

Investors

and owner-occupiers snapped up 379 flats, or 76 per cent of the 500

units on offer across the city as of 8.40pm, according to sales agents

Buyers

piled into Hong Kong’s biggest weekend property sales in seven months,

snapping up new homes on offer at three locations across the city over

the Labour Day holiday weekend, as they set aside concerns of a flare-up

in coronavirus cases to park their investments in fixed assets.

Investors

and owner-occupiers bought 379 flats, or 76 per cent of the 500 units

on offer across the city as of 8.40pm, according to sales agents. The

total tally excluded 10 luxury units which were sold without price

guidance, the results of which will be disclosed next week.

Road King Infrastructure Limited sold all 240 flats at its South Land project

at the Wong Chuk Hang subway station. The first apartment project to

sit atop a major subway station in about three decades received 5,500

bids, or an average of 22 buyers registering their interest for every

available unit, with one family splashing HK$200 million (US$25.8

million) for eight units of South Land’s three-bedroom apartments, agents said without identifying the buyers.

Brisk

sales were also reported at Sino Land’s One Soho project in Mong Kok,

where 121 of the 168 apartments found buyers. Sun Hung Kai Properties

(SHKP), aiming to repeat its 90 per cent sell-out launch from last

weekend, sold 18 of the 82 apartments on offer at phase two of its Regency Bay development in Tuen Mun.

The

bull run in the residential property market underscores the economic

conundrum amid raging coronavirus pandemic: the torrent of cheap money

unleashed by global central banks to bolster the world economy finding

its way into the stock market and fixed assets, as investors seek higher

returns for capital. Hong Kong’s economy is struggling to claw its way

out of the worst contraction on record, and the city’s jobless rate is

at a multi-year high.

“The

sales progress of the three projects can be regarded as hot,” property

agent said. “Purchasing power is increasingly being released as people

worry that money will depreciate amid low interest rates, and they

prefer to invest it in property.”

One in three buyers at One Soho was buying the flat to rent out, the agent said. Regency Bay tends

to attract customers who are buying the homes to live in and we are

estimating that 80 per cent of buyers were owner-occupiers, the agent

said.

Hong

Kong’s home prices have been edging upwards in recent months, as the

Covid-19 outbreak tapers off while the number of vaccinations rose. The

monthly home price index may rise by 4.6 per cent in the second quarter,

according to another property agency, forecasting that the gauge could

climb to a record in May or June.

An

influx of new immigrants, mainly from mainland China, also bolstered

home sales. The price index for lived-in homes rose to a 20-month high

in March as rich investors and buyers turned bullish about the local

market.

South Land

was jointly developed by Road King, Ping An Insurance and the local

subway operator MTR Corporation. The flats on offer ranged from

one-bedroom units to three-bedroom apartments, priced between HK$11.5

million and HK$32.4 million each, or HK$27,005 to HK$38,155 per square

foot.

One

in two customers at the project was buying for investment, agent said.

“The investment potential is huge, with the rental return at around 0.3

per cent,” the agent said.

In

contrast, One Soho featured smaller, one-bedroom studios priced between

HK$7 million and HK$8.2 million after a 14.5 per cent discount. The

price range attracted mostly younger buyers, agents said.

At Regency Bay,

74 units were for first-come-first-served today, with prices between

HK$5.7 million and HK$8.7 million, and between HK$17,192 and HK$20,310

per square foot. The other eight were for undisclosed bids without price

guidance.

(South China Morning Post)

上月甲廈錄26宗買賣

疫情稍緩和,帶動甲廈交投回暖。據代理指出,上月50大甲廈共錄26宗買賣,按月上升逾八成,創過去3年單月新高。

代理數據顯示,今年4月五十大甲廈共錄26宗買賣,較3月的14宗升85.7%,創自2018年3月以來新高、即3年新高紀錄;至於成交總樓面涉11.1萬方呎,按月挫13.2%,主要是因為3月市場連錄多宗全層大手買賣,推高基數所致,總結今年首4個月,五十大甲廈共錄62宗買賣,為去年全年76宗的81.6%。

創近三年單月新高

若按區域劃分,上月九龍區成交量最多,錄得17宗,至於新界及港島區分別錄4宗及5宗。其中,東九龍期內共錄8宗買賣,是上月表現最佳的分區,尖沙嘴 (包括尖東) 亦錄得6宗交投。若以大廈分類,上月葵涌新都會廣場連錄4宗買賣,是成交量最多的大廈。而近期有拆售活動進行的中環中心,上月也錄得3宗易手。

代理表示,去年底工商鋪「撤辣」,加上本地疫情緩和,刺激市場交投氣氛,同時,環球游資充裕,股市表現暢旺,部分資金轉投寫字樓市場,帶動交投出現「報復式反彈」,上月買賣宗數亦重返一七、一八年旺市水平。

該代理續指,上月以東九龍交投表現較突出,因為該區甲廈呎價普遍1萬餘,屬低水,吸引不少新晉投資者入市,帶動交投,展望後市,代理認為,政府已經推出「回港易」計畫,現時亦與澳門及澳洲、紐西蘭等地商討旅遊氣泡,相信稍後中港通關也有望實現,故對後市感樂觀。

(星島日報)

更多中環中心寫字樓出售樓盤資訊請參閱:中環中心寫字樓出售

更多中環區甲級寫字樓出售樓盤資訊請參閱:中環區甲級寫字樓出售

中環巨鋪每呎80元租出重返十年前水平

經濟環境欠佳情況下,大鋪拆細出租司空見慣,惟市場亦有例外,中環皇后大道中地標商廈娛樂行,數個細鋪被合併為一個約5000方呎巨鋪,由食肆進駐,平均呎租約80元,較舊租金減逾50%,重返十年前水平。

消息人士表示,上址為皇后大道中30號娛樂行部分地下及1樓,前身為時裝店、紅酒及咖啡店,都是反修例前受捧的行業,惟隨着近年經濟走下坡,租客離去,鋪位亦丟空多個月,最近被合併為一個建築面積約5000方呎的巨鋪,由美式餐廳進駐,售賣漢堡包及沙律等食品,月租40萬,較舊租金減少約50%,平均每呎約80元,重返十年前水平。

細鋪合併月收租40萬

中環核心區近期湧現吉鋪,主要由兩類型租客「填上」,食肆及口罩店,上述娛樂行對面的華人行,地鋪有一家口罩店,擁有口罩製造機,在貴重的鬧市「設廠」,向路人展示生產過程,這個鋪位面積約1093方呎,上手鐘表店月租高達110萬,最新月租30萬,下跌約73%。

名店巨鋪拆售出租

上述屬於中環皇后大道中「皇中之皇」地段,主要港鐵站出口皆設於此,由此地段步行2至3分鐘,走至皇后大道中九號基座嘉軒廣場,曾是Hermes自用的巨鋪,3年前易手後,一直丟空多時,最後巨鋪被拆細招租,短租客包括藝術畫廊及快閃店,消息人士指,其中地下6號鋪及閣樓亦錄長租,建築面積約3000方呎,由食肆進駐,月租20萬,平均呎租約67元。不過,現時所見,仍未見有食肆進駐。

中環擺花街與市中心有距離,錄得38號地鋪及1樓,建築面積約3200方呎,由人氣咖啡品牌承租,月租35萬,較舊租客運動品店Under Armour舊租金,足足跌65%。

(星島日報)

更多娛樂行寫字樓出租樓盤資訊請參閱:娛樂行寫字樓出租

更多華人行寫字樓出租樓盤資訊請參閱:華人行寫字樓出租

更多皇后大道中九號寫字樓出租樓盤資訊請參閱:皇后大道中九號寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

銅鑼灣商業地掀財團爭奪

儘管疫市下商廈造價持續受壓,惟政府推地步伐未見放緩,銅鑼灣加路連山道商業地,將於本周五截標,為同區近年罕有大型商業地供應,市場估值約150億,每呎地價約1.4萬,料吸引本地及內地大中型財團爭逐;新地及華懋均表示,會研究入標競投項目。

市場估值150億

上述項目為銅鑼灣加路連山道商業地,地盤面積15.9萬方呎,以地積比率約6.76倍計,可建樓面約107.6萬方呎。有測量師表示,近期疫情及環球經濟下,料對競投意欲亦將受影響,加上同期中環商業地王亦推出招標,攤分市場焦點,預期市場反應會較審慎,料估值逾150億,每呎價估值約1.4萬。

新地副董事總經理雷霆稱,集團正研究入標;此外,華懋集團行政總裁蔡宏興表示,本港為國際金融中心,商業前景值得看俏,集團正研究入標。

該地皮早於10多年前,由規劃署將前機電工程署舊總部、前民安隊大樓等組成的大型用地重建發展,直至今個財政年度才放入賣地表,為同區罕有大型供應。

(星島日報)

樓價年內料升3%至5% 協成行方文雄:購買力穩步釋放

近期樓市交投回勇,協成行董事總經理方文雄認為,大灣區發展將成為本港經濟發展的主引擎,加上疫情近期稍放緩,在低息環境及供應有限等利好因素支持下,市場購買力穩定釋放,料今年樓市表現較去年為佳,預期至年底,在未來約8個月可錄3%至5%升幅。

協成行方文雄接受本報訪問時指出,儘管疫情持續反覆,惟樓市近期交投氣氛已見改善,隨着疫苗啟動接種,本港經濟可重新起步,配合大灣區發展,樓市前景值得看俏。

料發展商貼市價推盤

他指,「現今樓市正處復甦期,惟近期新盤交投不俗,客源包括年輕上車客及換樓客,證明市場需求殷切,加上低息環境及供不應求等因素支持,預期今年樓市表現較去年為佳,至年底樓價料可錄約3%至5%升幅。」

中小型單位主導大市

另外,他稱,受疫情等因素影響,市場早前積壓不少購買力,隨經濟環境稍回穩,發展商紛開盤吸客,因市場購買力殷切,他們不怕競爭,造就該購買力得以釋放。他亦稱,現今市道估計,料發展商以貼市價推盤,採貨如輪轉的銷售策略,以維持穩定的資金流,單位戶型則以中小型單位作主導。

對於集團最新推盤大計,方文雄指,集團何文田勝利道單幢項目,料最快今年第3季應市,地盤面積約4890方呎,可建樓面約4.14萬方呎,涉約71伙,面積由286方呎至481方呎,主打1房及2房,料於明年第3季竣工,料力吸家庭客及年輕上車客源。

勝利道項目料下季應市

對於政府近期有意重提空置稅,他回應指,豪宅物業屬市場罕有供應,惟對民生影響不大,該政策對市況有一定影響,並指豪宅物業買賣決策應由發展商決定,發展商都以貨如輪轉的銷售策略為主,故不會囤積單位待售。

另一方面,方文雄亦指出,自疫情於去年初爆發,樓價表現仍然「硬淨」,惟他認為本港樓價持續高企,亦有礙經濟發展,事實上,現今土地供應呈供不應求,故希望政府積極覓地,以紓緩樓價壓力,可行措施包括發展棕地及填海等,若有效增加土地供應,對發展商言,亦屬「佳音」。

(星島日報)

工廈呎價低供應缺 疫後反彈力高

代理:市場熱錢多 利投資市場

投資市場轉好,代理認為,量化寬鬆下市場熱錢多,有利投資市場,而外資基金近期主攻工廈,該代理分析因呎價便宜,貼近成本價,疫後反彈力高。

受疫情影響,去年大手物業市場非常淡靜,而隨着今年疫情緩和,投資氣氛明顯有改善,近期相繼有逾10億大手買賣出現。代理分析,資金主導投資市場,在量化寬鬆下,資金流入地產市場,更不擔心泡沫,「環球資金多,熱錢湧港,美國及其他國家進行量化寬鬆印銀紙,至今仍未停止。今次規模不是個別地區而是全世界,當全世界都有泡沫,便不是泡沫,未來資產價格可看高一綫。香港樓價平穩,其他歐美地區,疫情下樓價沒有下跌,相信是資金太多。」

地產市場 最壞時間已過

去年環球疫情影響投資氣氛,至今未完全解決。該代理相信,香港地產市場最壞時間已過,復甦在即,「疫情令準買家未能來港視察,加上看不清前景,故暫緩入市。去年尾第4波,為本港市場最大憂慮之時,但隨着疫情緩和,最壞時間已過。政府控疫措施有效,疫苗出現可望控制疫情。最近與新加坡啟動旅遊氣泡,港人從內地返港免14日隔離等,這些因素對地產市道更有幫助。」

投資市場略為轉旺,正是集合眾多因素,代理料下半年更旺,「亞洲地區特別大中華區控疫上較佳,香港復甦料快,可吸引資金流入。另外,政府去年尾減印花稅,買賣物業個案即上升。至於去年多項法例落實,局勢較明朗。」該代理認為,外資基金不只投資香港,亦在內地物色投資物業,故未見外資對香港投資興趣減,「投資無國界,只睇賺錢機會。對外資基金來說,今次可能是難得投資機會,因為價格下挫。最近投資市場轉活,相信下半年更加暢旺。」

通關後利甲廈 中資有力填補

近期投資市場出現兩大現象,首先工廈交投一枝獨秀連錄大額成交,另外買家主力為外資基金。市場消息指,荃灣有線電視大樓多層物業,獲施羅德鵬里基金以約26億元承接,涉及56萬平方呎樓面,暫為今年最大額工商舖買賣。另外,葵涌、屯門及長沙灣,均錄全幢工廈買賣,單計外資承接工廈,今年已錄逾60億元成交。他分析,工廈集多個有利因素,「工廈呎價較低,而新供應亦缺乏,政府即使推工業地皮,新買家多作數據中心,故傳統工廈更少。」代理預計,資金追捧低水物業,故只要呎價偏低,便足以吸引資金入市,「不論基金及投資者,投資最重要睇呎價,若價格基數低,接近建築成本,買家即有興趣。如荃灣工廈最近成交呎價約4,000餘元,貼近地價,屬非常低水。疫情過後,物業價格反彈力度高」」

至於近月表現較弱的商廈市場,該代理認為市況日後會有改善,通關後中資機構將來港開業,有利甲廈市場,「中資機構有力填補,始終很多大型科網企業準備來港上市。」

(經濟日報)