Henderson

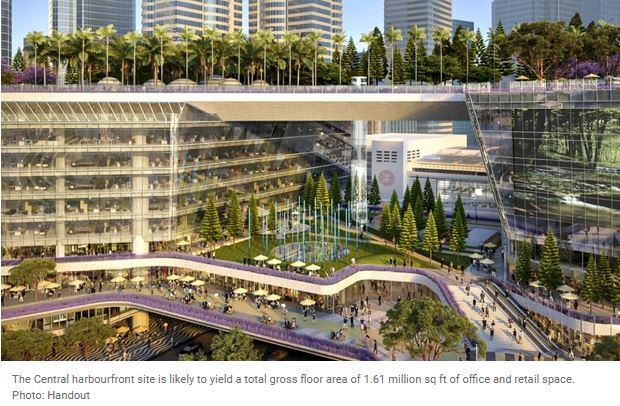

Land says it will invest HK$63 billion to develop the site into an

iconic landmark and social destination dedicated to the public

The plot was estimated to fetch between HK$37 billion and up to HK$55 billion, according to valuers

Henderson Land Development

won the bid for Hong Kong’s most expensive commercial land, combining a

sprawling design with a record price tag to beat five contenders in the

government’s “two-envelope” tender for the harbourfront plot in

Central.

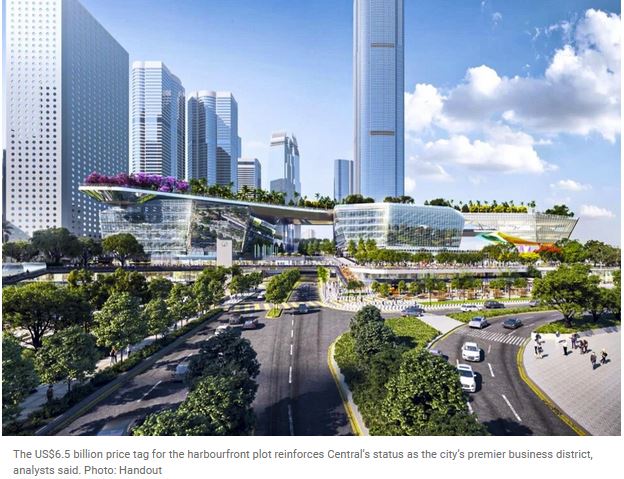

A

unit of Henderson will pay the record-setting HK$50.8 billion (US$6.5

billion) for a 50-year land grant of New Central Harbourfront Commercial

Site 3, according to a statement by the government.

The plot, north of the city’s old General Post Office and next to the

International Finance Centre, measures 516,316 square feet (47,967

square metres), and can yield 1.6 million sq ft in gross floor area.

Henderson

said in a statement that it will invest HK$63 billion to develop the

site to create an iconic landmark and a “social destination dedicated to

public enjoyment”.

The

winning price, close to the top end of the market’s valuation of

between HK$37 billion and HK$55 billion, is the second trophy in four

years for Henderson since the developer, controlled by one of Hong

Kong’s wealthiest families, paid what was then a record HK$23.28 billion in 2017 for the government’s Murray Road car park to turn it into an office tower.

The successful bid “is based on the idea of a bridge, and aims to

curate a world-class iconic landmark in Hong Kong, enhance the

connectivity between the hinterland and harbourfront in Central, and

create a vast amount of green and public spaces,” a spokesperson for the

Development Bureau said. “The development is expected to achieve good

integration with the surrounding environment and vitalise the

harbourfront area.”

A

key feature of the design is its height limit, devoid of any building

taller than 50 metres (164 feet) on the plot’s western fringe, with

nothing higher than 16 metres to the east.

The

constraint was to honour a 1971 agreement granted to Hongkong Land

Limited, which paid what was then a record price of HK$258 million to

lease a plot for 75 years, where the Jardine House tower now stands. The

then British colonial government agreed that no building directly to

the north of Jardine House would ever obstruct its views. As a result,

the height of the General Post Office building, built in 1976 north of

Jardine House, was capped at 120ft (37m).

“We

are excited to take part in this world-class development, which will

form one of the most important and strategic additions to Hong Kong’s

CBD,” said Martin Lee Ka-shing, chairman of Henderson Land. “We are

confident that the project will generate favourable financial returns to

the company.”

Henderson

said that the project will be delivered in two phases, with the first

phase due to complete by 2027. Phase one will have 270,000 sq ft of

office space and 340,000 sq ft of retail, dining and entertainment

spaces. Phase two, targeted for completion in 2032, will have 390,000 sq

ft of office space and 600,000 sq ft of retail space.

The

price tag of the winning bid works out to HK$31,463 per square foot, 37

per cent cheaper than the commercial plot that Henderson paid for at

Murray Road in 2017, according to property agency.

“Office

development at such an iconic location will be highly sought after by

both big multinational and mainland Chinese corporations,” an agent

said.

Henderson

plans to erect three buildings on the harbourfront to accentuate Hong

Kong’s image as Asia’s World City. The block closest to the harbour will

be multifunctional, while the other two will be office buildings.

The

focal point of the entire design is the old Star Ferry Clock Tower,

which will be reconstructed close to its original position to maintain a

visual connection with the harbour and Hong Kong’s maritime heritage,

according to the land sale condition.

The

“two-envelope” approach to awarding tenders was a way to put a cap on

land prices, awarding bids on meritorious designs, as well as the

highest price. Henderson’s Pacific Gate Development unit attained the

highest marks for its premium and non-premium proposals, according to

the government’s Tender Assessment Panel (TAP).

Six

bids were received for the site, of which four failed to attain the

passing mark for both the premium and non-premium proposals in the

two-envelop approach, the government said, without naming those that

failed.

The

tender attracted Hong Kong’s biggest developers: the most valuable

developer Sun Hung Kai Properties, Li Ka-shing’s flagship company CK

Asset Holdings, as well as tycoon Peter Woo’s Wharf Real Estate

Investment Company. The city’s subway operator MTR Corporation submitted

a joint proposal with Chinachem Group, while Robert Ng Chee Siong’s

Sino Land partnered with the Lo family’s Great Eagle Holdings and China

Merchants Group in a joint bid.

Henderson’s bid reflects the developer’s confidence in the Central business district’s prospects, another agent said.

(South China Morning Post)

For more information of Office for Lease at International Finance Centre please visit: Office for Lease at International Finance Centre

For more information of Grade A Office for Lease in Central please visit: Grade A Office for Lease in Central

Henderson scoops prime Central harbor site for $50.8b

Henderson

Land Development has spent HK$50.8 billion to secure site 3 of the New

Central Harbourfront with a 50-year land grant following a two-envelope

open tender.

The

516,300-square-foot site at Man Yiu Street sits right next to

International Finance Centre, which was jointly developed by Henderson,

and enjoys a good view of Victoria Harbour.

The

sum looks to be the highest-ever selling price for a single site in

Hong Kong. It had been valued at between HK$37 billion and HK$56.5

billion.

An official for the Development Bureau said the vision is for site 3 to become a new landmark in Hong Kong.

"The

successful tenderer's proposal is based on the idea of a bridge and

aims to curate a world-class iconic landmark in Hong Kong, enhance the

connectivity between the hinterland and harborfront in Central and

create a vast amount of green and public space."

It

added: "The successful tenderer proposes to have three buildings with a

view to accentuating Hong Kong's image as Asia's World City."

The block closest to the harbor will be multi-functional whereas the other two will be office buildings.

Adequate

separation is proposed among the buildings as ventilation corridors and

"city windows" to ensure the project will have sufficient natural

ventilation and lighting.

The public open space proposed will exceed the minimum of 25,000 square meters as required in the tender document.

What is already known as Horizon Park - a platform at roof level - will connect the three buildings.

The public will be able to enjoy panoramic views of the Central cityscape and Victoria Harbour from there.

The platform, to be fashioned as an urban forest, will also provide a lawn, jogging routes and outdoor space for public use.

The

proposal also provides a pedestrian network to link with existing

routes in Central, connecting its hinterland areas with the harborfront.

There will also be a pedestrian connection with Central MTR Station.

The

administration adopted a two-envelope approach in the tender to take

both design and premium into consideration, meaning an equal weighting

for premium and non-premium proposals was adopted.

A

tender assessment panel assessed the tender proposals in accordance

with requirements, and Henderson Land's Pacific Gate Development

attained the highest marks with its ideas.

The

SAR administration had received six tenders. But four of them did not

conform with a requirement that a tender must attain a passing mark for

both the premium and non-premium proposals in the two-envelope approach.

In

other words, two of the tenders - including Henderson's successful one -

fulfilled both requirements. That led to one of the two being given a

higher total mark and hence awarded the tender.

CK

Asset, New World Development and a consortium formed by Sino Land,

China Merchants Land and Great Eagle were also among the bidders.

Development

Bureau officials will be releasing combined scores, the premium offer

and the gist of the design proposals of the second conforming tender

after the completion of transaction procedures.

Site

3's 516,300 square feet offer a gross floor area of 1.84 million sq ft

and will be mainly used for commercial and retail purposes.

There will also be 228,000 sq ft for government, institutional or community facilities plus a car park.

Netting out areas for public use, the average price is HK$31,462 per sq ft in gross floor area.

This latest winning of a tender by Henderson Land marks its second major investment in Central in 4 years.

The

developer submitted the winning tender for a commercial site on Murray

Road with a HK$23.2 billion bid in May 2017. That was a record high for

Hong Kong at that time.

Given

the top gross floor area of around 465,000 square feet, the average

price stood at around HK$50,063 - also a high that still stands in the

SAR.

That came before

Sun Hung Kai Properties purchased the giant commercial site atop the

West Kowloon Station for HK$42.2 billion in November 2019, which set the

record high before site 3.

The also came with an area of over 643,100 sq ft, or a gross floor area of 3.16 million sq ft.

(The Standard)

For more information of Office for Lease at International Finance Centre please visit: Office for Lease at International Finance Centre

For more information of Grade A Office for Lease in Central please visit: Grade A Office for Lease in Central

Monaco One hits the market with 99 flats

More developers are launching new projects, with one at Kai Tak and another in Kennedy Town.

Wheelock opens the first price list of Monaco One in Kai Tak today, offering at least 99 flats with prices starting HK$7 million.

A

1,471-square-foot special unit with four bedrooms may be put in the

first round of sales by tender, said managing director Ricky Wong

Kwong-yiu. It is expected to break the record of the highest price per

square foot at Kai Tak.

Meanwhile,

the developer revealed a three-bedroom show flat, replicating a

552-sq-ft unit in the project. The largest three-bedroom in Monaco One is 671 sq ft. All show flats will be open to the public on the weekend, along with registration.

Providing

a total of 492 flats with one and two-bedroom flats accounting for 80

percent of the total, the project is targeted at first-time home buyers

and nuclear families.

In

Kennedy Town, the Kennedy 38, jointly developed by Wheelock, Sun Hung

Kai Properties (0016) and Henderson Land Development (0012) will open

show flats next week.

Rebuilt

from a 46-year-old industrial building, Kennedy 38 has only one block

and provides 341 homes, where 30 percent are studios and 60 percent are

one-bedrooms.

The

selling price of the project will take reference from neighboring new

projects, which is around HK$33,000 per square foot, said Victor Lui

Ting, the deputy managing director of SHKP.

(The Standard)

恒地508億奪中環商地 港歷來最貴

中環新海濱商業地由恒地 (00012) 以508億元獨資奪得,成本港最高價新地王,每平方呎樓面地價約3.1萬元,總投資額630億元,將以「橋」為概念打造成地標式商場及商廈,成中區新地標。

李家誠:總投資額630億 打造世界級地標

被視為超級地王的中環新海濱3號用地,發展局昨日公布,以「雙信封制」(因政府重視用地建築設計,故此要求發展商以獨立信封分別提交設計建議書和價格建議書,而非價高者得) 方式批予恒地旗下國基發展有限公司,其在價格建議和非價格建議的得分均是最高,總分共得100分。

恒地標書出價508億元,將會打破新地 (00016) 在2019年,以422億元奪得西九高鐵站項目紀錄,成為全港歷來最貴價地皮,屬於市場估值範圍內。若以項目商業樓面161萬平方呎計算,每平方呎樓面地價約3.1萬元,雖然低於美利道地王 (現為商廈THE HENDERSON) 的每平方呎5萬元。市場人士指,地皮地價合理,為寫字樓部分較美利道項目為低。

恒地4年斥740億 奪中環兩地

連同在2017年以232.8億元投得美利道地皮,恒地在4年內以740億元連奪兩幅中環商業地王,兩幅地皮合共總投資額達890億元。

恒地集團主席李家誠稱,將投資630億元打造項目成為世界級地標建築、朝氣蓬勃海濱長廊及為公眾提供大量日常享用的活動空間,將顯著提升恒地在中環國際商務中心地位,連同THE HENDERSON (藝術) 和H CODE (娛樂),組成恒地多維平台,將中環海岸綫轉變為標誌性國際樞紐。

發展局則指,政府的願景是將3號用地打造成香港的嶄新地標,一個以人為本、着重可持續發展和城市設計,以及與四周環境融合的典範。

政府接6標書 4份不合格

項目在6月份截標時,接獲6份標書,來自恒地、新地 (00016)、長實 (01113)、信置 (00083) 夥拍招商局置地及鷹君 (00041) 財團、港鐵 (00066) 夥拍九倉 (00004) 及華懋財團等,但最終有4分標書未能在兩部分達到合格要求,故此最終只有兩份標書被視為符合要求。

至於恒地的標書被評為「100分」,意思其實不是指標書滿分,而是正如政府所指「在價格建議和非價格建議的個別評審中,表現最好的標書會獲取滿分」。

按照恒地規劃,3號用地總數約160萬平方呎樓面,零售、餐飲和娛樂空間等用途將會佔94萬平方呎,將會較ifc商場 (58萬平方呎)更大6成,其核心為一個6層高的水族館,另外提供約66萬平方呎辦公室樓面,將分為兩期發展,分別在2027及2032年落成。

據代理行最新資料顯示,中環甲廈空置率,升至7.8%,為近年新高。租金方面,中環超甲廈呎租,亦由高峰期回調2至3成,目前中環指標超甲廈國際金融中心二期,近日成交呎租約120至140元,而交易廣場呎租則約120元。

(經濟日報)

更多國際金融中心寫字樓出租樓盤資訊請參閱:國際金融中心寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

頂尖購物商場94萬呎規模超IFC

中環民耀街新海濱3號商業地王 (下稱新海濱3號地) 剛由恒地 (00012) 以508億元投得,成為賣地表歷來造價最貴的地皮。發展商將興建3座建築物,總建築面積約161.46萬方呎,當中有94萬方呎為商場樓面,規模較同區主要商場國際金融中心 (IFC) 商場大17.5%。整個項目分兩期發展,第一期將於2027年完成。

恒地表示,新海濱3號地王項目勢成為中環核心區和海濱的重要接駁,計劃發展成一個綜合用途地標,該用地分兩期發展,第一期預料於2027年落成,包括約27萬方呎寫字樓樓面、34萬方呎零售、餐飲和娛樂空間,以及約900個停車位。

分兩期發展 最快2027落成

第二期將於2032年完成,提供約39萬方呎寫字樓樓面、60萬方呎零售空間和連接港鐵中環站的地下通道。

項目落成後,將提供94萬方呎商場,較鄰近的國金中心商場總面積共80萬方呎,多出約17.5%樓面。恒地形容,未來該頂尖購物商場集藝術、雕塑、自然、文化和劇場於一身,其核心為一個6層高的水族館。

除了建築物樓面面積外,恒地擬創造超過30萬方呎的都市公園空間連接中環和海濱長廊的林蔭大道、重置天星小輪鐘樓及相關的廣場空間,供市民24小時使用。

市場人士指出,現時區內超甲級寫字樓如國際金融中心二期 (IFC 2) 的呎租約130至150元,與高峰期相比下跌逾三成;至於國際金融中心商場最新零售舖位呎租介乎400至600元。以此推算,區內商場的舖位呎租,較寫字樓呎租高出1倍以上。

超甲廈呎租回升 氣氛利好

有代理稱,新海濱3號地的地皮剪裁及設計,「相信比較適合做零售,而近海位置可打造特色高檔餐飲」。

該代理又說,寫字樓市場近期雖然低迷,但已有低位回升跡象,未來粵港澳大灣區的發展大趨勢下,中資企業對中環超甲級寫字樓的需求只會有增無減。

有測量師提到,今年中環寫字樓及商舖租賃市場漸見改善,為發展商增添發展此項目的信心。

今年首7個月,中環甲級寫字樓租金回落3.3%,惟已於8月開始連續兩個月回升,累積漲0.7%,呎租重返90元以上水平,可見市場逐漸呈現復甦跡象。

(信報)

更多國際金融中心寫字樓出租樓盤資訊請參閱:國際金融中心寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

恒地逾四年中環押注890億

政府近年先後批出兩幅中環核心區矚目商業地王,均由恒地 (00012) 獨資摘下,以該兩幅地皮地價連建築費的總投資額計算,恒地約4年半時間,已於中環押注890億元。

恒地率先於2017年5月擊敗8個對手,以232.8億元中標中環美利道商業地王,按照該地皮的總樓面面積約46.5萬方呎計算,樓面呎價高達50064元,至今仍屬本港賣地史上樓面呎價最貴的地王。

恒地當時預算該項目總投資額逾260億元,將興建優質寫字樓連商舖,並於今年7月宣布把項目命名為The Henderson,預告2023年落成,已獲拍賣行佳士得預租其中4層。

政府地價收入逾1251億超標

事隔4年半,恒地昨再以508億元投得中環新海濱3號地,樓面呎價31463元,雖較The

Henderson的樓面呎價低37.2%,但已是本港賣地表商業地的樓面呎價次高。以新海濱3號地的總投資額逾630億元計算,意味恒地在該兩幅中環地皮上的總投資額逾890億元。

恒地近月搶地意欲積極,今年9月才以81.89億元中標市區重建局紅磡庇利街/榮光街重建項目,預計可興建約1150個住宅單位。該項目連同剛中標的新海濱3號地,恒地在不足3個月時間,共斥資接近590億元投地。

另外,新海濱3號地的地價,是政府本財政年度地價收入能否達標的關鍵,綜合地政總署和市場資訊,本財政年度透過官地招標和補地價等的地價收入料超過1251億元,已超越今年2月《財政預算案》估算的976億元約28.2%。

(信報)

代理:中環商業地批出 料帶動港島甲廈空置情況改善

中環新海濱3號商業地以天價508億元由恒地 (0012) 奪標,有代理表示,面對近期經濟環境及疫情影響,今次新海濱地皮的中標價相對合理,亦符合市場預期,相信將會利好寫字樓長遠發展。該代理又指,隨著今次中環新海濱地皮公佈中標價,將會帶動到港島區特別是中環及金鐘一帶的商廈吸納情況,加上通關在即的因素推動下,將會加快中資及外資入市步伐,預料短期內港島甲廈空置情況改善幅度會更大,同時,中標消息對本呈膠著狀態的港島區商廈買賣市場有正面幫助,預料個別洽購中的商廈買賣個案將會加快落實,買賣價亦會穩步上揚。

(明報)

莊士紅磡酒店 基金16億洽購

東鐵綫過海段快通車 具潛力改共居

全幢物業續成基金追捧對象,莊士旗下紅磡蕪湖街逸酒店 (Hotel Sav),獲基金出價16億元洽購,物業總樓面12萬呎,提供388房。

市場消息指,紅磡全幢酒店獲基金洽購,涉及物業為莊士集團旗下逸酒店,位於紅磡蕪湖街83號,物業前身為莊士紅磡廣場,屬商廈用途,於1996年落成,業主近年把物業改裝成酒店,於2015年正式啟用。

呎價1.3萬 每間房價約412萬

物業樓高25層,地下及1樓為酒店大堂及商舖,5至25樓為客房,每層提供約23間房,房間總數約388間。據悉,未有疫情前,房間每晚房價約750至1,000元,項目總樓而約12.2萬平方呎。消息指,近日有財團出價洽購,出價約16億元,呎價約1.3萬元,而每房價值約412萬元。

消息指,洽購項目為外資基金,看準項目位於市區,而東鐵綫過海段明年有望通車,屆時紅磡來往港島區更為方便,除了傳統酒店用途外,亦有潛力改裝成共居。

疫情下零旅客狀態一年多,衝擊酒店入住率,令不少酒店出現經營困難,酒店造價亦有所下降,同時間,個別財團趁酒店價格回調,有興趣購入全幢酒店,日後或更改用途。如油麻地487至489號CASA酒店,去年業主曾把物業放售,叫價約8億元,而近日項目獲財團積極洽購,出價達6.5億元,預計快將易手。消息稱,該財團為一家外資基金,擬購入後發展共居。

另有代理行資料顯示,10月份市場共錄得約404宗工商舖買賣個案,為自2021年6月起按月呈跌勢,數字更為今年度新低,對上一次低成交宗數要數2021年11月,當時工商舖市場僅錄得384宗。

(經濟日報)

工商鋪錄404宗成交 代理行:屬今年以來新低

工商鋪交投氣氛比去年改善,不過,由於經濟氣氛尚未見明朗,近期交投有所放緩。根據代理行統計,10月份工商鋪共錄約404宗成交,涉及總金額約75.85億,為今年度按月新低,僅次於去年11月水平。該代理行預測,股票市場波動頻仍,投資磚頭保值,工商鋪受惠多個利好政策,入市成本降低,同時回報相對穩定,料有更多新晉投資者有興趣。

10月成交金額約75.85億

該行代理表示,根據資料顯示,10月份市場共錄約404宗工商舖買賣個案,為自2021年6月起按月呈跌勢,數字更為今年度新低,對上一次低成交宗數要數2021年11月,當時市場僅錄384宗。同時,10月份工商鋪成交宗數對比9月減少約18%,不過較2020年10月持續錄增幅,遞增約11%。至於金額方面,由於成交宗數下跌,加上月內矚目大額交易比9月份為少,10月總成交金額錄約75.85億,按月跌約36%,按年同期比較則見升勢,金額升約一成。

該代理續表示,10月份工商鋪成交宗數下跌,主因9月份有一手項目推出,億京旗下觀塘道368號甲廈項目開售,帶動該月整體錄約90宗寫字樓買賣,到10月份一手項目銷情漸放緩,宗數明顯下降,月內僅錄約46宗買賣。金額下跌則因9月份錄多宗大額成交,例如荔枝角道888號3層樓面以約12億沽出、中環及銅鑼灣均錄巨鋪交易等,令10月份成交金額略見遜色。

(星島日報)

更多觀塘道368號寫字樓出售樓盤資訊請參閱:觀塘道368號寫字樓出售

更多觀塘區甲級寫字樓出售樓盤資訊請參閱:觀塘區甲級寫字樓出售

更多荔枝角道888號寫字樓出售樓盤資訊請參閱:荔枝角道888號寫字樓出售

更多長沙灣區甲級寫字樓出售樓盤資訊請參閱:長沙灣區甲級寫字樓出售

億京觀塘甲廈每呎1.31萬售

億京拆售中的觀塘甲廈,反應不俗,買家有掃入全層單位的投資者,亦有自用用家,有上市公司更斥資購入特色單位自用,連命名權購入。該廈亦不乏千餘萬的成交,市場消息透露,觀塘道368號錄一個細單位成交,涉及為11樓D室,建築面積940方呎,以每呎約13100元易手,作價1231.4萬。

作價逾1231萬

該廈對上一宗為一個高層相連單位,以7100萬成交,呎價約1.54萬,買家購入作業務擴充用途,涉及32樓B、C及D室,面積分別為2035方呎、1164方呎及1382方呎,總樓面約4581方呎,獲企業以約7100萬成交,呎價約15499元,買家購入作業務擴充用途。

該廈錄上市公司購入單位自用,中國波頓集團以約1.56億購入頂層單位,建築面積6869方呎,另天台約1025方呎,呎價約22759元,作為總部,將連同項目冠名權。

外號「手套大王」的葉建明及其友人,以4.516億購入該廈,葉氏購入該廈3層全層特色戶,分別為該廈33樓、35樓及36樓全層單位,該項目毗鄰港鐵牛頭角站,受惠屯馬綫及快將通車的沙中綫。寫字樓單位建築面積由654至9566方呎。前身為英亞工廠大廈,億京於2017年以13.2億購入全幢重建商廈,可建樓面約25萬方呎,早前以7.8億完成補地價。

(星島日報)

更多觀塘道368號寫字樓出售樓盤資訊請參閱:觀塘道368號寫字樓出售

更多觀塘區甲級寫字樓出售樓盤資訊請參閱:觀塘區甲級寫字樓出售

深水埗舊樓強拍底價3.27億

近年市區土地供應罕有,不少財團透過強拍增加土儲;由財團申請強拍的深水埗醫局街舊樓,最新獲土地審裁處頒下強拍令,底價為3.27億,對比2020年10月申請強拍時市場估值約1.8109億,高出80.6%。

據土地審裁處文件顯示,是次獲批強拍令的項目位於醫局街134至140號,涉及4座舊樓物業,據判詞指出,最新該財團持有醫局街134號至138號全數業權,而140號舊樓最新亦持有89.58%業權,整個項目平均持有約94.79%業權,目前僅餘下1個單位並未成功收購,該小業主從未出席審訊,亦無法聯繫,屬失蹤小業主。

已收集約90%業權

根據判詞指出,申請人曾委託結構工程師對該舊樓進行結構評估,認為該建築物已達其設計壽命,加上維修情況欠佳,部分設施未能符合現代安全標準和法定要求,而且維修成本與重建成本不成比例,認為重建發展是合適做法。再者申請人已採取一切合理步驟取得全部業權,故批出強拍令。

上址現為4幢樓高約5層商住物業,地下為商鋪,樓上則屬住宅;早於1956年落成,至今約65年樓齡。整個項目佔地面積合共約4617方呎,若以住宅重建發展,涉及地積比約7.5倍,可建總樓面約34627方呎;若以商業或商住物業,則以地積比9倍發展,可建總樓面約41553方呎。

上述舊樓由新暉投資發展有限公司於去年提出強拍申請,當年該公司董事為陳承邦、朱威澔、朱威霖以及匯隆控股有限公司執行董事蘇宏進。據土地審裁處資料顯示,該處今年迄今暫批出19宗強拍令;而強拍申請個案則暫錄13宗,對比去年同期的29宗申請,大減16宗,跌幅高達55%。

(星島日報)

豫港大廈全層意向租金9.8萬

有代理表示,灣仔豫港大廈21樓全層,面積約3251方呎,業主意向租金約9.8萬元,呎租約30元。

該行指出,上述單位間隔四正實用,外望城市繁華景觀,配備具格調的寫字樓裝潢,即租即用。大廈附設2部客梯及停車場,方便用家出入。

(信報)

更多豫港大廈寫字樓出租樓盤資訊請參閱:豫港大廈寫字樓出租

更多灣仔區甲級寫字樓出租樓盤資訊請參閱:灣仔區甲級寫字樓出租