The United States is leveraging on the SAR's property market at a time when the office segment is reeling from pandemic woes.

The American Chamber of Commerce in Hong Kong bought a floor at Hong Kong Diamond Exchange Building in Central for HK$85.8 million after it sold its office space of 5,968 square feet at Bank of America Tower on Harcourt Road for HK$145 million in October.

The 2,750-sq-ft floor at the 26-story Hong Kong Diamond Exchange Building

at 8-10 Duddell Street was sold off at HK$31,229 psf. The seller, who

bought the floor for HK$12.2 million in 1991, will pick up HK$73.6

million.

The deal went through after the sale of the US

government's six-block residential property at Shouson Hill - a thorny

issue for potential buyers amid the Sino-US rift. That was not completed

until February.

Beijing had stepped in unexpectedly and said its approval was needed in late 2020.

The Land Registry told Hang Lung Properties

(0101), which agreed to buy the luxury villas for HK$2.56 billion in

September, that if the US consulate general intended to rent, purchase

or sell any property in Hong Kong, then the US government must make a

written application to China at least 60 days before any deal.

It also stated that the US consulate was not a commercial entity, and nor was the property ordinary real estate.

Washington had put the six blocks occupying a

94,796-sq-ft spread at 37 Shouson Hill Road up for sale amid tensions

over Hong Kong. It had held the property since 1948.

The twists raised eyebrows as tycoon Ronnie Chan

Chi-chung, the chairman of Hang Lung Properties, has good relations with

influential elements in the mainland and the United States.

Beijing's high-profile interference has rarely been seen in other transactions of consulate property in Hong Kong.

Five years ago the Canadian consulate sold a house

at 6 Goldsmith Road in Jardine's Lookout to Pansy Ho Chiu-king,

daughter of the late Macau casino tycoon Stanley Ho.

And in 2011, the French consulate sold its property at 8 Pollock's Path to Ryoden Development.

(The Standard)

For more information of Office for Sale at Bank of America Tower please visit: Office for Sale at Bank of America Tower

For more information of Grade A Office for Sale in Admiralty please visit: Grade A Office for Sale in Admiralty

For more information of Office for Sale at Hong Kong Diamond Exchange Building please visit: Office for Sale at Hong Kong Diamond Exchange Building

For more information of Grade A Office for Sale in Central please visit: Grade A Office for Sale in Central

Property turnover shoots up

The property sector saw turnover more than double

to HK$85.1 billion last month from a year before, data from the Land

Registry shows.

That was up 122 percent on a year-on-year basis and 9.1 percent month on month.

By volume, property transactions surged to a two-year high, up 88 percent year on year and 0.9 percent month on month to 9,150.

Residential property deals amounted to 7,325, up 78.6 percent year on year and down 1.6 percent month on month.

Property agent said first-hand private home sales

declined in April after months of hot sales. Transactions saw a 33

percent decline month on month.

That came as Henderson Land Development (0012) expects to release about 50 units more in the third price list of The Henley I in Kai Tak.

It plans to open the first round of sales on

Sunday to offer at least 146 units, said general manager of sales Thomas

Lam Tat Man. At least 10 featured units will open for sales by tender

on Saturday.

The company received at least 1,400 checks and was oversubscribed more than eight times.

AquilaSquare Mile

in Tai Kok Tsui will open sales of 22 units on Saturday, with prices

between HK$23,043 and HK$27,173 per sq ft after discounts.

RK Properties will offer 180 units at South Land,

the first phase of The Southside development above Wong Chuk Hang

Station, on Saturday. The developer may also launch eight units by

tender at the same time.

Mainland developer Sino-Ocean Group (3377) will offer 45 units at Uptify in Mong Kok for sale on Saturday.

The first round of sales includes 17 studio units,

23 one-bedroom units and five one-bedroom with study room units,

ranging from 172 square feet to 318 sq ft.

The price is between HK$19,596 and HK$25,055 per sq ft after discounts.

Emerald Bay Phase 2

in Tuen Mun will put 110 units up for sale on Saturday and 27 units up

for tender on Monday. The minimum price of a 223-sq-ft flat is HK$3.73

million.

CK Asset (1113) sold a 2,945-sq-ft unit at 21 Borrett Road in the Mid-Levels for HK$232.8 million, or HK$79,000 per sq ft.

In the secondary market, an 863-sq-ft flat at

South Horizons in Ap Lei Chau changed hands for HK$18.3 million, or

HK$21,205 per sq ft. The seller, who bought the unit for HK$4.43 million

in 1993, will see a capital gain of HK$13.87 million.

The one-month Hong Kong interbank offered rate, which is linked to the mortgage rate, fell to 0.08089 percent yesterday.

(The Standard)

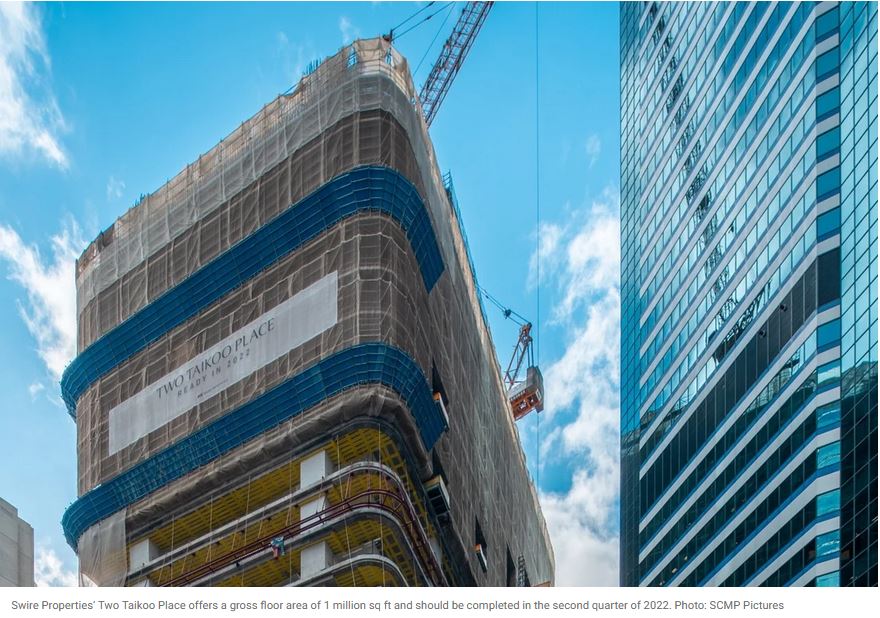

Swiss

bank Julius Baer leases office space in Swire’s Two Taikoo Place,

Quarry Bay, in biggest ‘decentralisation deal’ since 2018

The

bank, currently based in Central, has leased four floors in the

41-storey skyscraper, which property agents described as the largest

‘decentralisation deal’ in Hong Kong since late 2018

Many

companies have left Central, the world’s most expensive place to run an

office, to take up space in non-core districts such as Causeway Bay,

Quarry Bay and Tsim Sha Tsui

Swiss private bank Julius

Baer will move into Swire Properties’ new 41-floor skyscraper, Two

Taikoo Place in Quarry Bay, which property agents described as the

largest “decentralisation deal” in more than two years in Hong Kong.

The bank, currently based

in Central, said it has leased four floors of the office building,

which is scheduled for completion in the second quarter of 2022.

Swire said it has

successfully secured its first anchor tenant, which is from the finance

sector and will take up four floors covering 100,000 square feet of the

new building, but did not provide further information. The company would

not say whether it was referring to Julius Baer.

“We are increasingly

attracting a greater proportion of both professional services and those

from the banking sector. For most of them, obviously [moving from

Central] represents cost saving, but they are also increasingly looking

for space where they can design offices that cater to a new workplace

strategy,” said Don Taylor, director of office, Swire Properties.

Julius Baer currently has three floors in the International Finance Centre (IFC) with a lease expiring at the end of 2023 and two floors in Exchange Square expiring in March 2023, according to Land Registry documents.

“We

will continue to have our presence in Central in the foreseeable

future. We continue to hire and this new premises in Quarry Bay will be

our significant investment in Hong Kong,” said the bank, which has its

headquarters in Zurich. “This will allow us to expand our presence in

the next decade [and] to design the future workplace and cater to the

growing needs of our clients.”

The

average monthly rent in Quarry Bay was about HK$50 (US$6.44) per square

foot in the first quarter, just 40 per cent that of Central, according

to property agent.

That would mean the Swiss bank could save nearly HK$5 million a month with a wholesale relocation.

“Such a move would save the Swiss bank at least half of what it used to pay,” agent said.

“This is the biggest decentralisation deal since the SFC announced its relocation to Quarry Bay in late 2018.

Decentralisation has

become a growing trend as companies have left Central, the world’s most

expensive place to run an office, to take up space in non-core districts

such as Causeway Bay, Quarry Bay and Tsim Sha Tsui. It has been going

on since late 2018, when rents hit a record high in the city.

The Securities and Futures Commission (SFC) moved out of the Cheung Kong Center in August last year, having inked the deal in late 2018.

BNP Paribas was reported to have shed one floor in Two IFC in January this year while Australian investment bank Macquarie Group gave up a major portion of space it leases at One IFC last June.

Recently, some

international companies have been moving back to Central, to take

advantage of a dramatic decline in rents caused by the Covid-19

pandemic’s blow to the economy. They include rating agency S&P which

relocated from ICC to Three Exchange Square.

But market observers

believe that amid the city’s worst recession on record, companies are

still cautious about spending big on leasing office space.

“Although there are some

cases of companies moving back to Central as rents have turned soft

there, the greater trend continues to be cost-saving relocations amid

uncertainties ahead,” agent said.

Hong Kong’s economy

rebounded by 7.8 per cent in the first quarter of 2021, after a sinking

to a historic low a year ago amid the coronavirus pandemic.

“Occupiers are focused on

cost, workplace health, safety, and we are likely to see an increase in

office relocations in the future. There is increased emphasis from

landlords to offer greater occupier amenity and experience, from

flexible office space, communal meeting and conferencing facilities to

pop-up style F&B that adds to the user experience,” another agent

said.

To meet the changing

requirements, Swire plans to roll out more flexible space in Two Taikoo

Place, with on-demand meeting rooms and event spaces as well as informal

collaborative spaces.

“There will be winners

and losers. The landlords that adapt to the changing requirements of

corporate users are clearly going to benefit,” Swire’s Taylor said.

“In order to give their

employees the confidence to come to work after Covid-19, to retain and

secure talent, occupiers are picking their work locations very

carefully. Many are looking at new buildings like Two Taikoo Place that

can offer them a blank campus to implement new workplace solutions, for

example reducing the density of work stations, and having high ceiling

and natural light.”

(South China Morning Post)

For more information of Office for Lease at International Finance Centre please visit: Office for Lease at International Finance Centre

For more information of Office for Lease at Exchange Square please visit: Office for Lease at Exchange Square

For more information of Office for Lease at Cheung Kong Center please visit: Office for Lease at Cheung Kong Center

For more information of Grade A Office for Lease in Central please visit: Grade A Office for Lease in Central

For more information of Office for Lease at International Commerce Centre please visit: Office for Lease at International Commerce Centre

For more information of Grade A Office for Lease in Tsim Sha Tsui please visit: Grade A Office for Lease in Tsim Sha Tsui

HKR International invests more in Hong Kong’s older buildings as home prices climb amid land shortage

The

developer behind Discovery Bay has recently spent HK$677 million

(US$87.2 million) on two buildings – one industrial and one residential –

for redevelopment

The

number of industrial properties changing hands rose 37 per cent in

March to the highest level since May 2019, according to data from

property agency

HKR International, the

home builder behind Discovery Bay, is focusing more on redeveloping

older buildings in urban areas as the city’s famous shortage of land

forces developers to try new strategies in order to tap rising home

prices.

It has spent HK$677

million (US$87.2 million) on two buildings – one industrial and one

residential – since December for redevelopment.

“The continuous shortage

of land in Hong Kong, especially in prime locations, has caused property

developers to turn to alternative means of growing their portfolios,”

said executive chairman Victor Cha Mou-zing in an email interview with

the Post.

“Acquisition and conversion of old buildings, and transforming low-yield growth assets is gaining popularity among developers.”

Hong Kong’s home prices

have been edging upwards in recent months, as the Covid-19 outbreak

tapers off and the roll-out of vaccinations has gathered pace.

Cha, formerly deputy

chairman and managing director of the company, was named executive

chairman of HKR late last year after his older brother Payson Cha

Mou-sing, 77, died in early November.

The 71-year-old has more than 40 years of experience in real estate development under his belt.

In December, HKR paid

HK$310 million for a 16-storey industrial building, the United Daily

News Centre, in Kowloon’s To Kwa Wan area. Then in March it purchased at

a 66-year-old residential building on Hollywood Road and Upper Lascar

Row in Sheung Wan for HK$367.3 million.

It has filed an

application to the Town Planning Board to convert the United Daily News

Centre into a 24-storey, 110-unit residential tower. Residential units

will take up 45,538 square feet, while 8,708 square feet will be

commercial spaces, according to a document released by the planning

board last Friday.

The proposed

redevelopment would generate a total gross floor area of 54,246 sq ft,

according to the submitted plan, and could translate to an average land

cost of HK$5,716 per sq ft before the land premium payable to the

government.

The acquisition came two weeks after the government announced the removal of double-stamp duty on non-residential properties.

The double taxation –

known as Doubled Ad Valorem Stamp Duty (DSD) – was introduced in

February 2013 with the aim of tackling speculative activity in the

market. It doubled or increased stamp duty rates across the board. The

maximum rate has now dropped back from 8.5 per cent to 4.25 per cent,

spurring the industrial investment market.

On a monthly basis, the

number of industrial properties changing hands rose 37 per cent to 349

in March, the highest level since May 2019, according to data from

property agency.

The agency said the total transaction value jumped 24 per cent to HK$2.3 billion in the same period.

“It is a trend for

builders to acquire old buildings for redevelopment as small to

medium-sized players have been edged out by the fierce competition in

government tenders,” a surveyor said.

The diversification away

from Discovery Bay – a sprawling community on Lantau Island – could help

to reduce risk, the surveyor said.

“With a limited supply of

industrial buildings in urban area, the commercial value for the

redevelopment of such properties will be attractive to developers,”

another agent said.

(South China Morning Post)

美國商會斥8588萬 入市中環乙廈

香港美國商會繼去年放售金鐘美國銀行中心一籃子單位後,近日入市中環乙廈。根據土地註冊處資料,中環香港鑽石會大廈高層全層,上月初以8,588萬元成交,據代理提供資料,該層面積2,750平方呎,呎價約3.12萬元。

新買家是香港美國商會,本報已向商會查詢有關事宜,惟至截稿前仍未收到會方回覆。而原業主於1991年以1,220萬元買入上址,持貨近30年,是次轉手帳面獲利7,368萬元,物業升值逾6倍。

事實上,早前有指商會因財困而沽出旗下一籃子物業,例如金鐘美國銀行中心19樓的04至07室、及13室,單位總面積5,968平方呎,並於去年10月以約1.4億元沽出,呎價約2.3萬元。會方前後「一買一賣」,未扣除印花稅、地產代理佣金等雜費,美國商會淨套現約5,412萬元。

尖沙咀漢威大廈地舖 呎售8萬

另外,尖沙咀漢威大廈地下A號舖,面積約1,000平方呎,近日以8,000萬元沽出,呎價8萬元。資料顯示,買家為嘉林國際有限公司,而該公司董事是陳善飛,即嘉林國際物流有限公司的創辦人。

而上述單位旁邊的B號地舖,面積相同,於本年初以意向價約8,800萬元放售,呎價叫8.8萬元。

(經濟日報)

更多美國銀行中心寫字樓出售樓盤資訊請參閱:美國銀行中心寫字樓出售

更多金鐘區甲級寫字樓出售樓盤資訊請參閱:金鐘區甲級寫字樓出售

更多香港鑽石會大廈寫字樓出售樓盤資訊請參閱:香港鑽石會大廈寫字樓出售

更多中環區甲級寫字樓出售樓盤資訊請參閱:中環區甲級寫字樓出售

信和廣場巨鋪減58%租出丟空近兩年平均每呎23元

銅鑼灣最新錄巨鋪承租,信和廣場一個巨鋪,面積逾1.4萬方呎,在丟空接近兩年後,最新獲日本料理以每月約33萬承租,較舊租金大跌約58%,平均每呎23元,重返十年前水平。

位處波斯富街及告士打道交界的信和廣場,位置上自成一角,惟該廈基座商場聚集名店及高級食肆,地鋪有專賣名牌手袋服飾的ISA

Boutique旗艦店,1樓有「阿一鮑魚」富臨飯堂。消息人士透露,毗鄰富臨飯堂的1樓103號鋪,建築面積約14342方呎,最新由日本料理板神承租,月租約33萬,較舊租客譽宴月租約80萬,足足下跌58%,最新平均呎租僅23元。

日本料理月租33萬進駐

知情人士續說,該鋪舊租客早於2019年5月離場,面積巨大,加上業主嚴選租客,令該鋪位丟空接近兩年,最新迎來的日本料理,堪稱全港面積最巨型的日式食肆,該店只提供100個座位,以巨鋪面積計,人均呎數逾140方呎,場地闊落,且是正宗日本食肆,不論午餐或晚餐人均消費1000元,高級食肆此時擴張,正顯示租客看好後市。而該名租客在接手鋪位後,日夜趕工,目前剛在試業,下月才正式開業。

羅珠雄8500萬沽鴻福地廠

事實上,近期區內巨鋪頻獲食肆承租,漢堡飽店進駐羅素街1樓巨鋪,舊址化妝品連鎖店莎莎;區內謝斐道517號總統戲院,舊址酒家,最新由五糧液國際餐飲承租,鋪位裝修中。

據代理指,由資深投資者羅珠雄持有的觀塘鴻福工業大廈地廠,以8500萬易手,面積10850方呎,呎價約7834元,屬市價水平,上址由汽車美容以19萬租用,料回報約2.6厘。

皇后大道中九號每呎3.45萬售

市場消息透露,金鐘力寶中心1座中層10至11室,面積約2440方呎,坐享山景對正電梯,以每呎約60元獲金融公司承租,創屬近一年呎租次高,月租約14.64萬。

消息指,中環皇后大道中九號中層12至13室,面積811方呎,以約2799.9萬易手,呎價約34524元。土地註冊處資料顯示,上址原業主於2000年以425萬購入,21年升值約5.5倍。

上月錄645宗工商鋪買賣

據代理統計,4月份市場錄約645宗工商鋪買賣,總金額約108.93億,按月微跌約3.8%及10.5%,對比去年同期勁升2.14倍及1.06倍。代理表示,月內矚目大額買賣,包括新世界以約13億售出銅鑼灣百德新街22至36號翡翠明珠廣場地下及地庫,傳新買家為恒力投資。

(星島日報)

更多信和廣場寫字樓出租樓盤資訊請參閱:信和廣場寫字樓出租

更多銅鑼灣區甲級寫字樓出租樓盤資訊請參閱:銅鑼灣區甲級寫字樓出租

更多力寶中心寫字樓出售樓盤資訊請參閱:力寶中心寫字樓出售

更多金鐘區甲級寫字樓出售樓盤資訊請參閱:金鐘區甲級寫字樓出售

更多皇后大道中九號寫字樓出售樓盤資訊請參閱:皇后大道中九號寫字樓出售

更多中環區甲級寫字樓出售樓盤資訊請參閱:中環區甲級寫字樓出售

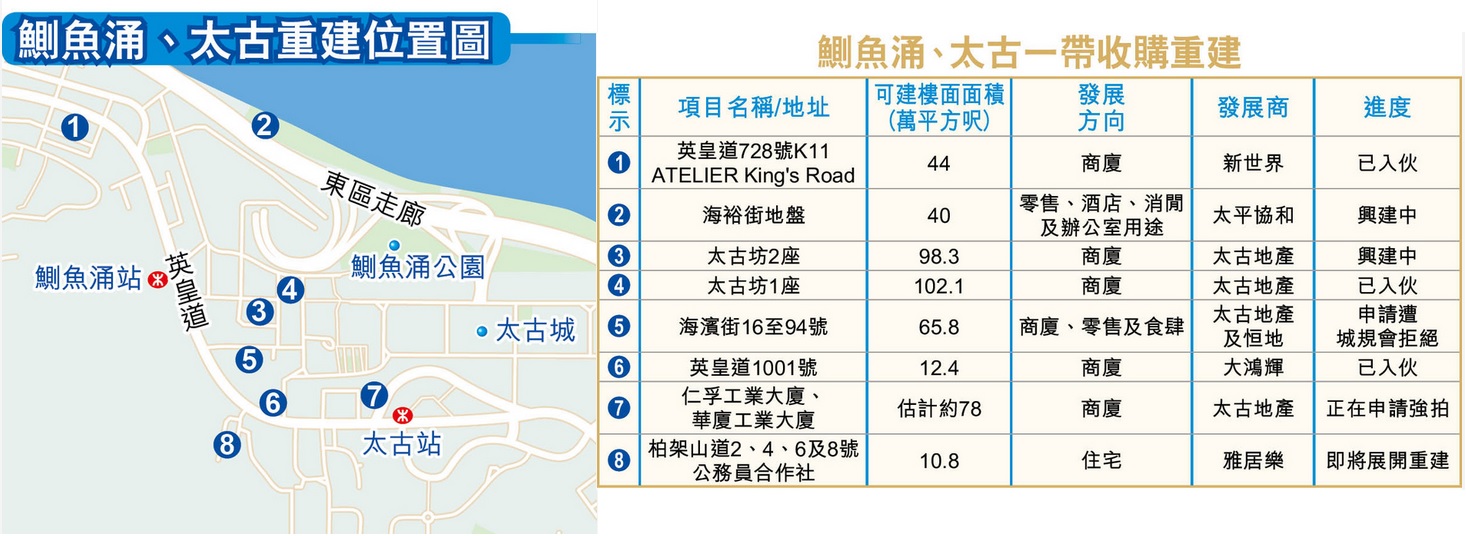

太古持344萬呎商業樓面 稱霸港島東

受「去中環化」影響下,港島東的商業地位與日俱增,其中鰂魚涌一帶現有約8個重建項目,料可為該區供應逾450萬平方呎商業樓面,單計大地主太古地產 (01972) 區內手持的項目,已涉逾344萬平方呎商業樓面,同時,區內不乏其他發展商,透過收購區內舊樓「插旗」。

早在19世紀已落戶於鰂魚涌的太古,先區內興建糖廠、船塢及汽水廠,其後於80至90年代逐步發展太古坊商業區及太古一帶商廈,令港島東的商業地位提升。而單計區內持有4個項目,涉及的總樓面面積達344.2萬平方呎。

太古坊2座望年內竣工

近年太古地產續積極發展其鰂魚涌核心商業區太古坊,集團於2016年宣布重建其中3幢工廈,包括康和大廈、常盛大廈及和域大廈,並已經陸續重建成太古坊一座及二座,合共供應逾200萬平方呎商業樓面,其中太古坊一座已於2018年落成,其總樓面面積約102.1萬平方呎,項目樓高48層,為近年區內規模最大的甲級商廈。另外,太古坊2座將料於2021年竣工,預計可提供約98.3萬平方呎商業樓面。

事實上,鰂魚涌一帶近年亦接連錄得多宗舊樓收購個案,當中去年太古夥拍恒地 (00012) 就鰂魚涌濱海街16至94號及英皇道983至987A號舊樓,曾向城規會申請重建為兩幢32層高的商廈,惟申請終遭拒絕。

柏架山公務員合作社 擬建住宅

另一個大型發展商新世界 (00017) 近年亦踴躍發展重建項目,除了鄰近的北角皇都戲院重建項目上馬在即,集團旗下北角甲級商廈 K11 ATELIER King's Road 完成重建,並為該區提供約44萬平方呎的商業樓面。

除了商業項目以外,鰂魚涌亦不乏住宅重建工程,早前由雅居樂收購,位處鰂魚涌柏架山道2、4、6及8號的公務員合作社物業,已由發展商以底價約4.52億元奪得,並初步計劃興建3座住宅。值得留意的是,雅居樂於數年前亦已收購比鄰的柏架山道10至12號及14至16號公務員合作社物業,可見發展商正積極在區內擴大發展版圖。

(經濟日報)

更多太古坊一座寫字樓出租樓盤資訊請參閱:太古坊一座寫字樓出租

更多K11 ATELIER King’s Road寫字樓出租樓盤資訊請參閱:K11 ATELIER King’s Road 寫字樓出租

更多鰂魚涌區甲級寫字樓出租樓盤資訊請參閱:鰂魚涌區甲級寫字樓出租

山頂洋房傳8.74億「賣殼」

由九倉持有、並由會德豐地產負責銷售的山頂77/79 PEAK ROAD,市傳項目79A號大屋,以公司股權轉讓形式沽出,作價約8.74億,呎價達11萬,成交價及呎價同創項目新高。

市場消息指,77/79 PEAK ROAD的79A號大屋,傳以公司股權轉讓形式沽出,成交價逾8.74億,以大屋面積7896方呎計,呎價達11萬,成交價及呎價為項目新高。本報昨日就有關消息向會德豐地產作查詢,但截稿前尚未獲回覆。

仍未上載銷售安排

項目共提供8幢大屋,已先後沽出5幢洋房,而是次傳沽出的79A號屋,則尚未公布銷售安排。是次傳沽出的79A號屋,尚未公布銷售安排,未能正式推出市場發售,但可透過公司股權轉讓形式發售。

據土地註冊處資料,發展商於18年10月,以4.79億內部轉讓79A號屋予DELUXE ACHIEVE LIMITED,目前該公司董事分別為吳天海、徐耀祥及包靜國,均為九倉高層。

同系啟德 GRANDE MONACO 昨售出9伙,包括5伙低座單位,面積446至1123方呎,成交價1173.6萬至3591.354萬元,涉資逾1.68億。藍田 KOKO HILLS 再沽1伙,為3座高層H室,520方呎,售價1119.7萬,呎價21533元,項目累售107伙,套現逾13.3億。

(星島日報)

漢口道鋪8000萬易手嘉林物流陳善飛承接

尖沙嘴漢口道漢威大廈地鋪早前以8000萬易手,買家身分曝光,為嘉林國際物流創辦人陳善飛。

本報早前率先報道尖沙嘴漢口道44號漢威大廈地下A號鋪易手,買家身分終曝光。據土地註冊處資料顯示,買家以公司名義嘉林國際有限公司登記,註冊董事陳善飛,為嘉林國際物流註冊董事,原業主早於1968年以28萬購入,及後於2012年由陳英鴻及陳英圖,以遺產承繼人身分承接,物業於53年間升值7972萬,升幅約284倍。

豪宅投資者轉投鋪市

市場消息指,陳善飛由豪宅投資者轉投鋪市,他近年以約4.95億購入山頂TWELVE PEAKS雙號屋,及以1.22億購入西半山天匯中層單位。

據嘉林國際物流網頁資料顯示,該公司1998年成立,從事海運拼箱業務,於本港及內地擁有17家分公司和5個海外辦事處;本報向嘉林國際物流查詢,惟截稿前未獲回覆。業內人士指出,該鋪位面積約1000方呎,呎價約8萬,交吉易手,於鋪市高峰時,澳門鉅記餅家以每月約35萬承租。

屯門井財街金銘大廈地下雙號鋪,建築面積約500方呎,以1160萬售出,呎價約2.32萬,原業主於2013年以1250萬購入,持貨8年帳面蝕讓90萬,期間貶值約7.2%,現址髮型屋月租3.2萬,料回報約3.3厘。

(星島日報)