Link REIT. bids for Causeway Bay site

Link Real Estate Investment Trust (0823) said it has bid for the commercial land on Caroline Hill Road in Causeway Bay.

Chief

executive George Hongchoy Kwok-lung said this reflects the confidence

in the future of Hong Kong, noting that the city is the base and core

market of Link REIT.

Link REIT is prepared to develop the site based on tender conditions and is open to a partnership.

Previously

the REIT acquired a retail-cum-office building at HK$5.91 billion,

formerly known as Trade and Industry Department Tower at No 700 Nathan Road, Kowloon.

(The Standard)

For more information of Office for Lease at 700 Nathan Road please visit: Office for Lease at 700 Nathan Road

For more information of Grade A Office for Lease in Mong Kok please visit: Grade A Office for Lease in Mong Kok

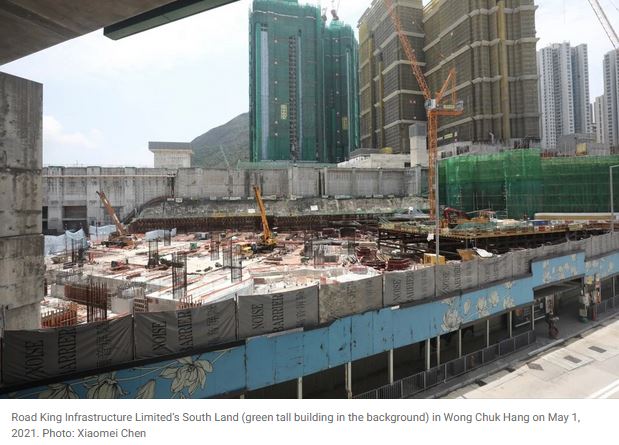

Hong Kong buyers snap up all 180 of Road King’s South Land flats, as economic growth lifted moods

Road King Infrastructure sold all 180 of its South Land

flats at Wong Chuk Hang, repeating its sell-out weekend amid enthusiasm

for the first mass property project atop a subway station in decades

In Mong Kok, Sino Ocean sold 27 of the 45 flats on offer at its Uptify project, sales agents said

New

homes on offer in Hong Kong over the weekend were greeted with fanfare

and enthusiasm, as a stronger-than-expected growth pace in the city’s

economy bolstered confidence and brought investors back into the

property market.

Road King Infrastructure Limited sold all 180 of its South Land

flats at Wong Chuk Hang, repeating its sell-out weekend amid enthusiasm

for the first mass property project atop a subway station in decades.

In Mong Kok, Sino Ocean sold 27 of the 45 flats on offer at its Uptify project, sales agents said.

“The

sales results were not a surprise,” agent said. “A high sales number

was expected. Some units priced at more than HK$7 million (US$901,380)

at Uptify were unsold because buyers were taking a wait-and-see attitude.”

The

strong sales response underscores how the forecast-beating performance

by Hong Kong’s economy had lifted sentiments. First-quarter economy

expanded 7.8 per cent at the fastest pace in 11 years, beating

economists’ forecasts while ending a six-quarter losing streak.

Hong

Kong’s home prices have edged upwards in recent months as a rising

number of vaccinations helped the city authorities get the Covid-19

pandemic under control.

Prices at South Land’s

180 flats started at HK$11.6 million, going up to HK$66 million (US$8.5

million), or a range of HK$27,005 to HK$54,187 per square foot.

The project’s sales kicked off on May 2, when Road King put the first 240 apartments of South Land

on the market. The project sold out, with as many as 22 buyers bidding

for every available unit. One family spent HK$200 million to snap up

seven of the three-bedroom apartments during the sale, agents said.

Across town in Mong Kok, Uptify

was priced between HK$3.98 million and HK$7.34 million, or HK$19,596 to

HK$25,055 per square foot. The project was favoured by first-home

buyers and younger residents, who made up most of the buyers registering

their bids, according to agents.

More

than 600 new apartment units had been transacted in May, and the number

is likely to break through the 1,000 mark after buoyant sales this

weekend. Last weekend, more than 900 flats hit the city’s residential

property market, the biggest sale in seven months.

On Sunday, Henderson Land Development will offer 196 units at The Henley,

its first project in Kai Tak. Prices of the project are 11 per cent

higher than another project on the site of the city’s former airport in

February.

(South China Morning Post)

銅鑼灣商地接6標書 區內地主紛參戰

希慎華懋合資競投 利福夥信置等組財團

銅鑼灣加路連山道商業地昨截標,並接獲6份標書,參與競投的以大型發展商為主,當中不乏銅鑼灣大地主希慎 (00014) 夥華懋,更有「稀客」領展 (00823) 入標。發展商對本港商業前景有信心。

「百億地王」銅鑼灣加路連山道商業地昨日截標,據地政總署公布,項目合共收6份標書,並吸引多間大型發展商競投。區內擁多個大型項目的大地主希慎,是次夥拍華懋入標;而信置 (00083) 是次組織「黃金組合」入標,成員包括在區內經營SOGO的利福國際 (01212) 、嘉里建設 (00683) 及中渝置地 (01224) 。另外,會德豐地產、長實 (01113) 、新地 (00016) 、領展均以獨資身份競投。

華懋行政總裁蔡宏興指,希慎在該區商業及零售物業發展經驗豐富,所以很高興與希慎合作競投。集團對香港前景富信心,預料辦公室需求在經濟復甦下將會回升,尤其香港作為國際金融及貿易中心,對寫字樓的需求更殷切,會繼續物色合適的商業及住宅項目發展。

對前景有信心 領展獨資入標

而自數年前開始加入投地市場的領展,是次獨資競投。領展行政總裁王國龍表示,這次獨資競投,反映集團對香港的前景充滿信心。另外,他表示集團正尋求合營夥伴;亦相信出價具競爭力。集團未有透露地皮的發展模式。以往領展多以發展民生或公、居屋商場為主,近幾年均有參與競投不同商業地,奪得的項目包括觀塘海濱匯及旺角 T.O.P This is Our Place (前工業貿易署大樓)。

有測量師稱,由於地皮的規模及投資額較大,是次所收的標書數目相當不俗。在經濟前景未明朗下,料發展商出價傾向審慎。

另一測量師指,項目的樓面地價料可高於西九高鐵站上蓋商業地,而成交價亦對中環商業地的地價具參考價值。

值得留意的是,市場已將地皮估值下調約3成至113億至172億元,每平方呎樓面地價介乎1.05萬至1.6萬元。

項目位於銅鑼灣加路連山道,地盤面積約15.9萬平方呎,以地積比約6.76倍計,可建樓面達107.6萬平方呎。按照賣地章程,中標財團需興建幼兒中心、長者日間護理中心及地區康健中心。此外,財團亦需興建行人天橋,接駁希慎旗下的利園商場,而地皮亦不可拆售。

(經濟日報)

更多海濱匯寫字樓出租樓盤資訊請參閱:海濱匯寫字樓出租

更多觀塘區甲級寫字樓出租樓盤資訊請參閱:觀塘區甲級寫字樓出租

更多彌敦道700號寫字樓出租樓盤資訊請參閱:彌敦道700號寫字樓出租

更多旺角區甲級寫字樓出租樓盤資訊請參閱:旺角區甲級寫字樓出租

更多利園寫字樓出租資訊請參閱:利園寫字樓出租

更多銅鑼灣區甲級寫字樓出租樓盤資訊請參閱:銅鑼灣區甲級寫字樓出租