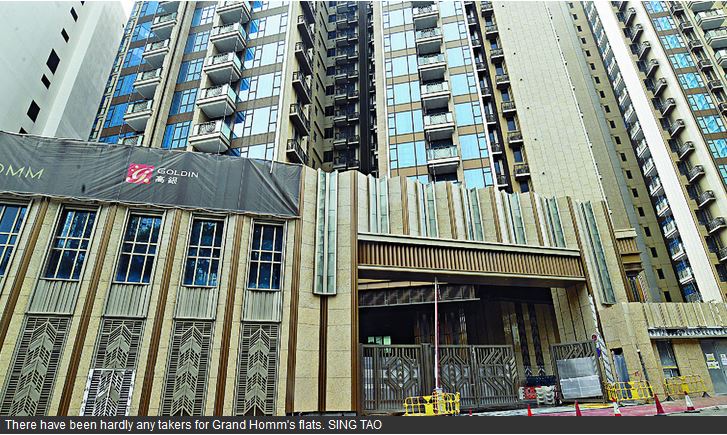

Debt-laden Goldin Financial (0530) has sold just

around 7 percent of 401 flats on offer at Grand Homm in Ho Man Tin, and

the developer has delayed delivery of the homes to buyers for more than

six months now.

The firm previously missed the delivery date in

late November and the project is stoking fears that it may become an

unfinished real-estate project, which is rarely seen in the city.

The developer said on Sunday the homes are expected to be completed on July 6, due to the impact of the pandemic and weather.

Meanwhile, property agencies reportedly dropped

the sales work on the project six months ago and have not received the

commission from the previous deals.

Grand Homm marks Goldin Financial's first residential project in Hong Kong, with six residential buildings.

It offers 401 standard units and 26 special ones, covering an area ranging from 848 square feet to 1,447 sq ft.

Goldin Financial, chaired by tycoon Pan Sutong, incurred a net loss of more than HK$8 billion in 2020, and its Goldin Financial Global Centre in Kowloon Bay was taken over by its creditors and sold for HK$14.3 billion.

In the primary market, New World Development

(0017) will launch at least 90 units of the third phase of The Pavilia

Farm on top of Tai Wai Station after receiving more than 11,000

registrations of intent from potential buyers for the 182 flats in three

days.

The developer expected to launch the first round of sales as soon as this Saturday, involving about 300 units.

In other news, a luxury house at Wing On Towers 12, Jardines Lookout, is up for sale for more than HK$610 million, agent said.

In May, secondary transactions at 10 major estates fell 4.8 percent to 358 from a month ago as home prices continued to rise.

(The Standard)

For more information of Office for Lease at Goldin Financial Global Centre please visit: Office for Lease at Goldin Financial Global Centre

For more information of Grade A Office for Lease in Kowloon Bay please visit: Grade A Office for Lease in Kowloon Bay

Hong Kong developers take to wining and dining office tenants, step up restaurant and bar openings

Most Hong Kong developers are expanding their F&B offerings to better serve and retain tenants amid a rise in vacancy rates

We see a growing demand for lifestyle spaces among office tenants, Hysan executive says

Hong Kong property

developers and landlords are welcoming more restaurants and bars to

their office buildings, as they look to offer more entertainment options

to their tenants in an otherwise soft office market.

More than five new food

and beverage (F&B) outlets are set to open in and around Taikoo

Place this year, for instance. These include trendy Australian seafood

restaurant Catch, boutique cafe HAVN, Lady M, which is famous for its

cakes, and Japanese hand rolled sushi and sake bar TMK.

“Taikoo Place needs to

appeal to younger members of the world … we need to make sure that it

has all the amenities and restaurants and bars, and I think we have

achieved that,” said Don Taylor, the director of office at Swire

Properties. The developer owns and operates Taikoo Place and is a major

landlord in Quarry Bay.

Most Hong Kong developers

are putting more effort into expanding their F&B offerings to

better serve and retain tenants amid a rise in vacant spaces in their

office buildings. The vacancy rate for grade A offices rose to 7.9 per

cent in Central in April, 12.4 per cent in Wan Chai and 7.5 per cent in

Causeway Bay, according to property agency.

“Office tenants nowadays

are, in general, more demanding, while landlords would like to enhance

the image of their building and provide extra amenities to tenants,”

agent said.

Swire Properties, which

recently launched Two Taikoo Place, a 41-storey building, could go a

step further and improve the F&B offering across the whole of Taikoo

Place, Taylor said. “We will put more higher-end dining in place to

cater to the demand of executives of our corporate tenants, who can

entertain their clients here. We are currently looking at a number of

different spaces within Taikoo Place and are speaking to a number of

different operators,” he added.

Hysan Development, the

biggest landlord in Causeway Bay, will feature alfresco dining among

other F&B options in a new grade A office tower it hopes to unveil

in the district by 2026-27. “We see a growing demand for lifestyle

spaces among our office tenants,” said Ricky Lui, Hysan’s chief

operating officer.

Last summer, 132-year-old

landlord and developer Hongkong Land launched Basehall, a food court

with nine stalls run by some of the city’s trendiest F&B operators,

including Honbo, Co Thanh and Young Master Brewery, in the basement of Jardine House.

The company, which owns about 450,000 square metres of prime office and

retail properties in Central, will offer more “innovative and trendy”

dining places in the next six to 12 months, it said.

“It has become slightly

more apparent recently that we are seeing F&B elements not just in

the basements and lobbies, but also on rooftops, floors with balconies …

We have had some discussions with various landlords on this,” agent

said.

“F&B operators, they

are always up for unique locations. So rooftops and balcony floors are

always interesting options for them,” the agent added.

(South China Morning Post)

For more information of Office for Lease at Jardine House please visit: Office for Lease at Jardine House

For more information of Grade A Office for Lease in Central please visit: Grade A Office for Lease in Central

英皇西環舊樓批強拍高陞大樓收逾91%業權項目底價2.59億

市區地皮供應有限,財團積極收購舊樓,由英皇收購的西環高陞大樓,新獲批強拍令,目前已收約91.89%業權,底價為2.59億,較19年市場估值約2.4億高約8%。

據土地審裁處資料,目前英皇持有高陞大樓91.89%,僅餘3伙未獲收購,分別為1樓A室、C室及3樓B室,涉及3組小業主。據判詞指出,該項目樓齡已高,不少單位狀況甚差,現時強拍申請人已持有逾80%業權,故重建屬合理做法。

可建樓面約1.9萬呎

項目底價為2.59億,較19年申請強拍時,市場估值2.4億高出約8%。該項目為商住物業,地盤面積2144方呎,可建樓面約1.9萬方呎,樓齡約55年,鄰近西營盤港鐵站,具有一定重建價值。

翻查資料,英皇去年宣布與慈善機構新家園協會合作,並將上述項目約22個單位發展成「共.融舍」房屋共享計畫,並以象徵式1元租金租予新家園負責營運,為期1年。

底價較19年高8%

私人土地供應減少,使發展商也積極透過舊樓收購增加土地儲備,英皇近年頻以強拍重建增加土地儲備。

業主阻尖區舊樓強拍敗訴

資料顯示,英皇集團早前向土地審裁處申請強拍筲箕灣南安街仲齊大廈,項目估值約1.75億,項目地盤面積3000方呎,現為樓高8層商住物業,早於1964年落成入伙,樓齡55年。

該集團於鄰近亦有收購項目,如筲箕灣南安街73號德福樓、75號的合榮大廈,以及77號的茂發樓,料將會整合發展。

另外,鄧成波家族旗下尖沙嘴加連威老道65至73號舊樓,原於去年7月批出強拍,底價逾19億,惟於拍賣前夕,遭小業主向高等法院提出反對,並批出暫緩令。據法院最新資料顯示,法庭判小業主敗訴,維持原有強拍安排。

(星島日報)

渣甸山屋地意向價逾6.1億

渣甸山為港島傳統豪宅地段,其中區內布思道12號 (見圖) 各業主近期達成共識,推出該地段放售。資料顯示,物業其中一位業主為大律師公會前主席林孟達,早於2002年6月以950萬購入。

該地盤面積約8138方呎,以地積比率0.75倍計算,可建約6137方呎,意向價逾6.1億,樓面呎價逾99397元。代理稱,項目景觀開揚,私隱度高,新買家可重建4層高連車庫的獨立屋。

(星島日報)

有成行物流全幢2.17億售

本報早前率先報道的粉嶺安樂門街38號有成行物流中心全幢以2.17億易手。據土地註冊處資料顯示,該買家以公司名義EAGLE

SWIFT LIMITED登記,為海外註冊公司,原業主為廣大食品有限公司 (KWONG TAI SIK PUNG COMPANY

LIMITED),註冊董事包括梁冠禧、沈濟福等人,為有成行辦館相關人士,早於2001年以2000萬購入,持貨20年帳面獲利1.97億,期間升值近9.85倍。

20年升值9.85倍

據業人士指出,上址總樓面約46278方呎,以易手價計,平均呎價約4689元。

甲廈亦錄租賃成交,市場消息指出,中環美國銀行中心中層09室,面積約674方呎,以每呎54.9元租出,月租約37002.6元。據業內人士指出,上述單位屬較細面積,租金屬市價水平。

同時,商廈市場亦罕有銀主盤買賣。消息指,旺角上海中心中層單位,為銀主盤,面積828方呎,以443.8萬售出,呎價約5360元,低市價約一成。

(星島日報)

更多美國銀行中心寫字樓出租樓盤資訊請參閱:美國銀行中心寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

運輸署22元呎 租九龍灣宏天廣場全層

整體東九龍租務淡靜,九龍灣宏天廣場全層,以每呎約22元租出,新租客為政府部門。

消息指,九龍灣宏天廣場中層全層,面積約2.8萬平方呎,以每月62萬元租出,呎租約22元,租金較去年跌約1成。據了解,新租客為政府部門,料作運輸署辦公室之用。事實上,該廈不少樓面亦由政府部門租用,包括社會福利署等。

月租62萬 較去年跌1成

近期整體租務未見活躍,消息指,觀塘綠景NEO大廈一單位獲洽租,面積約6,000平方呎,每平方呎約28元。據悉,該公司為健身器材設計生產商,早前租用尖沙咀港威大廈單位。而租用觀塘較大單位,可容納更多員工,租金較尖沙咀便宜。

核心區甲廈租務方面,消息指,美國銀行中心中層09室,面積約674平方呎,以每呎約55元租出。另同安蘭街18號中層,面積約2,464平方呎,成交呎租約45元。

(經濟日報)

更多宏天廣場寫字樓出租樓盤資訊請參閱:宏天廣場寫字樓出租

更多九龍灣區甲級寫字樓出租樓盤資訊請參閱:九龍灣區甲級寫字樓出租

更多綠景NEO大廈寫字樓出租樓盤資訊請參閱:綠景NEO大廈寫字樓出租

更多觀塘區甲級寫字樓出租樓盤資訊請參閱:觀塘區甲級寫字樓出租

更多港威大廈寫字樓出租樓盤資訊請參閱:港威大廈寫字樓出租

更多尖沙咀區甲級寫字樓出租樓盤資訊請參閱:尖沙咀區甲級寫字樓出租

更多美國銀行中心寫字樓出租樓盤資訊請參閱:美國銀行中心寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

灣仔海外信託銀行大廈位處告士打道,最大優點是享有無遮擋全維港海景,非常舒適。

告士打道為灣仔商廈集中地,交通上,由港鐵灣仔站步行至該廈約10分鐘,附近亦有多條巴士綫可到達。值得一提,物業樓下有接駁天橋,前往灣仔北,而日後亦鄰近港鐵會展站,屆時交通可望更便利。物業設有多層停車場,駕車人士可從大廈謝斐道入口進入停車場。

飲食配套上,上班一族可到附近謝斐道及駱克道,有多間茶餐廳以及酒樓可供選擇,或前往灣仔北新鴻基中心及華潤大廈,不僅有酒樓、酒吧等,亦有新落成的酒店,有特色餐廳提供。

實用達8成 全層用家為主

大廈於1978年落成,樓高29層,物業分別設有告士打道及謝斐道入口,均可前往物業電梯大堂。大廈入口、電梯大堂等早年曾翻新,加設電子水牌,整體觀感仍勝同區乙廈。

標準樓面全層面積由6,999至7,344平方呎,該廈主要為全層用家為主,較少間細單位。間隔上四正,實用率高達8成。

位處單邊 享優質海景

物業最大優點在景觀上,因大廈位處單邊,前面亦沒有任何遮擋,可享優質海景。

買賣方面,2015年,由中原地產創辦人施永青等持有的灣仔海外信託銀行大廈20樓連車位,以1.16億元成交,呎價15,797元,持貨5年帳面獲利逾半億元,呎價一度創新高。

2017年,物業中高層全層,面積約6,984平方呎,以約1.222億元易手,呎價高見17,500元。大廈對上一宗買賣為2019年,物業全層單位連車位,以7,800萬易手,平均呎價1.13萬,買家為上市公司海峽石油化工控股 (00852) 。

租務上,去年大廈錄3宗租務成交,其中低層單位,面積約7,344平方呎,以每月約26.4萬元租出,呎租約36元。今年物業僅錄一宗租務,涉及中層全層,面積約7,344平方呎,成交呎租約28元。

(經濟日報)

更多海外信託銀行大廈寫字樓出租樓盤資訊請參閱:海外信託銀行大廈寫字樓出租

更多新鴻基中心寫字樓出租樓盤資訊請參閱:新鴻基中心寫字樓出租

更多華潤大廈寫字樓出租樓盤資訊請參閱:華潤大廈寫字樓出租

更多灣仔區甲級寫字樓出租樓盤資訊請參閱:灣仔區甲級寫字樓出租

更多海外信託銀行大廈寫字樓出售樓盤資訊請參閱:海外信託銀行大廈寫字樓出售

更多灣仔區甲級寫字樓出售樓盤資訊請參閱:灣仔區甲級寫字樓出售

商務氣氛轉好 旺角錄疫後最大租務

資料顯示,今年第一季錄得約1,304宗舖位租賃成交,總金額約1.35億元,比上季約1,442宗及1.38億元水平相若,至於按年比較則上升逾五成。踏入第二季,疫情進一步緩和,租務活動轉活,各核心區均錄舖位租務成交。

迪生創建300萬 租彌敦道舖

旺角區方面,近日錄得數宗商舖租務個案,更罕有出現數百萬月租成交個案。迪生創建指,與招商永隆銀行達成協議,租用旺角彌敦道636號銀行中心廣場地下01至03、06至19號舖及1樓17號舖,租期由2021年8月至2027年,為期6年,涉及租金約2.1626億元,月租涉及約300萬元。

涉及物業旺角銀行中心廣場,為區內核心零售地段,旁為港鐵站出口,人流暢旺。舖位面積約1.2萬平方呎,現時由周大福、屈臣氏等租用。是次新租務涉及月租約300萬元,按金額計為去年疫情爆發後,最大宗舖位租務成交。對上一宗較大手商租務,為中環興瑋大廈兩層,獲恒生銀行以每月120萬元租用。

迪生創建業務主要為時裝、手錶等,旗下品牌包括百貨Harvey Nichols、美容專門店BEAUTY AVENUE等,而集團位於旺角朗豪坊商場的BEAUTY AVENUE涉及逾萬平方呎,據悉租約即將屆滿。業界人士估計,不排除租用銀行中心舖作搬遷。

BALENO亞皆老街舖 月租60萬

另外,區內錄得時裝店租務,涉及旺角亞皆老街24至26號地下連閣樓,面積合共約2,556平方呎,由時裝連鎖店BALENO以每月60萬承租,平均呎租234元。該時裝店去年尾曾短租舖位,涉及約半年,如今轉為長租。翻查資料,舖位曾由蘋果牌牛仔服裝自用,兩年前遷出。

旺角吉舖數目多,個別舖位由短租店承接。旺角西洋菜南街14至24號榮地下,面積約1,600平方呎,獲佐丹奴以月約20萬元短租。該品牌早年曾租用物業,今年初完結遷出,如今以短租形式重返。據了解,品牌早年以90萬元租用舖位,新租金跌逾77%。

分析指,疫情緩和,消費氣氛轉好,令零售商感興趣開業,加上舖租較高峰期大跌,租務明顯上升。旺角區向來集合本地及旅客消費,旅客暫未重返,仍有本土客支持,令零售商趁租金下跌,重新租舖開業迎商機。

疫情緩和下,整體商務氣氛轉好,過往集合本地及旅客消費的旺角區,租務個案增加,更錄得疫後最大宗商舖租務。

(經濟日報)

鄧成波家族勝訴 尖沙咀舊樓准強拍

底價19.26億 合併鄰地重建供13萬呎

舊樓收購進入收成期,三個舊樓強拍重建項目陸續獲批,涉資約24.9億元,預計能帶來18.1萬平方呎樓面,其中已故舖王鄧成波生前收購的尖沙咀加連威老道舊樓,獲法庭批准繼續強拍。

舖王鄧成波家族在2017年就加連威老道65至73號收購至逾8成業權之後,向土地審裁處申請強制拍賣,並在去年6月獲批出強拍令,拍賣程序原定在去年7月舉行,但當時遇上有一名小業主向高等法院反對,並批出暫緩令。

該小業主律師質疑加連威老道73號與75號共用同一條樓梯,若果73號重建後,小業主在75號持有的單位亦無法使用,認為《舊樓強拍條例》是重建整幢物業,而不是物業的一部分。

不過,據法庭判詞指出,香港現有業權制度以地段 (lot) 為單位,而並認為73號跟75號屬於不同公契,彼此獨立,而屋宇署亦會審批方案確保73號拆卸後不會影響75號的運作,才批出拆樓紙,故此最終拒絕小業主的上訴申請。

按照資料顯示,加連威老道65至73號拍賣底價達19.26億元,若果合併地盤重建,將可提供約13萬平方呎樓面。

永義紅磡舊樓今拍賣

另外,英皇國際 (00163)

收購的的西營盤皇后大道西高陞大樓,最新獲土地審裁處批出強拍令,項目底價為2.59億元。高陞大樓位於西營盤皇后大道西78至80號及荷李活道265至267號,比鄰荷李活道公園。據文件顯示,英皇相關人士目前已持有大廈業權約91.89%。項目地盤面積約2,144平方呎,可建樓面涉約1.9萬平方呎。

另外,永義國際 (01218) 持有大部分業權的紅磡漆咸道北472號、474號、476號及478號,將於今日上午10時進行強拍,底價為3億元。項目現為兩幢5至6層高的舊樓,分別於1956及1957年落成,其地盤面積約3,562平方呎。

(經濟日報)