Hang Lung Properties (0101) is this week offering 130 flats at The Aperture

in Ngau Tau Kok, which carry an average discounted price of HK$22,628.

That is 5 percent higher than prices for the first batch.

The flats going on the market on Saturday range

from one-bedroom to three-bedroom homes, with sizes from 320 square feet

to 770 sf.

More new homes are also going on sales listings elsewhere on Saturday.

In Tseung Kwan O, the latest round of sales will involve 312 flats at Manor Hill from Kowloon Development (0034).

A new project from Henderson Land Development (0012) at Caine Hill in Sheung Wan will see 50 flats being offered on Saturday.

Also this week, Sun Hung Kai Properties (0016)

will publish a first price list for the Yoho Hub project atop Yuen Long

MTR Station, which will be providing at least 206 homes.

At Mid-Levels West, Henderson acquired several old

buildings at Robinson Road for HK$522 million through a compulsory

sale, and it has now received a nod for another compulsory sale for a

10,361 sf site also at Robinson Road.

On other home-related topics, a property agency

expects that next year could see a 10 percent hike in overall property

prices because of an easing of the pandemic situation, which would see a

reopening of the border with the mainland.

(The Standard)

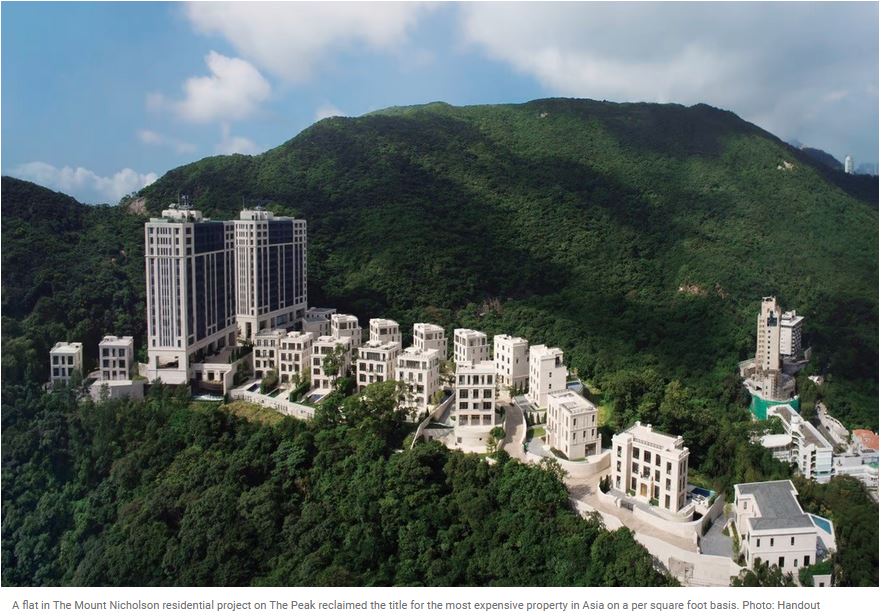

Who is the buyer of the US$82 million property on The Peak – Asia’s most expensive flat?

Lau

Chauin, the daughter of the chairman of Heungkong Group, paid

HK$140,800 (US$18,050) per square foot for a flat and three parking

spaces in Mount Nicholson on The Peak

The previous record for Asia’s most expensive flat on a per square foot basis was held by CK Asset’s 21 Borrett Road project

The buyer of Asia’s most expensive flat in the ultra-luxury Mount Nicholson project on The Peak is Lau Chauin, according to a source close to the deal.

Lau,

the daughter of Lau Chi-keung, the chairman of Heungkong Group, which

has interests ranging from logistics and finance to health care and

property development on the mainland, bought flats 16C and 16D in phase

three of the exclusive project for a combined HK$1.2 billion (US$154

million) last month.

Flat

16D, measuring 4,544 sq ft and three car parking spaces in the project

developed by Wharf Holdings and Nan Fung Development, was sold for

HK$639.8 million, or HK$140,800 per square foot, making it Asia’s most

expensive flat on a per square foot basis. It broke the record held by a

flat in CK Asset Holding’s 21 Borrett Road

luxury residential project in Mid-Levels. That flat, which also came

with three parking spaces, sold for HK$459.4 million, or HK$136,000 per

square foot, in February.

The

price for the 4,186 sq ft flat 16C at Mount Nicholson was HK$560.92

million, or HK$134,000 per square foot, slightly lower than the Borrett

Road flat.

“About

50 per cent of Hong Kong’s ultra-luxury homes [in the past two years]

have been sold to wealthy mainland Chinese or so called new

Hongkongers,” property agent said. “Buyers from the mainland are willing

to pay big bucks for homes on The Peak as spectacular views like those

of Victoria Harbour are rare in China.”

New Hongkongers comprise 60 per cent of the owners of two of the most

exclusive residential addresses in Hong Kong – 21 Borrett Road and Mount

Nicholson, according to land title searches conducted by the South China Morning Post.

The

term “new Hongkongers” is applied to residents who have recently

acquired permanent residency in the city. Permanent residents do not

have to pay an extra 30 per cent stamp duty on property purchases levied

on non-permanent residents.

Lau,

a first-time local buyer with permanent residency, paid only 4.25 per

cent, or HK$23.84 million, in tax for flat 16C, according to local media

reports. But for flat 16D she was required to pay a 15 per cent tax, or

HK$95.97 million.

In

2018, the Lau family bought two more flats – 11C and 11D – in the same

project for HK$1.16 billion, shelling out another HK$27 million for

three parking spaces last year, according to media reports.

The family has spent a total HK$2.36 billion for four flats and six parking spaces at Mount Nicholson.

The

Heungkong Group, which currently employs 20,000 people, started off as a

furniture seller in Shenzhen in 1990, according to the company’s

website. It operates two major furniture chains – Heungkong Furniture

and Kinhom Furniture – across China. It also operates the furniture

trading platform, Kinhom.com, which has more than 6,000 furniture

brands.

Heungkong

later expanded into health care, logistics, property development and

finance. It owns stakes in many financial institutions such as China

Guanfa Bank, GF Securities and GF Funds and is also a principal

shareholder of Guangdong Nanyue Bank and Bank of Tianjin, according to

its website.

Meanwhile,

Xu Hang, the co-founder of Shenzhen-listed Mindray Bio-Medical

Electronics, has bought a 4,664 sq ft penthouse at 39 Conduit Road,

Mid-Levels, for HK$308 million, according to media reports.

The

fully furnished four-bedroom flat on the 45th floor, which was

previously owned by the debt-laden mainland Chinese conglomerate HNA Group, had been put up for sale by creditors in August.

A property agency declined to comment on the Post’s queries related to the transaction on Tuesday.

Another agent said that for mainlanders owning a super deluxe house in Hong Kong is a mark of elite status.

“Unlike

mainland buyers who will pay record prices for such properties,

Hongkongers are much more conservative and do not like to flaunt their

wealth,” the agent said.

(South China Morning Post)

Deluge of new flat handovers to depress Lohas Park rents in the short term, say agents

Nearly 4,200 flats in Sea To Sky, Marini and Montara will be delivered in the next few months

A few owners have rented their flats at rates below the asking price, agents say

Rents in Lohas Park are

expected to come under pressure amid an increase in supply of new homes

in the area, property agents say.

Nearly 4,200 homes in three projects – Sea to Sky,

Marini and Montara – will be ready for occupation in Hong Kong’s

largest residential enclave this quarter and in the first quarter of

next year. Marini is the largest of the three with 1,653 units, while Sea to Sky and Montara have 1,422 and 1,120 units, respectively.

“Rents will definitely face heavy downward pressure with so many new units available around the same time,” property agent said.

Some 200 to 400 units are already on the market, with rents of about HK$40 (US$5.1) per square foot, agents said.

A two-bedroom, 468 sq ft unit at Sea to Sky was recently rented at HK$16,000 a month, 5 per cent lower than the asking price, according to another agent.

Tseung Kwan O has long

been popular with renters, especially mainland students, thanks to its

cheaper prices and proximity to local universities.

Rents in the area

bottomed out at the end of last year, having fallen by 5-10 per cent

because of the social unrest in 2019 and later due to the Covid-19

pandemic. As the city brought the pandemic under control, universities

and schools resumed normal operations this year, which allowed mainland

students to return. As a result, rents started to inch up this year,

with the average rent about 10-15 per cent higher than in 2019.

With the opening of the

480,000 sq ft Lohas shopping mall last year, and international schools

and kindergartens coming up in the area, more local and expatriate

families would love to move in, agents said.

They added that as the

area provides a range flat sizes, most of which are new and come with

club facilities, these will appeal to a young clientele.

Property agents remain optimistic about rents in Lohas Park and Tseung Kwan O.

After the market digests the supply from Montara, Sea to Sky and Marini, the rental market will return to normal, agent said.

Another agent said that

the 1.8km Cross Bay Link connecting Tseung Kwan O-Lam Tin Tunnel to Wan

Po Road, which is set to be completed next year, will relieve traffic

congestion in the area and further increase the popularity of the area.

(South China Morning Post)

Hong Kong property investment to grow by 20 per cent next year, led by hotels, serviced apartments, property consultancy said

Multifamily

conversions – hotels converted into long-stay flats for rental – are

proving an attractive investment, property consultant said

Industrial buildings and sites were among the most active sectors, last year and that is expected to continue

Hong Kong will see

property investment grow by a fifth in 2022, with hotels and serviced

apartments set to become investors’ main acquisition target, according

to a property consultancy.

There will be 200 major

transactions next year valued at around HK$100 billion (US$12.81

billion), the highest since 2018, according to the global property

service firm’s “Hong Kong and Greater Bay Area (GBA) Property Market

2021 Review and 2022 Outlook.”

As the pandemic gradually

eased and the economy regained some life this year, Hong Kong’s

property market has shown signs of recovery.

“Investors worldwide have

recently been drawn to emerging multifamily conversions such as

serviced apartments and hotel properties,” property consultant said.

“The aforementioned asset classes will likely benefit from the revival

of tourism activities when the border gradually reopens.”

Multifamily conversions –

hotels converted into long-stay flats for rental – are proving an

attractive investment, the consultant said.

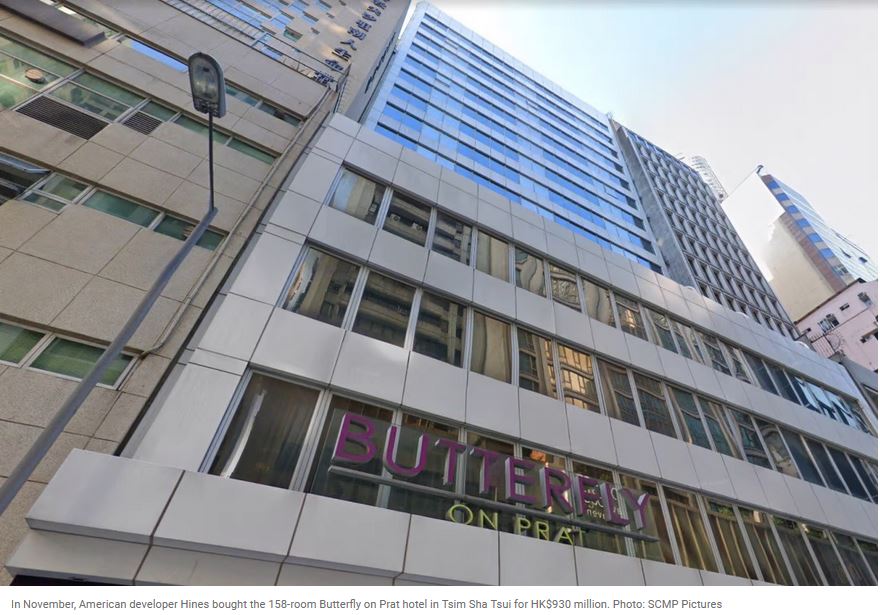

In November, American

developer Hines bought the 158-room Butterfly on Prat hotel in Tsim Sha

Tsui for HK$930 million. Hines planned to convert the hotel into a

co-living flagship to be managed by local residential operator Dash

Living.

Major investment deals in

2021 were mainly driven by local investors and foreign funds. The

number of transactions more than doubled from the previous year.

Industrial buildings and

development sites were among the most active sectors, each accounting

for about 30 per cent of the total volume, according to the property

consultancy.

“Demand for industrial buildings in 2021 was at a historic high, and we expect this to continue in 2022,” the consultant said.

On Monday, Sun Hung Kai

Properties agreed to lease an en-bloc industrial building spanning

158,000 square feet to Kerry Logistics. Located in Tuen Mun, in the New

Territories, the logistics warehouse is near the Hong Kong International

Airport and enjoys well-developed transport facilities.

Sun Hung Kai, Hong Kong’s

biggest home builder by market value, owns an industrial and logistics

portfolio with gross floor area of about 4.5 million square feet along

with nearly 12,000 car parking spaces.

Across Hong Kong, the

sector consists of 43 industrial premises available for rent, including

buildings, industrial-office developments and advanced logistics

centres.

“During the pandemic,

industrial has offered a higher rental return yield compared to other

commercial sectors such as office and retail,” said Raymond Fok Lee-man,

head of the Industrial and Logistics Portfolio Department at Sun Hung

Kai.

The industrial sector

also benefits from government policies, and the fact warehouse rent has

been the least affected by the pandemic, according another property

consultancy.

“The trend will continue

in 2022. However, it may slow down due to the shortage of available

stock in the market as a lot of stock has been absorbed by institutional

buyers during 2021,” the other consultant said.

Property consultant

expects industrial buildings, residential development sites and

multifamily conversions to become the three key pillars of the

investment market in 2022.

(South China Morning Post)

中環甲廈租金明年勢回勇

新冠肺炎疫情逐漸受控,整體經濟開始步入復甦期,甲級寫字樓租賃市場連續兩季表現回暖。有代理行指出,寫字樓租金跌幅已見收窄,預計明年中環頂級寫字樓租金或重現增長。

該行代理表示,2021年第四季甲級寫字樓的吸納量為18.55萬方呎,雖然全年吸納量仍為負57.87萬方呎 (遷出騰空的樓面多於新租出樓面),但較2020年全年的負230萬方呎已經大為改善。新租賃成交以金融及保險行業租戶為主,佔約42%。

商廈租金方面,今年全年各區平均跌幅為4.7%,下跌幅度相比去年的19.3%大為收窄;整體待租率由今年第二季的14.4%,回落至第四季的13.6%。

該代理認為,2022年將有超過200萬方呎全新甲級寫字樓供應相繼落成,整體待租率料升至16%至17%,導致整體平均租金將下調1%至3%。不過,由於新落成商廈主要位於非核心區,故中環頂級寫字樓租金有望錄得約1%的輕微增長。

代理行:住宅價看漲一成

該行另一代理指出,疫情受控,經濟正處於穩步復甦階段,消費市場得以改善,商舖租金已經見底,空置率將進一步下降。預期2022年舖租將於上半年進一步回揚,升幅由2%至5%,中環的租金漲幅估計更可達5%至8%。

另一代理預期,2022年本港住宅樓市仍然向好,樓價將有5%至10%升幅,其中較看好位於市區的豪宅。

(信報)

西半山舊樓強拍 恒地5.2億統一業權

恒地 (00012) 在西半山積極收購舊樓,羅便臣道94、94A及96號的舊樓,昨日舉行公開拍賣,最終由手持1號牌的恒地執行董事黃浩明在無競爭下、以底價5.221億元投得。

黃浩明指,項目收購約6至7年,將會連同羅便臣道98及100號一同發展,組成約1.2萬平方呎地盤,以地積比率5倍發展,可建樓面約6.08萬平方呎,將會興建中型單位為主,預計最快兩年後開售樓花。

旗下羅便臣道88號 批強拍令

同時,集團位於羅便臣道88號舊樓,亦獲土地審裁處批出強拍令,拍賣底價10.09億元。恒地在2020年時候申請強拍,其後再增持至96%業權,只剩最後兩個單位未完成收購。

土地審裁處決定頒發強拍令,並將底價定為10.09億元,按照估值報告指出,地盤可建樓面51,805平方呎,每呎樓地價約1.95萬元。

(經濟日報)

葵涌工廈重建積極 變身數據中心

受惠工廈活化政策,各區工廈頻頻申請重建或改裝,以釋出物業最大潛力,當中葵涌近年的工廈重建或改裝個案轉趨積極,目前中葵涌有12個相關的申請,涉及總樓面面積高達261.84萬平方呎。而隨5G時代降臨,數據中心的改劃申請亦增加。

葵涌區有不少工業區,其中葵涌道以東的工業區,近年積極轉型,相繼錄有不少工廈重建或者改裝個案,最新有外資基金將本年中購入的工廈,向城規會申請改裝為數據中心。

光輝凍倉申改數據中心

該工廈為永業街11至19號光輝凍倉(二倉),外資基金ESR在今年5月以18億元向已故「舖王」鄧成波買入上址後,近期向城規會申請將全幢工廈改裝為15層高的數據中心,並以地積比率10.19倍發展,涉及總樓面約35.23萬平方呎。申請者認為,擬議發展可加速葵涌工業區的活化進展。

事實上,隨着5G年代來臨,整個大氣候逐漸轉變,市場對數據中心的需求大大增加,計入上述最新申請,單計葵涌區已錄至少7宗的相關重建或改建申請,涉約179萬平方呎樓面。在上述申請中,具中資背景的萬國數據最積極,集團先後為區內3幢工廈並申請重建為數據中心,涉及地點包括打磚坪街57至61號中央工業大廈、藍田街2至16號葵涌聯發工業第一大廈及大圓街2至10號美羅工業大廈,合共涉及約75.9萬平方呎總樓面。

另外,金朝陽 (00878) 早前亦就位於華星街13至17號的南華冷房大廈,向城規會申請發展1幢20層高的數據中心,涉及總樓面約21.8萬平方呎。興勝創建 (00896) 旗下業成街22號太平洋貨運大廈,擬建成1幢樓高22層的數據中心。

羅氏美光 重建新工廈

值得一提的是,中葵涌一帶亦有不少重建為商廈的申請,如美聯工商舖 (00459) 夥同德永佳集團 (00321) ,為羅氏美光發展大廈向城規會重建成1幢26層高的新式工廈。

而房委會早前已完成有關為轄下6幢工廈重建為公營房屋的可行性研究,計劃把其中位於大連排道103至113號的葵安工廠大廈擬將清拆,並重建為公營房屋,預計可提供約600個單位。

(經濟日報)